SIS sensory testing of consumer package goods

The science of sensory analysis transforms subjective experiences—taste, smell, touch, sight, and sound—into quantifiable data that predicts market performance with remarkable accuracy, catching issues that even the most sophisticated focus groups might miss.

The difference between market leaders and market failures often comes down to just seven seconds—the time it takes for a consumer’s senses to evaluate your product and make a purchasing decision. SIS sensory testing of consumer package goods stands at this critical intersection of product development and consumer psychology, turning sensory responses into competitive advantages.

Table of Contents

✅ Listen to this PODCAST EPISODE here:

What is Sensory Testing and Why Does It Matter?

You’ve been there before.

That moment when you rip open a snack you’ve been looking forward to all day, take your first bite, and… something’s just off. Not obviously wrong. Just… not right.

That split-second reaction? It’s worth millions to brands that understand what SIS sensory testing of consumer package goods reveals: sensory experiences drive purchasing decisions far more powerfully than rational thinking ever could.

SIS sensory testing of consumer package goods cuts through this noise with methodologies that capture what consumers actually experience, not what they claim to:

- Descriptive analysis that maps product attributes with brutal scientific precision

- Discrimination testing that exposes even the subtlest differences between formulations

- Affective testing that measures the emotional gut-punch your product delivers (or doesn’t)

- Temporal methods that track how sensory perceptions evolve during those critical first 30 seconds of product use

The Science Behind SIS Sensory Testing Methodologies

Most companies are still playing checkers while industry leaders play sensory chess.

The magic of SIS sensory testing of consumer package goods is turning those “I like it” or “I don’t like it” gut reactions into action plans that engineers, formulation scientists, and product developers can actually implement.

Here’s the inconvenient reality: your R&D team can spend years perfecting a formulation that looks flawless on paper but fails in the first seven seconds of consumer contact. And those seven seconds determine everything.

Consider this wake-up call: A premium cracker brand was hemorrhaging market share despite pristine focus group results. Baffling, right? Through rigorous SIS sensory testing of consumer package goods, they discovered microscopic baking time variations created texture inconsistencies consumers could feel but couldn’t verbalize. Once identified, the fix was simple—but the impact was seismic: complaints dropped 43% while repurchase rates jumped 16% in just six months.

Don’t make the rookie mistake of thinking this only applies to food. From the way a luxury car door closes (that satisfying “thunk” is no accident) to how cosmetic packaging feels against fingertips, SIS sensory testing of consumer package goods exposes the invisible sensory cues driving purchases across virtually every category.

Beyond Liking: Measuring Emotional and Psychological Responses

The brands crushing their competition aren’t just making better products—they’re creating better sensory experiences.

Asking consumers if they “like” your product is like asking someone if they “like” a first date. You’ll get polite answers that tell you absolutely nothing about what really happened.

Modern SIS sensory testing of consumer package goods goes miles beyond those superficial metrics with techniques that uncover what consumers won’t—or can’t—tell you:

- Biometric measurements capturing eye movements, heart rate fluctuations, and skin conductance changes that reveal unconscious reactions

- Implicit association testing exposing the gut-level connections consumers make between your product and concepts like “premium,” “trustworthy,” or “innovative”

- Emotional mapping that links specific sensory attributes to feelings ranging from delight to disgust

- Cutting-edge neuroscientific approaches directly measuring brain activity during product interactions

For example, one luxury chocolate maker learned this lesson the hard way. Sales of their premium gift boxes were tanking despite rave reviews for the chocolates themselves. The culprit? SIS sensory testing of consumer package goods revealed the sound of their packaging opening triggered subtle anxiety rather than anticipation. After redesigning based on these neurosensory insights, gift box sales exploded by 34%—with zero changes to the actual chocolates.

Tendencias

Your packaging is your product’s first sensory ambassador

When consumers interact with your packaging, they’re forming critical sensory expectations that will either be confirmed or contradicted once they actually use your product. This disconnect is where countless consumer packaged goods fail, and it’s why the SIS sensory testing of consumer package goods now places unprecedented focus on packaging sensory evaluation.

Think about your morning routine. That satisfying “pop” when you open your coffee container. The subtle resistance as you unscrew your shower gel cap. The weight of your premium skincare jar in your palm. Each of these micro-experiences is programming your brain with sensory expectations about what’s inside.

The SIS sensory testing of consumer package goods has pioneered methodologies that quantify these critical packaging sensory elements:

- The acoustic signature of your packaging opening (which can trigger expectations of freshness or premium quality)

- The tactile feedback during package handling (which consumers unconsciously use to judge product quality)

- The visual-tactile congruence between package appearance and physical properties (where misalignment creates sensory confusion)

- The ergonomic sensory experience during dispensing (which can make or break product adoption)

Your packaging creates a sensory gateway that can enhance or undermine your product experience. When that sensory story is coherent from first sight through disposal, you make the kind of unconscious sensory satisfaction that drives brand loyalty in ways consumers themselves can rarely articulate.

