Sensory Testing Research

Most product failures aren’t marketing problems—they’re neurological disconnects traditional research is completely blind to.

How much money did your company flush down the toilet last year on products consumers secretly hated? $1 million? $10 million? More?

Brilliant executives get fired after betting their careers on products that tanked despite glowing research reports. Not because they didn’t test—hell, they tested extensively… But because they used methodologies from the Stone Age that measured what consumers said rather than what their bodies actually felt.

Table of Contents

✅ Listen to this PODCAST EPISODE here:

The Science Behind Sensory Testing Research

Sensory testing research is built on a foundation that most market researchers have completely ignored: the vast majority of purchase decisions happen at a physiological level traditional research methods can’t touch. Your customers’ nervous systems make judgments in milliseconds that their conscious minds later rationalize, usually inaccurately.

This isn’t just academic theory—it’s why so many products with stellar test scores die horrible deaths in the marketplace. When you ask consumers what they think about a product, you’re accessing their post-hoc rationalization rather than the actual sensory response that will determine whether they ever pick up your product again.

Want proof? When a luxury skincare brand came to us baffled about why their new moisturizer—objectively superior in blind lab tests—was tanking in market despite excellent purchase intent and satisfaction scores, we discovered something their expensive focus groups completely missed.

While their product delivered superior hydration objectively, it created a specific sensory discord during the application phase. The temporal profile of absorption—how the product felt during the first 8-15 seconds after application—was activating mechanoreceptors in the skin that transmitted signals the brain interpreted as “wrong/artificial/concerning.”

This reaction wasn’t conscious or articulable. Consumers couldn’t tell you it was happening. They just knew something felt “not quite right” and didn’t buy the product again.

The Neuroscience Factor: How Our Brains Actually Process Sensory Input

Asking consumers what they think about products is fundamentally flawed because sensory processing happens largely below the level of conscious awareness, yet powerfully shapes behavior. Your brain is constantly being bombarded with sensory signals, with only a tiny fraction ever reaching conscious awareness. The rest directly influence attitudes and behaviors without ever entering the realm of what consumers can articulate.

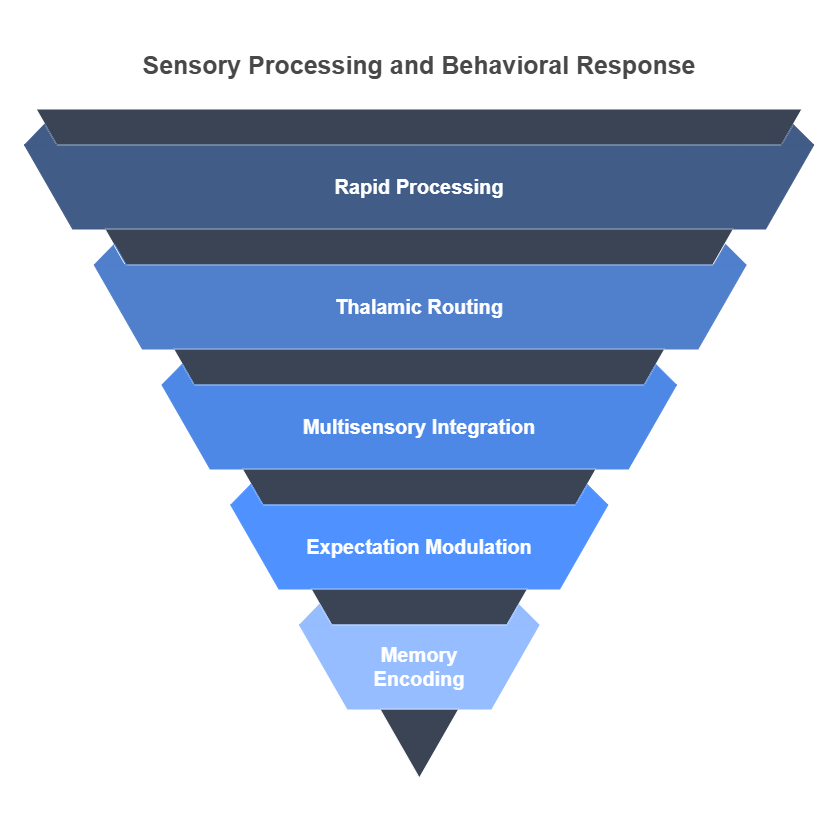

The neuroscience explains why this happens and why it’s so devastating to product performance:

- Rapid subcortical processing occurs first, with sensory information hitting the amygdala and other emotion-processing centers before reaching the conscious, rational parts of the brain.

