Robotic Process Automation in Financial Services

When our team at SIS International began researching robotic process automation in financial services five years ago, most executives viewed it as an experimental technology with limited applications. Fast forward to today, and it’s transforming everything from mortgage processing to compliance reporting.

Understanding RPA in the Financial Context

Our research shows that robotic process automation in financial services delivers the highest ROI when targeting processes that meet these criteria while also addressing significant pain points for employees or customers.

Process automation technology has evolved dramatically from simple macros to sophisticated intelligent solutions. Robotic process automation in financial services represents a spectrum of capabilities—from basic task automation to AI-enhanced systems that can handle complex decision-making. So, what makes this technology particularly powerful in financial environments is its ability to interact with existing systems without requiring extensive IT overhauls.

Key Applications Across Banking and Finance

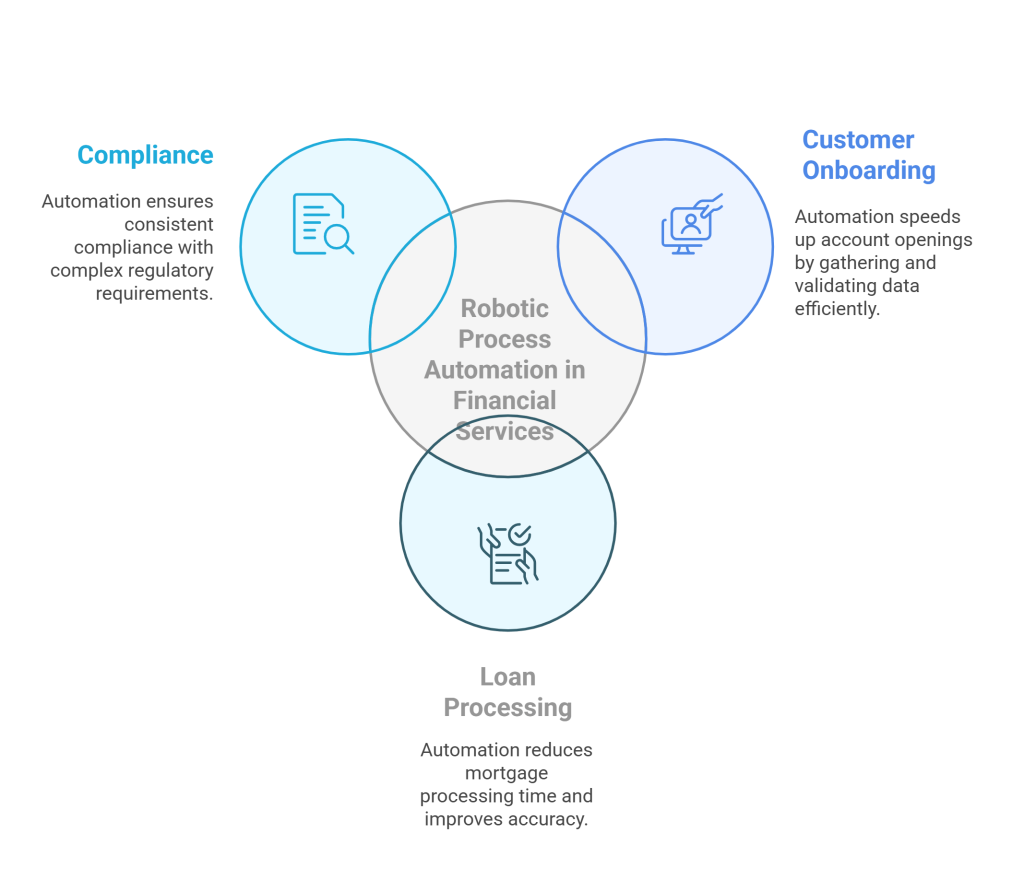

- Customer onboarding represents one of the most compelling use cases for automation in the industry. Robotic process automation in financial services has reduced account opening times from days to minutes at several institutions we’ve studied. The technology excels at gathering information from multiple sources, validating data against KYC requirements, and initiating appropriate workflows based on customer profiles.

- Loan processing has similarly been transformed. We’ve documented cases where robotic process automation in financial services reduced mortgage application processing time by 70% while improving accuracy rates. The technology excels at document verification, credit scoring integration, and compliance checking—steps that previously created significant bottlenecks in the lending pipeline.

- In compliance, robotic process automation in financial services has become nearly indispensable. With regulatory requirements growing more complex annually, automation provides consistent, auditable processes for everything from suspicious activity reporting to regulatory filing. We’ve seen compliance teams redirect thousands of hours toward strategic risk management rather than routine data gathering and report generation.

