Digital Transformation in Financial Services

The financial services industry has always been a cornerstone of the global economy, but in recent years, it has undergone a seismic shift. That’s why digital transformation in financial services is not just a buzzword; it’s a necessity for institutions striving to stay competitive in an era of rapid technological advancement.

… And at SIS International Research, we’ve partnered with financial leaders worldwide to navigate this transformation and uncover opportunities for growth and innovation.

What is Digital Transformation in Financial Services?

Digital transformation in financial services integrates advanced technologies to improve customer experiences, streamline operations, and drive innovation. It goes beyond merely adopting new tools—it’s about rethinking how financial institutions operate, engage with customers, and deliver value.

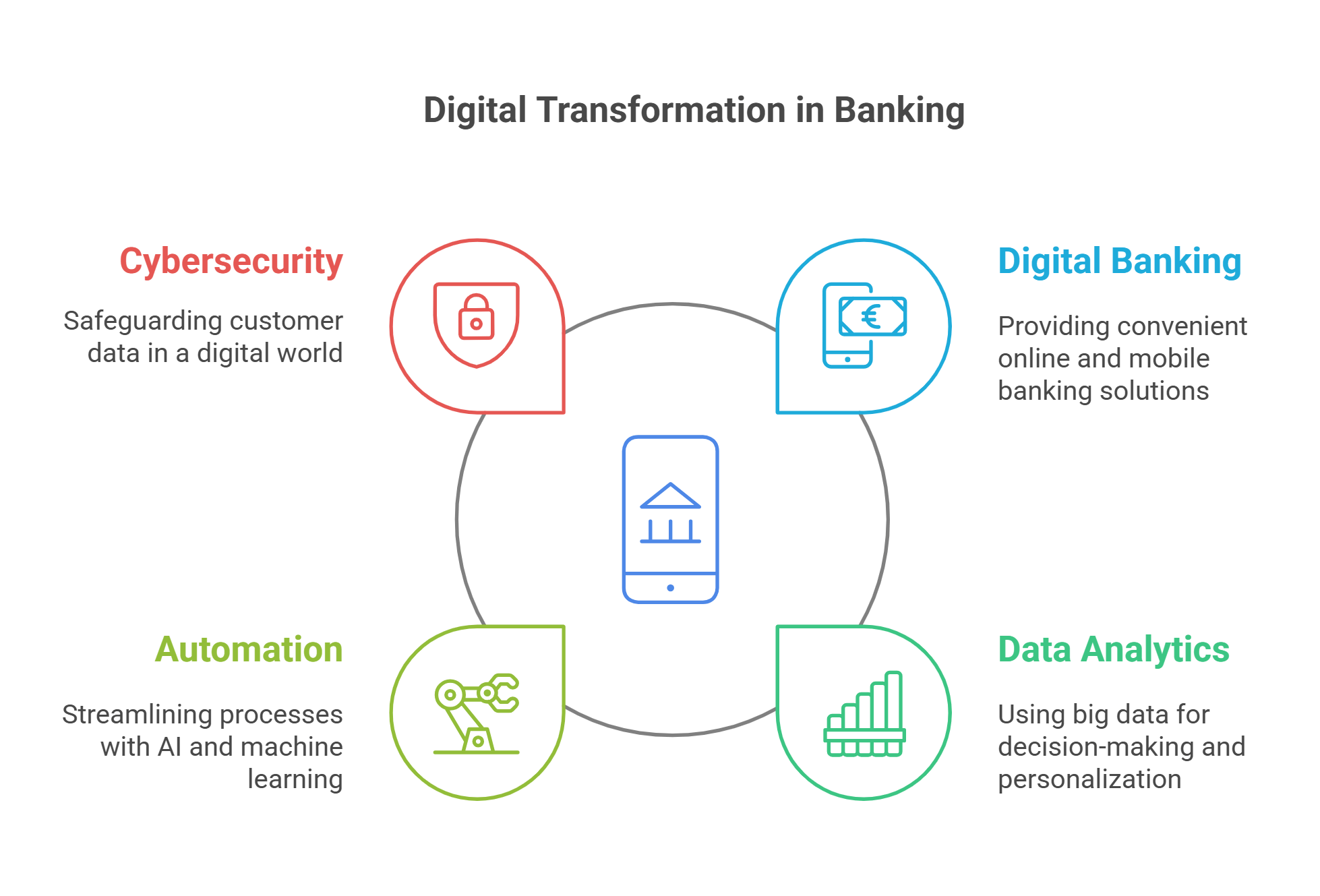

This transformation encompasses:

- Digital Banking: Offering online and mobile banking solutions.

- Datenanalyse: Leveraging big data to drive decision-making and personalization.

- Automation: Streamlining processes through AI and machine learning.

- Internet-Sicherheit: Protecting customer data in an increasingly digital landscape.

For instance, a global bank we partnered with implemented AI-driven chatbots to enhance customer service. Within six months, they reduced response times by 27% and improved customer satisfaction by 18%.

Why Digital Transformation in Financial Services Matters

The financial sector is no stranger to disruption. However, the COVID-19 pandemic accelerated the adoption of digital solutions, – and now there’s no turning back. So, here’s why digital transformation in financial services is critical:

- Changing Customer Expectations: Today’s customers demand seamless, personalized experiences across all touchpoints.

- Intensiver Wettbewerb: Fintech startups and non-traditional players are challenging established institutions.

- Einhaltung gesetzlicher Vorschriften: Digital tools help institutions stay ahead of evolving regulations.

- Kosteneffizienz: Automation reduces operational costs and increases productivity.

Key Pillars of Digital Transformation in Financial Services

At SIS, we’ve identified several pillars that drive successful digital transformation:

1. Customer-Centric Innovation

Putting customers at the center of transformation is essential. This includes:

-

- Developing intuitive mobile apps and online platforms.

- Offering personalized financial advice through AI-driven tools.

- Enhancing customer support with chatbots and virtual assistants.

2. Advanced Data Analytics

Data is the backbone of digital transformation. Institutions can:

-

- Use predictive analytics to anticipate customer needs.

- Identify trends to inform strategic decisions.

- Enhance risk management through real-time monitoring.

3. Automation and Efficiency

Automation streamlines operations and reduces manual errors. Examples include:

-

- Robotic Process Automation (RPA) for routine tasks.

- AI-driven fraud detection systems.

- Digital onboarding processes for new customers.

4. Cybersecurity and Compliance

As financial services become more digital, cybersecurity must evolve. Key measures include:

-

- Implementing multi-factor authentication.

- Conducting regular security audits.

- Using blockchain technology for secure transactions.

5. Workforce Transformation

Digital transformation isn’t just about technology—it’s about people. Training employees to adapt to new tools and fostering a culture of innovation are crucial.

Trends Shaping Digital Transformation in Financial Services

Digital transformation is about staying ahead of trends reshaping how businesses operate and customers interact with financial institutions. In any case, these are the main trends driving the future of financial services:

1. AI: The Brainpower Behind Transformation

AI is revolutionizing the way financial institutions work. Banks are leveraging AI to predict customer needs, automate repetitive tasks, and enhance decision-making with predictive analytics. For example, AI-powered chatbots provide instant customer support, while machine learning algorithms are detecting fraudulent transactions before they occur.

2. Blockchain Technology: Redefining Security and Transparency

It’s more than just cryptocurrency—it’s about simplifying complex processes like cross-border payments, smart contracts, and identity verification. Financial institutions are adopting blockchain to reduce costs, eliminate intermediaries, and ensure the security of sensitive customer data.

3. Open Banking: Collaboration Over Competition

Open banking is breaking down silos in the financial sector, encouraging collaboration between traditional banks, fintechs, and third-party developers. Open banking empowers customers with better financial products and services by allowing secure sharing of financial data (with customer consent). Imagine integrating all your accounts into one app or receiving personalized lending offers based on your financial history. This shift puts customers at the center of innovation.