- Thalamic routing distributes sensory information to specialized brain regions that process specific attributes—texture information follows different neural pathways than fragrance, for example.

- Multisensory integration combines inputs from different senses to create unified perceptions.

- Expectation modulation occurs when previous experiences create anticipatory frameworks that literally change how sensory inputs are processed. Your brain doesn’t passively receive sensory information—it actively predicts what should happen and notices when reality doesn’t match expectations.

- Memory encoding links sensory experiences to emotional states, creating powerful associative networks that drive future behavior. A single negative sensory experience can create an aversion strong enough to prevent repurchase forever, even if consumers can’t explain why.

This neurological complexity explains why traditional research often fails to predict market performance. When you ask consumers about products, you’re accessing only the conscious, cortical processing of sensory information—a tiny fraction of the neural activity that actually determines their behavior.

Sensory testing research acknowledges this reality by measuring responses systematically rather than relying on conscious articulation. The methodology is designed to capture how products interact with the full spectrum of neurological processing, not just the parts consumers can verbalize.

Building a Sensory Lexicon: The Language of Experience

One of the most powerful outcomes of sensory testing research goes beyond measurement to create something with permanent strategic value: a precise, consistent language for describing sensory experiences that transforms how organizations develop and market products.

The problem facing most companies is frustratingly basic: You can’t consistently create what you can’t precisely describe. When key sensory attributes are described with vague, inconsistent terminology, product development becomes an exercise in miscommunication and subjectivity that wastes millions in failed launches.

This sensory lexicon became a strategic asset that:

- Enabled precise communication between R&D, marketing, and executive leadership using consistent terminology with shared understanding.

- Created measurable development targets for innovation projects, replacing vague briefs with specific sensory specifications.

- Facilitated quality control by establishing quantifiable sensory standards against which production could be measured.

- Improved consumer communication by identifying which sensory attributes could be meaningfully conveyed in marketing.

- Enhanced competitive analysis by providing a consistent framework for benchmarking sensory performance across the category.

Common Sensory Testing Methods and Their Applications

| Sensory Testing Method | غاية | وصف | طلب |

|---|---|---|---|

| Discrimination Tests | Determine perceivable differences | Assessors identify differences between samples using triangle, duo-trio tests, etc. | Detect product reformulation effects or quality control issues |

| Descriptive Analysis | Describe sensory attributes | Trained panelists evaluate taste, aroma, texture, appearance | Helps optimize product sensory profile |

| Affective (Consumer) Tests | Assess preferences and acceptance | Untrained consumers give feedback on liking or preference | Aligns product development with consumer desires |

| Threshold Testing | Determine minimum detectable stimulus | Identifies the lowest level of a stimulus (e.g., sweetness) that is perceivable | Formulate products with desired sensory characteristics |

| Time-Intensity Evaluation | Measure changes over time | Evaluates how sensory attributes evolve during use | Useful for products where perception changes during consumption |

مصدر: Table compiled by SIS International based on standard Sensory Evaluation methodologies and industry research practices. For reference, see ISO 13299:2016 – Sensory analysis — Methodology.

Advanced Applications: Where Sensory Testing Research Gets Mind-Blowingly Powerful

The evolution of sensory testing research has accelerated dramatically in recent years, with emerging applications that are reshaping how forward-thinking companies approach product development – and they’re creating unprecedented competitive advantages such as:

Cross-cultural sensory mapping represents one of the most powerful extensions of sensory testing research, and it’s saving global companies millions in failed international launches. While most companies naively assume sensory preferences are universal or can be addressed with minor formulation tweaks, the neurological reality is far more complex.

Virtual reality-enhanced research has blown open entirely new possibilities for testing sensory experiences that were previously impossible to isolate or control. A hospitality client used this approach to optimize the multisensory experience of their guest rooms by manipulating individual sensory inputs within virtual environments. This methodology revealed that the specific acoustic properties of their spaces—something they had never considered important—were creating subtle stress responses that traditional research missed entirely because guests couldn’t consciously identify the source of their discomfort.

