Financial Services Consulting

Unlocking Opportunities in a Rapidly Changing World

When I founded SIS International Research, I envisioned a company that would serve as the bridge between market uncertainties and informed decision-making. Over the years, we’ve partnered with financial leaders to navigate their challenges through robust financial services market research. Today, I want to share insights on why this field is so vital and how it’s transforming businesses globally.

The Foundation of Financial Services Consulting

You might be wondering: Why is financial services consulting so important? The answer is simple yet profound. Financial institutions need clarity. Without it, they’re steering blind.

At SIS, we’ve seen how understanding market trends empowers businesses to:

- Launch products that meet real customer needs.

- Expand into new regions with confidence.

- Identify potential risks before they escalate.

One case that comes to mind is a fintech company we worked with last year. They needed to determine whether their mobile app would resonate in Southeast Asia. Our research revealed that nearly 70% of their target market preferred apps with integrated AI financial planning tools. After adapting their product, they increased adoption rates by 45% in just six months… That’s the power of focused research.

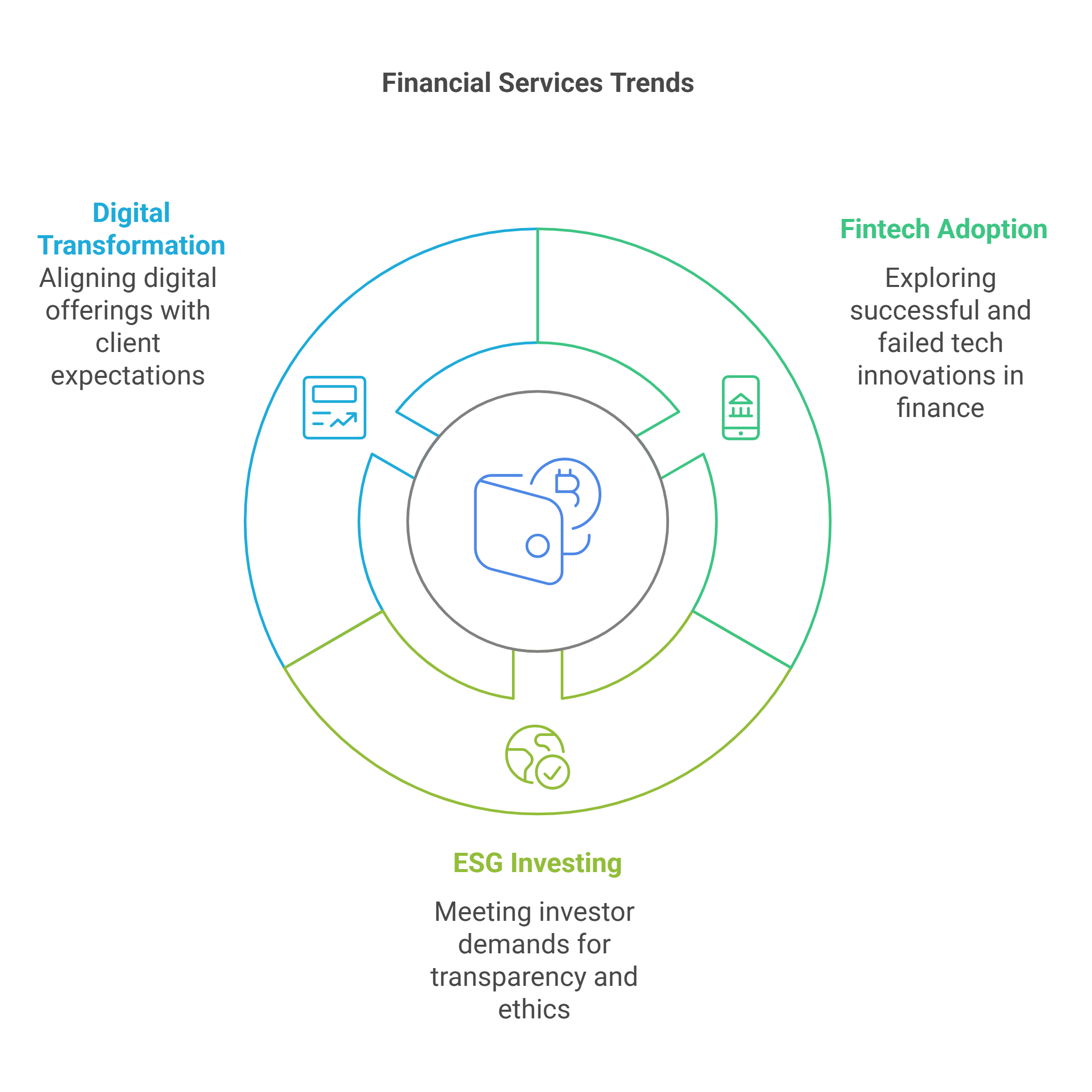

Emerging Trends in Financial Services Consulting

If you’re in financial services, you know the industry doesn’t sit still. Let’s talk about the trends reshaping the landscape—trends we’re helping our clients explore through financial services market research:

1. The Rise of Fintech

Fintech is a movement disrupting everything from payments to lending… But here’s the catch: Not all innovations stick. Companies that invest in financial services consulting uncover which technologies are here to stay and which are hype.

Take, for example, blockchain adoption. In one of our recent studies, we found that while 82% of financial firms are exploring blockchain, only 15% have achieved measurable ROI. Why? Lack of user trust. We help clients address such gaps with actionable insights.

2. ESG Investing

Environmental, Social, and Governance (ESG) factors are also critical for financial institutions. Investors demand transparency. Customers reward ethical companies. Research shows that 64% of millennials won’t invest in funds that fail ESG criteria.

