SIS Sensory Testing of Personal Care Products

A $120 million skincare line launch, completely tanked by a 3-second sensory experience.

That’s what happened when a global beauty conglomerate rushed their “scientifically advanced” facial moisturizer to market last year. Laboratory metrics? Perfect. Clinical results? Exceptional. But within weeks, returns flooded in and sales flatlined… The culprit? A barely perceptible tacky feeling lingered on the skin for approximately 180 seconds after application.

Those three minutes destroyed years of development and a seven-figure marketing campaign. And every bit of it was preventable with proper SIS sensory testing of personal care derivatives. This isn’t some rare catastrophe. It’s business as usual in an industry where the graveyard overflows with products that passed every technical assessment but failed the only test that ultimately matters: how they actually feel, smell, and look on real human bodies.

Table of Contents

✅ Listen to this PODCAST EPISODE here:

Beyond Performance: Why Sensory Experience Determines Success

Consumers can’t accurately articulate why they abandon personal care products. They’ll claim a product “didn’t work” when what they really mean is “I didn’t enjoy using it enough to find out if it worked.” They’ll insist efficacy is their priority while unconsciously responding to texture, scent, and skin feel that determine whether a product becomes a daily ritual or a forgotten bathroom shelf resident.

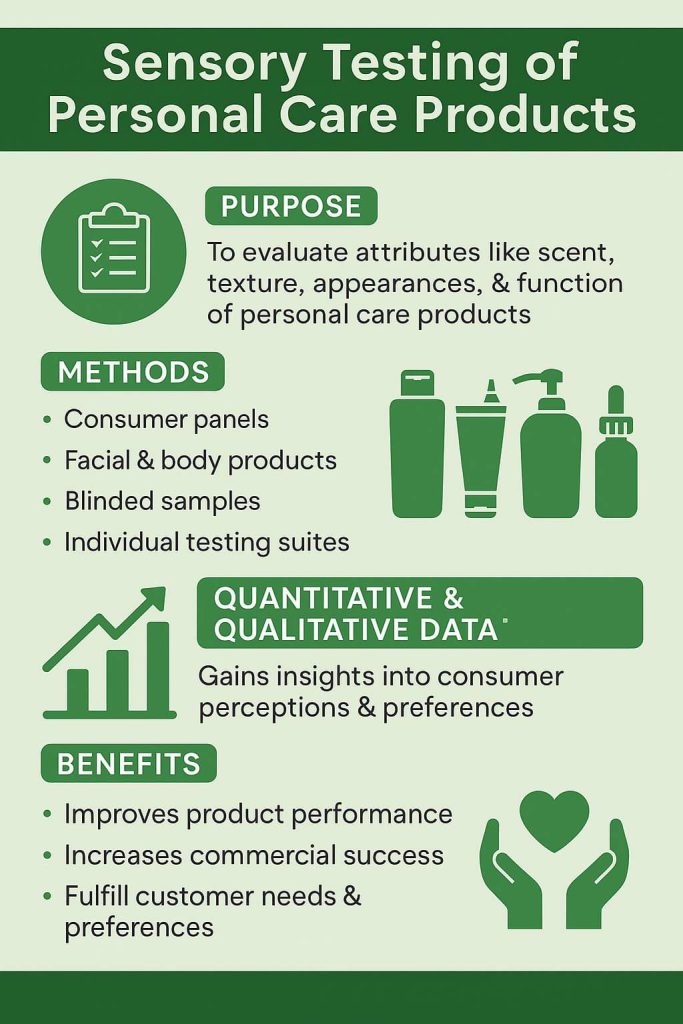

SIS sensory testing of personal care products cuts through this disconnect with methodologies that capture what consumers actually experience, not what they rationalize:

- Descriptive analysis that maps sensory profiles with scientific precision

- Temporal dominance studies that track how sensory perceptions evolve during and after application

- Emotional response measurement that quantifies feelings elicited during the usage experience

- Implicit testing that reveals unconscious associations formed during product use

Technology Integration in Modern Personal Care Sensory Testing

The field of SIS sensory testing of personal care products has undergone a technological revolution that’s created an unbridgeable gap between leaders and followers. Today’s cutting-edge protocols integrate:

- AI systems that detect subtle patterns across thousands of consumer sensory responses that human analysts would invariably miss

- 3D facial mapping that quantifies microscopic changes in skin appearance following product application

- Wearable sensors that track product performance and sensory attributes throughout the day in real-life conditions

- Advanced rheology measurements directly correlated with consumer sensory perceptions

These capabilities push SIS sensory testing of personal care products far beyond traditional limitations. A premium skincare brand experienced this firsthand when baffled by inconsistent consumer responses to a new serum despite seemingly perfect performance metrics. SIS International’s integrated approach combined sensory panel data with advanced biometric analysis to identify specific absorption characteristics creating subtle tactile feedback that differed dramatically between skin types.