Individual phenotyping for personalized product development represents perhaps the most revolutionary application of sensory testing research. By mapping individual variations in sensory perception—differences in receptor density, neural processing, and preference formation—companies can develop targeted products for specific sensory segments rather than settling for one-size-fits-all compromises.

As market research continues evolving, sensory testing research remains at the forefront of methodologies that deliver both scientific rigor and practical business value by connecting physical product properties directly to consumer perception and behavior.

Implementation Challenges: Why Most Companies Screw This Up

Let’s get honest about the obstacles you’ll face implementing sensory testing research in organizations accustomed to traditional research approaches. Understanding these hurdles—and how to overcome them—can mean the difference between transformative success and frustrating failure.

Organizational skepticism typically emerges as the first major barrier, particularly from marketing teams who’ve built careers on traditional consumer research.

Technical complexity presents another significant challenge that derails many initial implementations. The scientific rigor that makes quantitative sensory testing so powerful also makes it more sophisticated than traditional consumer research methods that anyone can understand and interpret.

Integration with existing processes often becomes a sticking point that prevents insights from actually improving products. Companies have established product development workflows that can be resistant to new methodological inputs. .

Resource allocation challenges inevitably arise, particularly for companies new to the methodology. Sensory testing research requires specialized expertise and equipment that most organizations don’t initially possess.

Cultural resistance to sensory-driven decision-making can become the most persistent challenge. Many organizations have deeply ingrained traditions of deferring to the subjective judgments of key executives or technical experts rather than objective sensory data.

The ROI of Sensory Excellence: Calculating Your Payback

The question executives inevitably ask before investing in sensory testing research is straightforward: “What’s the return on this investment?” You can confidently expect the financial impact to exceed expectations—often by orders of magnitude. However, measuring that return requires specific approaches that capture the full spectrum of business benefits.

Direct product performance improvements provide the most immediately visible ROI—and they’re often dramatic enough to pay for the entire sensory testing research investment many times over.

Development efficiency gains create substantial but frequently overlooked returns that drop straight to the bottom line. Traditional product development typically involves multiple rounds of consumer testing and reformulation—an expensive and time-consuming process with unpredictable outcomes.

Premium pricing opportunities emerge when sensory excellence creates genuine differentiation perceived by consumers. A home fragrance brand discovered through sensory testing research that specific scent release kinetics—how the fragrance evolved over time—drove willingness to pay far more than initial scent appeal.

Key Takeaways: Sensory Testing Research

✅ Sensory testing research transforms how products are developed by measuring consumers’ actual physiological responses rather than just their stated opinions—capturing the neurological reality that drives purchasing behavior

✅ Most product failures aren’t marketing problems—they’re sensory disconnects where products create negative physiological responses that consumers can’t articulate but that ultimately determine repurchase behavior

✅ The human nervous system processes sensory information largely below conscious awareness, creating powerful behavioral influences that traditional research methods completely miss

✅ Implementing sensory testing research requires systematically identifying which specific sensory attributes drive preference in your category, then developing precise protocols to measure these attributes objectively

✅ Applications extend far beyond obvious sensory categories—from automotive and medical devices to e-commerce and financial services, sensory optimization creates measurable competitive advantages

✅ Building a consistent sensory lexicon transforms organizational capability by creating a precise language for describing and creating sensory experiences that eliminate costly miscommunication

✅ Implementation challenges typically include organizational skepticism, technical complexity, and integration with existing processes—all addressable with the right approach

✅ The ROI manifests across multiple dimensions: direct performance improvements, development efficiency, premium pricing opportunities, marketing effectiveness, and competitive insulation

What Makes SIS International a Top Sensory Testing Research Partner?

When selecting a partner for sensory testing research, methodological expertise alone isn’t enough—you need a team that bridges the critical gap between sensory science and commercial impact. After four decades pioneering these approaches across categories, here’s what truly sets us apart:

- GLOBAL REACH: Sensory perception varies dramatically across cultures due to physiological differences and learned associations. Our presence in 120+ countries allows us to develop sensory testing protocols that capture these critical variations rather than assuming universal responses.