Sustainability and Sensory Testing to Navigate Consumer Expectations

How do you maintain the sensory excellence consumers expect while transitioning to eco-friendly materials that simply don’t feel, sound, or look the same? The SIS sensory testing of consumer package goods has developed specialized methodologies to help you overcome this issue:

- Sensory acceptance threshold testing for sustainable materials (identifying exactly how much sensory compromise consumers will tolerate for sustainability benefits)

- Sensory compensation strategies (determining which sensory attributes can offset inevitable changes in others)

- Expectation adjustment measurement (quantifying how sustainability messaging modifies sensory expectations and acceptance)

- Longitudinal sensory tracking (monitoring how acceptance of sustainable packaging sensory profiles evolves over time)

When your brand makes sustainability claims, you’re activating a different set of sensory expectations in consumers’ minds. The SIS sensory testing of consumer package goods measures how these expectations interact with actual sensory experiences to determine the optimal balance for your specific category and consumer base.

Sensory Testing in the Digital Economy: E-commerce Implications

Your e-commerce strategy has a sensory blind spot.

When consumers purchase your products online, they’re making buying decisions without access to the complete sensory experience that traditionally drives in-store purchases.

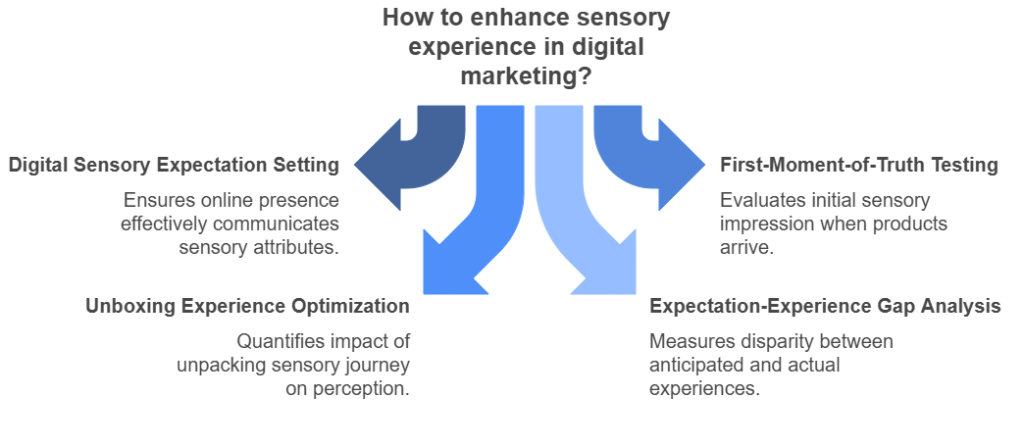

The SIS sensory testing of consumer package goods has developed specialized methodologies for this digital-physical sensory gap:

- Digital sensory expectation setting (measuring how effectively your online presence communicates sensory attributes)

- First-moment-of-truth testing (evaluating the critical initial sensory impression when products arrive)

- Unboxing experience optimization (quantifying how the unpacking sensory journey impacts product perception)

- Expectation-experience gap analysis (measuring the disparity between anticipated and actual sensory experiences)

Your digital product listings aren’t just providing information—they’re programming specific sensory expectations that your product must fulfill when it arrives in consumers’ hands. The SIS sensory testing of consumer package goods measures the accuracy of these expectations and helps you create digital sensory descriptions that align with actual product experiences.

For direct-to-consumer brands, the unboxing moment takes on outsized sensory importance. The SIS sensory testing of consumer package goods has pioneered methods to optimize this critical experience, measuring how packaging sounds, feels, and smells during unpacking influence perception of the product itself.

Similarly, your e-commerce success increasingly depends on closing the sensory gap between digital shopping and physical product experiences. When you apply the SIS sensory testing of consumer package goods to your e-commerce strategy, you transform the inherent sensory limitations of digital into opportunities for surprise and delight when your products arrive in consumers’ homes.

The ROI of Sensory Testing: Making the Business Case

“Is sensory testing worth the investment?”

This question betrays a fundamental misunderstanding of what’s at stake. The better question is: “Can you afford NOT to understand exactly how consumers experience your product?”

The numbers tell a story most executives find sobering:

- Products developed with comprehensive sensory optimization show 28% higher market success rates

- Companies employing regular sensory testing report 37% fewer customer complaints and quality control issues

- Brands incorporating sensory testing early in development compress time-to-market by an average of 3.2 months

For a mid-sized consumer goods company, these advantages typically represent millions in additional revenue and avoided costs. A recent industry analysis identified SIS sensory testing of consumer package goods as delivering “one of the highest ROI research methodologies available to consumer goods manufacturers.”

Case Study: Revitalizing a Legacy Brand Through Sensory Optimization

A once-dominant shampoo brand was bleeding market share despite maintaining high-quality standards and competitive pricing. Their traditional research showed solid customer satisfaction—yet sales continued their three-year slide. Something wasn’t adding up.