Implementation Challenges and Success Factors

After spending years studying RPA projects that crashed and burned while others skyrocketed to success, I’ve seen the patterns that separate winners from the financial institutions still drowning in manual processes. – and the banks and insurance companies crushing it with RPA aren’t necessarily the ones with the biggest budgets or the fanciest tech stacks. They’re the ones that recognized and conquered these hidden obstacles that most executives completely miss.

- Organizational Resistance: Human factors typically present greater obstacles than technology limitations. Financial institutions that invest heavily in employee communication, training, and involvement consistently achieve faster adoption and higher ROI from their robotic process automation in financial services programs.

- Process Standardization Requirements: Many financial institutions have allowed significant procedural variations across departments, branches, or regions. Before robotic process automation in financial services can be effectively implemented, these processes must be harmonized—a step that often yields efficiency benefits even before automation is applied.

- Security and Governance Frameworks: Financial environments demand robust controls for automation technologies. Our specialists have developed comprehensive frameworks ensuring robotic process automation in financial services maintains appropriate access limitations and audit trails. Successful organizations establish clear governance structures from the outset.

- Technology Integration Challenges: Legacy systems prevalent in financial services often lack modern APIs and documentation. Effective robotic process automation requires strategies for navigating these technical limitations while maintaining performance and reliability across complex system landscapes.

- Data Quality Issues: Automation amplifies the impact of poor data quality. Financial institutions implementing robotic process automation must often undertake parallel data cleansing initiatives to ensure bots can process information consistently without human intervention to resolve exceptions.

- Scalability Bottlenecks: Many institutions succeed with initial pilots but struggle to scale robotic process automation across the enterprise. Effective scaling requires infrastructure planning, standardized development practices, and centralized monitoring capabilities that can support hundreds or thousands of bots.

The ROI of Financial Process Automation

Kostenreduzierung remains a primary driver for robotic process automation in financial services, but focusing solely on headcount savings misses the broader value proposition. For instance, one global bank we worked with calculated that error elimination alone justified their entire automation investment, with efficiency gains representing pure upside.

Customer experience improvements generate substantial return on investment that’s often overlooked in traditional ROI calculations. When robotic process automation in financial services reduces processing times or enables 24/7 service availability, it directly impacts customer satisfaction and retention.

“The financial institutions seeing the greatest returns from robotic process automation are those measuring its impact across multiple dimensions—not just cost reduction but also risk mitigation, customer experience, and employee satisfaction,” I emphasized at a recent industry conference panel on automation economics.

Der scalability of robotic process automation in financial services creates particularly compelling economics. Once a process is automated, handling increased volume typically requires minimal additional investment.

Emerging Trends in Financial Automation

The boring back-office robots that started by mimicking mouse clicks are now morphing into something far more powerful. The banks crushing it today are reimagining what’s possible when machines and humans collaborate.

Here are the trends revolutionizing financial automation that most executives aren’t paying enough attention to:

Cross-Organizational Automation Ecosystems: The most innovative financial institutions are exploring automation that extends beyond organizational boundaries, creating collaborative workflows with partners, suppliers, and even competitors to improve industry-wide processes like KYC verification, fraud detection, and regulatory reporting.

Intelligent Automation: The next frontier beyond basic robotic process automation in financial services combines RPA with artificial intelligence, machine learning, and natural language processing. Our research teams are tracking remarkable innovations in areas like automated underwriting, anomaly detection, and personalized product recommendations.

Cloud-Based Delivery Models: Cloud deployment is rapidly gaining traction for robotic process automation in financial services. The flexibility, scalability, and reduced infrastructure requirements make cloud automation particularly attractive for mid-sized institutions looking to accelerate implementation while minimizing capital expenditures.

Democratization of Automation Development: Low-code and no-code platforms are enabling business users to create their own automation solutions with minimal IT support. This trend is dramatically accelerating the adoption of robotic process automation in financial services by removing technical bottlenecks and empowering those closest to the processes being automated.

Process Mining Integration: Leading financial institutions are combining process mining technologies with RPA to automatically discover automation opportunities and optimize existing processes. This data-driven approach identifies inefficiencies and bottlenecks that might be missed through traditional process analysis methods.

Hyperautomation Strategies: Forward-thinking organizations are moving beyond isolated automation initiatives toward comprehensive hyperautomation approaches that combine RPA with business process management, integration platforms, and analytics to create end-to-end automated workflows across departmental boundaries.