- 40+ YEARS OF EXPERIENCE: We’ve evolved with sensory science from basic preference testing through today’s sophisticated psychophysical methodologies.

- GLOBAL DATA BASES FOR RECRUITMENT: Effective sensory testing requires access to representative consumers with specific demographic and behavioral characteristics.

- IN-COUNTRY STAFF WITH OVER 33 LANGUAGES: Sensory language is inherently cultural and linguistic—the terms used to describe sensory experiences vary dramatically across languages in ways that cannot be captured through simple translation. Our native researchers ensure that sensory lexicons and testing protocols capture these nuances accurately.

- GLOBAL DATA ANALYTICS: Our dedicated analytics teams specialize in the complex statistical methods required for meaningful sensory data analysis, from multivariate techniques to temporal dominance modeling.

- AFFORDABLE RESEARCH: Our global scale and methodological efficiency allow us to deliver sophisticated sensory testing at price points significantly below typical sensory science laboratories. We’ve structured our approach to deliver maximum insight value without unnecessary complexity or overhead.

- CUSTOMIZED APPROACH: We don’t believe in one-size-fits-all sensory methodologies. Each testing protocol is tailored to your specific product category, business questions, and implementation context.

FAQs: Sensory Testing Research

What exactly is sensory testing research and how does it differ from traditional consumer research?

Sensory testing research is a scientific approach that measures how consumers’ bodies actually respond to products rather than just asking what they think. While traditional research captures conscious opinions (“Do you like this product?”), sensory testing researchmeasures physiological responses across all senses—touch, taste, smell, sight, and sound—often revealing critical drivers of preference that consumers can’t articulate but that ultimately determine whether they’ll buy again.

The fundamental difference is that traditional research assumes consumers can accurately report what drives their behavior, while sensory testing research acknowledges the neurological reality that most sensory processing happens below conscious awareness yet powerfully shapes purchase decisions.

How does sensory testing research integrate with our existing product development process?

The most effective integration of sensory testing research happens early in the development cycle rather than as a validation tool for finished products. The optimal approach is to begin with sensory mapping to identify which specific attributes drive preference in your category, then develop clear sensory targets for new products before formulation begins.

This approach transforms development from a subjective, opinion-driven process to one guided by objective sensory specifications. For companies with established stage-gate processes, we typically recommend integrating sensory testing research at three key points: initial concept development (to establish sensory targets), prototype evaluation (to assess progress toward those targets), and pre-launch validation (to ensure sensory excellence before market introduction).

What kind of ROI can we expect from implementing sensory testing research?

The financial returns from sensory testing research typically manifest in five key areas, often with combined impact that delivers extraordinary ROI.

First, direct product performance improvements almost immediately generate incremental revenue—we typically see repurchase rate increases of 25-50% for sensory-optimized products compared to those developed through traditional methods.

Second, development efficiency gains reduce both time-to-market and associated costs, with typical cycle time reductions of 30-45% and significant decreases in reformulation requirements.

Third, premium pricing opportunities emerge when products deliver superior sensory experiences, with our clients achieving price premiums of 15-40% for sensory-optimized offerings.

Fourth, marketing effectiveness improves dramatically when communication aligns with the sensory attributes that actually drive preference, increasing media efficiency by 25-50%.

Finally, competitive insulation creates sustained advantage as competitors struggle to identify and replicate the sensory factors driving your success. For a comprehensive ROI assessment tailored to your specific business context, our team can develop custom models that quantify the expected returns across these dimensions based on your category dynamics and implementation scope.

موقع منشأتنا في نيويورك

11 إي شارع 22، الطابق 2، نيويورك، نيويورك 10010 هاتف: 1(212) 505-6805+

حول سيس الدولية

سيس الدولية يقدم البحوث الكمية والنوعية والاستراتيجية. نحن نقدم البيانات والأدوات والاستراتيجيات والتقارير والرؤى لاتخاذ القرار. نقوم أيضًا بإجراء المقابلات والدراسات الاستقصائية ومجموعات التركيز وغيرها من أساليب وأساليب أبحاث السوق. اتصل بنا لمشروع أبحاث السوق القادم.