Our team recently conducted ESG-focused financial services market research for a global bank. We identified key sustainability metrics valued by their customers, and we optimized their marketing efforts—leading to a 25% increase in eco-conscious account openings.

3. Digital Transformation

Here’s a question for you: Are your digital offerings meeting client expectations? In our experience, many financial firms assume they’re ahead of the curve when, in reality, they’re lagging. For example, we worked with a traditional wealth management firm that struggled with client retention. Research revealed that 75% of their high-net-worth clients preferred mobile-first interactions. Implementing this insight reversed their declining client base within a year.

Why Partner with SIS International Research?

What sets SIS apart? The answer lies in our approach. We don’t just gather data—we provide clarity. Our financial services consulting combines qualitative and quantitative methods that provide:

Tailored Solutions for Unique Needs

We don’t believe in one-size-fits-all solutions. Instead, we craft research strategies that align with your objectives, ensuring the insights are relevant and actionable.

الوصول العالمي مع الخبرة المحلية

With a presence in major financial hubs worldwide, we offer a unique blend of global reach and localized knowledge. Our team provides insights grounded in regional expertise.

Affordable Research Solutions

We understand that financial institutions operate under budgetary constraints. That’s why we provide cost-effective research solutions without compromising quality, making professional insights accessible to organizations of all sizes.

خبرة الصناعة العميقة

Our specialists have extensive experience in the financial services sector. We understand the nuances of the industry and deliver insights that matter most to your business.

Actionable Insights, Not Just Data

Our research goes beyond collecting information—we analyze, interpret, and present findings in a way that supports clear and confident decision-making.

Cutting-Edge Methodologies

At SIS, we leverage advanced research techniques, including AI-driven data analysis, predictive modeling, and sentiment analysis. This ensures you stay ahead of industry trends and emerging customer needs.

Unbiased and Reliable Reporting

As a third-party research provider, we offer unbiased insights that you can trust. Our rigorous methodologies ensure that findings are reliable, transparent, and free from internal biases.

Comprehensive Research Capabilities

Our broad range of services ensures you get everything you need in one place.

Collaborative Approach

We don’t just work for you; we work with you. Our team engages with your stakeholders throughout the research process, ensuring alignment with your goals and priorities.

سجل حافل بالنجاحات

From multinational banks to niche investment firms, we’ve helped countless financial institutions achieve measurable outcomes. Our clients consistently see improved customer retention, expanded market share, and enhanced operational efficiency through our insights.

Key Components of Effective Financial Services Consulting

If you’re serious about thriving in the financial services industry, you can’t just collect data—you need to dive deep into the details that matter most.

1. Customer-Centric Insights

Don’t guess what your clients want—know it. Understand their pain points, preferences, and expectations. Customer-centric research uncovers what drives loyalty and helps you design products and services they’ll actually love.

2. Competitor Analysis

Your competition isn’t sleeping, and neither should you. Know where you stand and what your competitors are doing better (or worse). This analysis reveals opportunities you can exploit and threats you need to neutralize.

3. Regulatory Awareness

In the financial world, regulations can make or break your strategy. Stay ahead of compliance requirements to avoid unnecessary headaches and ensure you’re always playing by the rules.

4. Technology and Innovation Trends

Fintech, AI, blockchain—these aren’t just buzzwords. They’re shaping the future of financial services. Consulting helps you embrace the tools that drive efficiency and innovation, so you don’t get left behind.

5. Actionable Data and Insights

Data without action is just noise. Your research should deliver clear, actionable recommendations that guide your decision-making. Numbers and graphs are great, but what you do with them is what counts.

The Future of Financial Services مستشار

Looking ahead, I see financial services consulting playing an even bigger role in shaping the industry. AI and big data are transforming how we gather and analyze insights. Regions like Asia and Africa are becoming new growth hubs. And customers are demanding more personalized, transparent services.

To thrive, you need a partner who understands these shifts and can guide you through them. That’s where SIS comes in.

الأسئلة الشائعة

Q: What is financial services consulting?

Financial services consulting involves researching data to help financial institutions understand customer needs, market trends, and competitive landscapes. It provides actionable insights to guide decision-making.

Q: Why is financial services consulting necessary?

It’s crucial for identifying opportunities, mitigating risks, and staying competitive in a rapidly evolving industry. مستشار helps financial institutions make informed decisions about product development, customer targeting, and market expansion.

Q: What are some standard methods used in financial services مستشار?

Common methods include surveys, focus groups, in-depth interviews, data analysis, and competitive benchmarking. Advanced techniques like sentiment analysis and predictive modeling are also increasingly used.

Q: How can consulting improve customer satisfaction in financial services?

Consulting identifies customer pain points and preferences, enabling financial institutions to tailor their services and improve customer experiences. This leads to higher satisfaction and loyalty.

Q: Why choose SIS International Research for financial services consulting?

SIS combines decades of experience with cutting-edge methodologies to deliver actionable insights. Our global reach and industry expertise help clients navigate challenges and confidently seize opportunities.

موقع منشأتنا في نيويورك

11 إي شارع 22، الطابق 2، نيويورك، نيويورك 10010 هاتف: 1(212) 505-6805+

حول سيس الدولية

سيس الدولية يقدم البحوث الكمية والنوعية والاستراتيجية. نحن نقدم البيانات والأدوات والاستراتيجيات والتقارير والرؤى لاتخاذ القرار. نقوم أيضًا بإجراء المقابلات والدراسات الاستقصائية ومجموعات التركيز وغيرها من أساليب وأساليب أبحاث السوق. اتصل بنا لمشروع أبحاث السوق القادم.