Implementation of Best Practices for Financial Institutions

The biggest mistake financial institutions make is approaching robotic process automation as primarily an IT project rather than a business transformation enabled by technology

Strategic roadmapping separates successful robotic process automation initiatives from those that deliver underwhelming results. Choosing the right processes for your initial implementation is critical. Our robotic process automation in financial services research shows that ideal candidate processes should be rules-based, high-volume, and mature (meaning they don’t change frequently). When financial institutions begin with processes that meet these criteria, they typically achieve ROI within 6-9 months, building momentum for broader adoption.

Creating a Center of Excellence (CoE) has proven essential for scaling robotic process automation in financial services beyond initial pilot projects. This cross-functional team should include business process experts, technology specialists, and change management professionals. We’ve helped numerous financial institutions establish effective governance frameworks that balance centralized oversight with departmental flexibility in identifying automation opportunities.

Risikomanagement is highly important when implementing robotic process automation in financial services. Digital workers require the same careful access management as human employees—perhaps even more so given their ability to process transactions at scale. Leading institutions implement comprehensive security protocols including privileged access management, encryption of sensitive data, and continuous monitoring of bot activities.

Hybrid automation approaches are proving particularly effective for financial institutions with complex system landscapes. By combining robotic process automation in financial services with targeted API integrations where appropriate, organizations can optimize for both speed of implementation and long-term sustainability.

The Human Side of Automation

“The financial institutions seeing the greatest overall benefit from automation are those that view it as augmenting their human workforce rather than replacing it—creating digital assistants for employees rather than digital replacements.”

Workforce transformation represents the greatest challenge and opportunity in implementing robotic process automation in financial services. Employees naturally worry about job security when automation initiatives are announced. The most successful institutions address these concerns directly, clearly communicating how roles will evolve rather than disappear and investing heavily in reskilling programs.

The skills requirements for financial services professionals are undeniably shifting as robotic process automation becomes ubiquitous. Forward-thinking organizations are proactively developing training programs that help employees transition from process execution roles to process design, bot management, exception handling, and enhanced customer advisory positions. We’re helping several clients design career pathways that map how traditional financial services roles will evolve in an increasingly automated environment.

Measuring Success Beyond Cost Savings

Your CFO is obsessed with how many jobs your bots will eliminate… But here’s the brutal truth most financial executives miss: the banks making millions from automation aren’t the ones fixated on headcount reduction.

The financial institutions winning the automation game are tracking metrics that capture the full value spectrum. They’re measuring operational improvements like lightning-fast processing speeds and near-perfect accuracy rates. They’re quantifying risk reduction through decreased compliance exceptions. And they’re capturing how automation fundamentally transforms customer and employee experiences.

Global Adoption Patterns and Regional Variations

“What’s particularly interesting is how different regions learn from each other’s automation experiences—creating a global knowledge exchange that accelerates adoption across markets.”

Geographic differences in robotic process automation implementation reveal fascinating insights about financial markets worldwide.

North American institutions typically lead in automation scope and scale, with several major banks deploying thousands of bots across their operations. Our robotic process automation in financial services research shows these organizations focusing primarily on back-office efficiency and regulatory compliance applications.

European financial institutions have taken a somewhat different approach, with robotic process automation in financial services more frequently oriented toward enhancing customer-facing processes. This regional variation reflects both regulatory environments and competitive dynamics, with European banks often competing more directly on service experience than operational efficiency.

Asian markets present perhaps the most dynamic implementation patterns for robotic process automation in financial services. In countries like Singapore and South Korea, financial institutions are aggressively pursuing integrated automation strategies that combine RPA with AI and advanced analytics. Meanwhile, developing markets are leveraging automation to leapfrog traditional infrastructure limitations, delivering sophisticated digital services without the legacy burdens facing established institutions.

Ethical Considerations and Responsible Automation

Algorithmic transparency has become increasingly crucial as robotic process automation in financial services extends into decision-making domains like credit approval, fraud investigation, and investment recommendations.

Responsible workforce transition strategies are also essential components of ethical automation programs. The most forward-thinking financial institutions we’ve studied make explicit commitments to their employees when implementing robotic process automation in financial services. These typically include reskilling opportunities, internal mobility programs, and transparent communication about how roles will evolve rather than disappear.