Neurocosmetics and Advanced Sensory Evaluation

Your customers brains are experiencing them in ways they can’t even articulate.

Neurocosmetics is revolutionizing how you understand consumer responses to personal care products, and the SIS sensory testing of personal care products has pioneered the integration of neuroscience methodologies that measure what’s happening beneath conscious awareness when consumers interact with your formulations.

Think about your own morning skincare routine. That moment when a serum feels “just right” on your skin isn’t a simple preference—it’s a complex neurological response involving multiple brain regions processing thousands of sensory signals simultaneously. Traditional testing might tell you consumers “like” the experience, but SIS sensory testing of personal care products now reveals why they like it at a neurological level.

These advanced neurocosmetic methodologies include:

- Electroencephalography (EEG) measurements during product application that capture real-time brain responses to tactile sensations

- Galvanic skin response tracking that identifies unconscious arousal patterns triggered by specific sensory attributes

- Facial coding analysis that detects micro-expressions revealing emotional reactions to sensory experiences

- Implicit association testing that uncovers unconscious connections between sensory properties and desired outcomes

Your competitive advantage increasingly depends on creating products that resonate at this deeper neurological level. When SIS sensory testing of personal care products evaluates your formulations through neurocosmetic methodologies, you gain insights into consumer responses that your competitors can’t access through traditional testing—and that consumers themselves cannot consciously report.

Actually, the future of personal care lies in these personalized neurological sensory profiles. The SIS sensory testing of personal care products is already developing techniques to identify different neurological response patterns across consumer segments, enabling your brand to create products optimized for specific neurological preference groups rather than broad demographic categories.

Clean Beauty Movement: Sensory Challenges and Solutions

Your clean beauty initiatives face a critical sensory paradox: Consumers demand natural formulations but still expect the sensory experiences they’ve grown accustomed to from conventional products.

This sensory expectations gap has derailed countless clean beauty launches. Your customers may intellectually value clean ingredients, but their repurchase decisions are driven by sensory satisfaction that natural formulations have traditionally struggled to deliver.

The SIS sensory testing of personal care products has developed specialized methodologies to navigate this complex challenge:

- Clean-conventional sensory benchmarking that precisely identifies sensory gaps between natural formulations and conventional expectations

- Sensory compensation mapping that determines which natural ingredients can recreate specific conventional sensory attributes

- Sensory acceptance threshold testing that quantifies exactly how much sensory compromise consumers will tolerate for clean formulations

- Expectation recalibration measurements that assess how education and messaging shift sensory acceptance criteria

When your brand makes clean beauty claims, you’re activating specific sensory expectations that the SIS sensory testing of personal care products can measure and map. A natural haircare brand discovered this when their plant-based shampoo received positive initial feedback but poor repurchase rates. Comprehensive SIS sensory testing of personal care products revealed the formulation lacked the specific foam structure and immediate slip sensation consumers unconsciously expected from performance shampoos.

Virtual Testing and AI Applications

The SIS sensory testing of personal care products has pioneered integration of these breakthrough technologies:

- Virtual reality environments that simulate usage contexts from luxury bathrooms to workout facilities

- Digital sensory libraries that catalog thousands of sensory attributes with unprecedented precision

- AI-powered predictive modeling that forecasts consumer reactions to formulations before physical prototyping

- Remote sensory testing platforms that gather real-time feedback from consumers in their natural environments

- Sensory digital twins that create mathematical representations of complete product experiences

When your development team needs to optimize a formulation, traditional approaches require multiple physical prototypes and time-consuming consumer testing cycles. The SIS sensory testing of personal care products now offers alternatives that compress months of development into weeks through digital acceleration.

For instance. a global beauty brand experienced this transformation firsthand when developing a new moisturizer platform. Traditional development would have required 18-24 months and dozens of physical prototypes. Through the implementation of AI-powered SIS sensory testing of personal care products, they created digital sensory models that predicted consumer responses to thousands of potential formulations before making a single physical sample.

The results were transformative: development time reduced by 60%, prototype costs slashed by 72%, and—most importantly—first-round consumer acceptance rates increased from 32% to 76% because digital modeling had already eliminated sensory formulations likely to underperform.