4. Sustainability: Aligning Finances with Values

Sustainability isn’t just a trend—it’s a movement. Customers and investors alike are demanding financial services that prioritize environmental, social, and governance (ESG) criteria. From green loans to carbon-neutral investment portfolios, sustainability is driving the financial industry toward ethical innovation. Institutions that embrace sustainable practices aren’t just meeting regulatory requirements—they’re building stronger customer loyalty and attracting ESG-conscious investors.

The Future of Digital Transformation in Financial Services

Looking ahead, financial institutions must prioritize agility and innovation. The next wave of transformation will focus on:

- Hyper-Personalisierung: Using AI to create tailored customer experiences.

- Embedded Finance: Integrating financial services into non-financial platforms (e.g., e-commerce apps).

- Dezentrale Finanzen (DeFi): Leveraging blockchain for peer-to-peer financial interactions.

At SIS, we’re committed to helping financial leaders navigate these changes, ensuring they remain competitive and customer-focused.

What Sets SIS Apart in Digital Transformation in Financial Services?

In a crowded field of consulting firms, SIS International Forschung stands out as a leader in helping financial institutions embrace digital transformation with precision and confidence. Here’s what makes us different:

1. Unmatched Industry Expertise

We’ve worked with some of the world’s most forward-thinking financial institutions, from global banks to disruptive fintech startups. Our deep understanding of the financial services sector ensures that we’re not just offering advice—we’re delivering insights that truly matter.

2. Data-Driven Decision Making

At SIS, we believe that every recommendation should be rooted in evidence. Our strategies are powered by rigorous market research, predictive analytics, and real-time data, so you can make decisions with clarity and confidence.

3. Global Perspective with Local Insights

With a presence in major financial hubs worldwide, we bring a global lens to every project. But we also understand that digital transformation is not a one-size-fits-all approach. Our localized expertise ensures that your strategies are tailored to specific markets, regulations, and customer needs.

4. Tailored Solutions for Every Client

Your challenges are unique, and so are our solutions. We don’t believe in cookie-cutter strategies.

5. A Focus on Innovation and Agility

The financial industry doesn’t stand still, and neither do we. SIS helps you stay ahead of the curve by identifying emerging trends like AI, blockchain, and open banking, while ensuring your organization remains agile enough to adapt to rapid change.

6. Collaborative and Transparent Approach

We don’t just deliver reports and walk away. We partner with you every step of the way, working alongside your team to implement strategies, monitor progress, and refine plans as needed. And we keep things transparent—no hidden agendas or jargon.

7. Comprehensive Services Beyond Technology

Digital transformation is more than just adopting new tools—it’s about reshaping your entire organization. SIS ensures that your digital strategy is supported at every level.

FAQs

Q: What is digital transformation in financial services?

Digital transformation in financial services boils down to integrating advanced technologies like AI, big data, and automation to improve customer experiences, streamline operations, and drive innovation.

Q: Why is digital transformation necessary for financial institutions?

Digital transformation is essential for meeting changing customer expectations, staying competitive in a crowded market, ensuring regulatory compliance, and improving cost efficiency through automation.

Q: What technologies are driving digital transformation in financial services?

Key technologies include AI, machine learning, blockchain, robotic process automation (RPA), and advanced data analytics.

Q: How does digital transformation benefit customers?

Digital transformation enhances customer experiences by offering seamless, personalized services through mobile apps, online platforms, and AI-driven tools. It also ensures faster service delivery and greater transparency.

Unser Standort in New York

11 E 22nd Street, Floor 2, New York, NY 10010 T: +1(212) 505-6805

Über SIS International

SIS International bietet quantitative, qualitative und strategische Forschung an. Wir liefern Daten, Tools, Strategien, Berichte und Erkenntnisse zur Entscheidungsfindung. Wir führen auch Interviews, Umfragen, Fokusgruppen und andere Methoden und Ansätze der Marktforschung durch. Kontakt für Ihr nächstes Marktforschungsprojekt.