Customer consent and transparency regarding automated processes vary significantly across institutions implementing robotic process automation in financial services. While some proactively inform customers when interacting with digital workers, others maintain a “black box” approach. Our research suggests that transparency typically enhances customer trust, particularly as automation extends into more complex service interactions where customers may need to understand the limitations of automated systems.

Future Outlook for Financial Automation

The human-machine collaboration paradigm represents the most promising vision for robotic process automation in financial services. Rather than an either/or proposition, the most forward-thinking institutions are creating integrated teams where digital and human workers each handle the tasks best suited to their capabilities. This approach maximizes efficiency and effectiveness while creating more fulfilling roles for human employees.

Robotic Process Automation in Financial Services – Key Insights

- Fundamental Shift: RPA in financial services has evolved from experimental technology to a core strategic capability, transforming how institutions conceptualize their workforce and operations.

- Strategic Implementation: Successful RPA adoption requires starting with high-volume, rule-based processes that cause significant pain points rather than attempting enterprise-wide deployment simultaneously.

- Beyond Cost Cutting: While cost reduction remains a primary driver, the most significant benefits are error reduction, improved customer experience, and freeing employees for higher-value activities.

- Key Applications: Financial institutions see dramatic results when applying RPA to customer onboarding, loan processing, account reconciliation, and compliance reporting—reducing processing times by up to 70%.

- Organizational Resistance: Change management is often a greater challenge than technical limitations, making employee communication, training, and involvement critical success factors.

- Intelligent Automation: The convergence of RPA with AI, machine learning, and natural language processing enables automation of increasingly complex processes requiring judgment and decision-making.

- Human-Machine Collaboration: Rather than job elimination, the most forward-thinking institutions are creating integrated teams where digital and human workers each handle tasks best suited to their capabilities.

- Center of Excellence: Scaling RPA beyond initial pilots requires a cross-functional team including business process experts, technology specialists, and change management professionals.

- Regional Variations: North American institutions typically focus on back-office efficiency, European banks emphasize customer-facing processes, while Asian markets pursue integrated strategies combining RPA with AI.

- Competitive Necessity: The gap between automation leaders and laggards continues to widen, with RPA capabilities becoming critical in competitive positioning and even M&A evaluations.

- Process Mining: Leading institutions use process mining tools to analyze system logs and discover how work actually flows through their organizations, identifying automation opportunities that might otherwise be missed.

- Ethische Überlegungen: As RPA extends into decision-making domains, ensuring algorithmic transparency and responsible workforce transition strategies becomes increasingly important.

What Makes SIS International a Top Robotic Process Automation Research Partner?

Bei SIS International, we’ve been at the forefront of market research for over four decades, evolving alongside the industries we serve. Our expertise in robotic process automation in financial services combines deep industry knowledge with cutting-edge research methodologies. When financial institutions need authoritative insights to guide their automation journeys, they turn to SIS for comprehensive intelligence that drives results.

Here’s why leading financial organizations choose SIS International for their RPA research needs:

- Globale Reichweite: Our research network spans six continents with on-the-ground experts in 120+ countries, providing truly global perspectives on RPA implementation best practices and regional adoption patterns that financial institutions can leverage for competitive advantage.

- 40+ Years of Market Research Experience: Since 1984, we’ve refined our research methodologies through multiple technology transformations, bringing historical perspective and proven approaches to understand emerging technologies like RPA in the context of long-term industry evolution.

- Proprietary Global Databases: Our exclusive respondent pools include over 5,000 financial technology decision-makers worldwide, allowing us to rapidly gather insights from the specific stakeholders who influence automation strategies at leading institutions.

- Multilingual In-Country Researchers: With staff fluent in 33+ languages, we conduct primary research in local languages, capturing nuanced insights about automation perceptions and implementation challenges that would be missed by English-only researchers.

- Advanced Data Analytics Capabilities: Our dedicated data science team applies sophisticated analytical techniques to automation implementation data, identifying patterns and correlations that help financial institutions optimize their RPA strategies for maximum ROI.

- Cross-Industry Perspective: Unlike specialized consultancies, our work across 15+ industries allows us to transfer automation insights from sectors like healthcare and manufacturing to financial services, introducing innovative approaches that wouldn’t emerge from a finance-only perspective.

- Implementation-Focused Research: We go beyond theoretical white papers to provide actionable intelligence, including detailed process selection frameworks, ROI calculation models, and change management toolkits that clients can immediately apply to their automation initiatives.