Remote testing technologies are equally revolutionary. The SIS sensory testing of personal care products now includes methodologies for gathering sensory feedback from consumers in their actual homes, capturing authentic usage experiences that laboratory settings can never replicate.

The future of personal care development lies at this sensory-digital interface. When you incorporate advanced SIS sensory testing of personal care products technologies into your development process, you gain both speed and precision advantages that traditional approaches simply cannot match.

Advanced Methodologies in SIS Sensory Testing of Personal Care Products

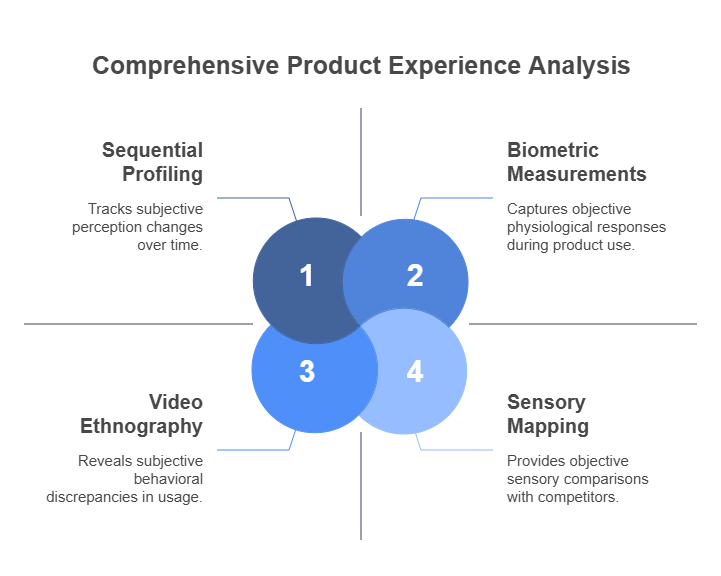

Modern SIS sensory testing of personal care products employs sophisticated methodologies that expose what conventional testing misses:

- Sequential Profiling tracks how perceptions evolve from initial application through hours of wear, revealing the dynamic nature of product experiences

- Biometric measurements capture physiological responses including facial micro-expressions, galvanic skin response, and heart rate variability during product use

- Video ethnography analyzes actual usage behavior in private settings, revealing disconnects between claimed and actual application methods

- Sensory mapping creates multi-dimensional models of how products compare to competitors and category benchmarks across dozens of sensory attributes

Key Insights Summary

✅ SIS sensory testing of personal care products transforms subjective user experiences into actionable data that predicts market performance with remarkable accuracy

✅ Personal care products that win in today’s marketplace deliver consistent sensory experiences that align with or exceed category expectations

✅ Regional and cultural variations in sensory preferences represent significant risks when ignored and competitive advantages when understood

✅ Modern personal care sensory testing integrates advanced technologies including biometrics, AI, and rheological analysis that traditional research can’t match

✅ Early integration of sensory testing dramatically reduces both development costs and time-to-market

✅ Comprehensive sensory optimization reliably delivers ROI of 1,500-2,000% when measured against sales performance

✅ Market-leading personal care brands maintain ongoing sensory testing programs rather than treating it as a one-time project

✅ SIS International’s combination of global coverage, speed, agility, and cost-effective pricing creates a competitive edge that traditional research firms cannot match

✅ The most successful personal care launches combine sensory excellence with operational efficiency—precisely what SIS methodologies are designed to optimize

✅ Smart brands are shifting from ingredient-focused development to holistic sensory experience design that creates lasting competitive advantages

What Makes SIS International a Top Personal Care Sensory Testing Provider?

Ten Reasons Personal Care Businesses Trust SIS for Sensory Testing:

- GLOBAL REACH: While others claim “international capabilities,” SIS conducts hands-on personal care sensory research across six continents, enabling true cross-cultural comparison.

- 40+ YEARS OF EXPERIENCE: With over four decades immersed in personal care sensory science, SIS has refined methodologies through shifting consumer preferences, regulatory changes, and emerging sensory technologies.

- GLOBAL DATA BASES FOR RECRUITMENT: SIS maintains specialized panels of both trained sensory experts and representative consumers in key personal care markets worldwide.

- IN-COUNTRY STAFF WITH OVER 33 LANGUAGES: Local teams with cultural fluency ensure that sensory research captures authentic responses rather than translation artifacts. When a Korean consumer describes a skin sensation as “chok-chok,” SIS understands this conveys hydration qualities that simply don’t exist in Western sensory vocabulary.

- GLOBAL DATA ANALYTICS: SIS transforms subjective personal care experiences into actionable data through proprietary algorithms developed specifically for sensory analysis.