FAQs

1. What specific financial processes are best suited for initial RPA implementation?

The ideal candidates for initial RPA implementation are high-volume, rule-based processes that follow consistent procedures with minimal exceptions. The best approach is identifying processes causing significant operational pain through manual errors, backlogs, or customer complaints. For maximum impact, look for processes that cross multiple systems where employees spend considerable time on data entry, validation, or transfer between applications. Starting with these processes typically delivers ROI within 6-9 months, creating momentum for broader adoption.

2. How do we accurately calculate the ROI of RPA implementation in financial services?

Calculating comprehensive ROI requires looking beyond direct labor cost reduction to capture multiple value streams. Start by measuring direct savings from reduced processing time and staff reallocation, but also quantify error reduction benefits (including avoided costs of error remediation), compliance improvements, capacity increases, and customer experience enhancements. Leading financial institutions track metrics like reduced processing time (often 40-70%), error rate reduction (typically 90%+), and capacity increases (average 3-5x).

For customer impact, measure reduced wait times, faster service delivery, and improved satisfaction scores. The most sophisticated ROI models also capture the value of improved employee satisfaction and retention as staff move to higher-value activities.

3. What organizational structure best supports successful RPA implementation?

The most effective approach is establishing a CoE that combines centralized governance with distributed implementation capabilities. This structure typically includes process analysts who identify automation opportunities, developers who build bots, business stakeholders who prioritize initiatives, and change management specialists who facilitate adoption.

The CoE maintains standards, security protocols, and best practices while empowering business units to identify automation candidates. This balanced approach avoids the twin pitfalls of excessive centralization (creating bottlenecks) and uncontrolled proliferation of bots (causing governance issues). Financial institutions implementing this structure typically scale from dozens to hundreds of bots within 12-18 months while maintaining appropriate controls.

4. How should we approach change management when implementing RPA?

Successful change management starts with transparent communication that addresses employee concerns directly while emphasizing how automation will enhance rather than replace their roles. Create visible executive sponsorship by having senior leaders actively communicate the strategic importance of automation. Involve employees directly in identifying automation opportunities—they know better than anyone which tasks are repetitive and frustrating.

Develop and communicate clear reskilling pathways showing how roles will evolve as automation expands. Celebrate and publicize early successes, highlighting operational improvements and enhanced employee experiences. Establish automation champions within business units who can provide peer support and advocacy.

5. What security and compliance considerations are unique to RPA in financial services?

Financial institutions must implement comprehensive security frameworks for their digital workforce, including privileged access management, encryption of sensitive data, and continuous monitoring of bot activities. Bots require the same (or higher) security controls as human employees, including detailed audit logs of all actions taken.

For compliance, ensure automated processes maintain appropriate documentation and are designed with transparency that allows auditors and regulators to understand how decisions are made. Implement robust testing protocols for regulatory requirements, and consider creating specialized compliance bots that can verify adherence to regulations across processes.

6. How are leading financial institutions integrating RPA with artificial intelligence?

The integration of RPA with AI capabilities is creating increasingly powerful automation solutions. Leading institutions are implementing document intelligence that combines RPA with computer vision and natural language processing to extract, interpret, and process unstructured data from documents like loan applications or account statements. Intelligent routing systems use machine learning to analyze incoming requests and direct them to appropriate automated or human-assisted workflows. Decision automation combines RPA with predictive models to make complex judgments in areas like credit underwriting or fraud detection, while maintaining human oversight for exceptions.

7. What skills and roles should we develop as we expand our automation capabilities?

As automation expands, financial institutions must develop new skills and roles across the organization. Process architects who can redesign workflows to optimize human-machine collaboration become essential. RPA developers with financial domain knowledge are in high demand, as are automation analysts who can identify and prioritize automation opportunities.

Exception handlers who manage complex cases that fall outside automated parameters represent an evolution of traditional processing roles. Change management specialists and digital workplace trainers help employees adapt to new working methods. For leadership roles, automation program managers who can align technology initiatives with business objectives become increasingly critical. The most forward-thinking institutions create dedicated career paths for these roles, with clear development plans that help employees transition from traditional operational positions to automation-related careers.

Unser Standort in New York

11 E 22nd Street, Floor 2, New York, NY 10010 T: +1(212) 505-6805

Über SIS International

SIS International bietet quantitative, qualitative und strategische Forschung an. Wir liefern Daten, Tools, Strategien, Berichte und Erkenntnisse zur Entscheidungsfindung. Wir führen auch Interviews, Umfragen, Fokusgruppen und andere Methoden und Ansätze der Marktforschung durch. Kontakt für Ihr nächstes Marktforschungsprojekt.