- COST EFFECTIVE PRICING: SIS offers modular designs ranging from targeted single-attribute testing to comprehensive sensory mapping, with transparent pricing that delivers 35-45% better value than competitors.

- CUSTOMIZED APPROACH: Template research yields template insights (and predictably mediocre results). Each SIS personal care sensory study is precision-engineered for specific business objectives, whether product development, competitor benchmarking, or quality control, as highlighted in their diverse case study portfolio.

- GLOBAL COVERAGE: SIS doesn’t just sample markets—they immerse in them. With testing facilities and consumer panels in over 50 countries spanning six continents, they capture nuanced cultural differences that determine whether your personal care product will be a global sensation or an expensive failure.

- SPEED OF SENSORY TESTING: SIS’s streamlined methodologies and permanent panels enable them to deliver comprehensive sensory results in 45% less time than industry averages, allowing personal care brands to iterate faster and beat competitors to market.

- AGILITY: SIS’s modular testing approach allows for rapid protocol adjustments as new insights emerge, creating an iterative sensory optimization process rather than rigid, linear testing.

FAQ: Common Questions About Personal Care Sensory Testing

What types of personal care products benefit most from sensory testing?

Let me be absolutely clear: all of them. While certain categories like skincare, haircare, and fragrance pioneered sensory science due to their obvious sensory components, today’s applications span the entire personal care industry. From deodorants to dental care, sun protection to baby products—any item that contacts human skin, hair or senses benefits from professional sensory evaluation. The more competitive your category, the more critical sensory testing becomes to differentiation and market success. I’ve seen “basic” categories like bar soap completely transformed through sensory optimization.

How many consumers should participate in a personal care sensory test?

It depends on your specific objectives, but here’s the practical answer most researchers hedge around: For statistical reliability, quantitative personal care sensory tests typically require 100-300 participants based on test complexity and expected effect sizes. Qualitative exploratory work might use smaller panels of 8-20 participants with specific sensory acuity. The key isn’t just sample size—it’s recruiting the right participants with relevant demographic profiles, skin/hair types, and sensory capabilities. One inappropriate participant can contaminate otherwise valid results. Quality beats quantity every single time in sensory research.

What’s the difference between consumer personal care sensory testing and expert panel evaluation?

They answer fundamentally different questions, and leading brands utilize both. Consumer testing measures subjective reactions from representative target audience members—the “what” of preference. Expert panels provide objective descriptions of product attributes using standardized terminology—the “why” behind those preferences. Think of consumer panels as measuring if people enjoy your product, while expert panels describe exactly what sensory attributes they’re responding to. Both approaches provide complementary intelligence. Choosing between them is like deciding whether your car needs an engine OR wheels instead of recognizing you need both.

Can sensory testing predict personal care product success?

No research methodology guarantees market success—anyone claiming otherwise is selling fantasy. However, personal care sensory testing has demonstrated remarkably strong correlative power with market performance. When integrated with traditional consumer research data, sensory testing significantly increases predictive accuracy by identifying potentially fatal sensory flaws that standard approaches routinely miss. The most valuable aspect isn’t just identifying what works—it’s catching sensory deal-breakers before your product reaches shelves and damages brand equity. I’ve seen countless products saved from market failure through pre-launch sensory adjustments.

How does personal care sensory testing differ from consumer product trials?

Fundamentally different approaches. Consumer trials typically ask simplistic preference questions over extended usage periods with minimal controls. Professional SIS sensory testing of personal care products employs scientific protocols with controlled environments, precise application methods, standardized evaluation parameters, and specialized response capture techniques. It’s the difference between asking “Did you like using this?” and systematically mapping the complete sensory experience from first impression through extended use with calibrated metrics.

Is personal care sensory testing only relevant for premium or prestige products?

This dangerous misconception has cost countless mass-market brands millions in failed launches. While sensory testing is critical for premium products where expectations are highest, it’s equally valuable for mass-market offerings where competition is fiercest. Many category leaders across price points conduct regular sensory testing on existing products to ensure consistency through manufacturing variations and to track how they perform against evolving category expectations.

Unser Standort in New York

11 E 22nd Street, Floor 2, New York, NY 10010 T: +1(212) 505-6805

Über SIS International

SIS International bietet quantitative, qualitative und strategische Forschung an. Wir liefern Daten, Tools, Strategien, Berichte und Erkenntnisse zur Entscheidungsfindung. Wir führen auch Interviews, Umfragen, Fokusgruppen und andere Methoden und Ansätze der Marktforschung durch. Kontakt für Ihr nächstes Marktforschungsprojekt.