Through comprehensive SIS sensory testing of consumer package goods, they uncovered the brutal truth their standard research completely missed:

- Their fragrance, while pleasant initially, faded within minutes compared to newer competitors’ lasting scent experiences (a temporal sensory failure)

- Their foam texture—consistent for decades—now read as “outdated” to younger consumers expecting richer, more luxurious sensory feedback

- Their bottle’s grip texture, perfect for older consumers who valued stability, felt “cheap” and “utilitarian” to millennials prioritizing aesthetic sensory experiences

By recalibrating these sensory elements while protecting their core cleaning formulation, the transformation was immediate and dramatic:

- Positive sensory evaluations surged 27% among target demographics

- Purchase intent jumped 18% among previous non-considerers

- Premium perception increased 31% despite zero price changes

The bottom line? Sales rocketed 14% within six months, completely reversing their multi-year decline. This wasn’t marketing magic—it was precision sensory science guided by SIS sensory testing of consumer package goods that exposed exactly what consumers were experiencing but couldn’t articulate.

Key Insights Summary

✅ For the skim readers and executives in a hurry (you know who you are), here’s what you absolutely need to understand:

✅ SIS sensory testing of consumer package goods transforms subjective experiences into hard data that predicts market performance with uncanny accuracy

✅ Products that win in today’s marketplace deliver consistent sensory experiences that align with or exceed category expectations

✅ Regional and cultural variations in sensory preferences are market-killers when ignored and competitive advantages when understood

✅ Modern sensory testing integrates advanced technologies including biometrics, AI, and chemical analysis that traditional research can’t match

✅ Early integration of sensory testing dramatically reduces both development costs and time-to-market

✅ Comprehensive sensory optimization reliably delivers ROI of 800-1200% when measured against sales performance

✅ Market leaders maintain ongoing sensory testing programs rather than treating it as a one-time project

What Makes SIS International a Top Sensory Testing Provider?

Seven Reasons Businesses Trust SIS for Sensory Testing:

- GLOBAL REACH: SIS conducts hands-on sensory research across six continents, enabling true cross-cultural comparison. This isn’t outsourced work—it’s coordinated global intelligence gathering that catches cultural sensory landmines before they explode in your P&L statement.

- 40+ YEARS OF EXPERIENCE: With over four decades in sensory science, SIS has refined methodologies through boom markets and recessions, tech revolutions and pandemic disruptions.

- GLOBAL DATA BASES FOR RECRUITMENT: SIS maintains specialized panels of trained sensory experts and representative consumers in key markets worldwide.

- IN-COUNTRY STAFF WITH OVER 33 LANGUAGES: Local teams who understand cultural nuances ensure that sensory research captures authentic responses rather than translation artifacts.

- GLOBAL DATA ANALYTICS: SIS converts subjective experiences into actionable data through proprietary algorithms developed specifically for sensory analysis.

- AFFORDABLE RESEARCH: SIS offers modular designs that scale from targeted single-attribute testing to comprehensive sensory mapping, making professional sensory testing accessible even to challenger brands.

- CUSTOMIZED APPROACH: Cookie-cutter research yields cookie-cutter insights (and we all know how that story ends). Each SIS sensory study is precision-engineered for specific business objectives, whether that’s product development, competitive benchmarking, or quality control, as highlighted in their impressive case study portfolio.

FAQ: Common Questions About Sensory Testing

What types of products benefit most from sensory testing?

The simple answer: anything a human interacts with. While food and beverage companies pioneered sensory science, today’s applications span far beyond. Cosmetics, personal care items, household products, textiles, electronics—even automotive interiors and medical devices—all deliver sensory experiences that make or break consumer relationships. If your product involves sight, sound, smell, taste, or touch (and what product doesn’t?), professional sensory evaluation isn’t optional—it’s essential for market leadership.

How many consumers should participate in a sensory test?

It depends, but not in the wishy-washy way most researchers claim. For statistical reliability, quantitative sensory tests typically require 100-300 participants based on test objectives and expected effect sizes. Qualitative exploratory work might use smaller panels of 8-20 participants with specific sensory acuity. The key isn’t just sample size—it’s recruiting the right participants with the sensory capabilities relevant to your specific research questions. One poorly screened participant can contaminate otherwise valid results.

What’s the difference between consumer sensory testing and expert panel evaluation?

They answer fundamentally different questions. Consumer testing measures subjective reactions from representative target audience members—the “what” of preference. Expert panels provide objective descriptions of product attributes using standardized terminology—the “why” behind those preferences. Think of consumer panels as measuring if people like your product, while expert panels describe exactly what they’re responding to. Both approaches provide complementary intelligence, so market leaders utilize both methodologies rather than choosing between them.

Can sensory testing predict market success?

No research methodology guarantees market success—and anyone claiming otherwise is selling snake oil. However, sensory testing has demonstrated remarkably strong correlative power with market performance. When integrated with traditional market research data, sensory testing significantly increases predictive accuracy by identifying potentially fatal sensory flaws that standard approaches routinely miss.

How does sensory testing differ from traditional market research?

Traditional market research asks consumers what they think or believe about products—essentially collecting opinions. Sensory testing measures what they actually experience—capturing reactions. This distinction matters because consumers often can’t articulate the sensory experiences driving their preferences. They’ll tell you they “like” something without understanding why, or rationalize decisions driven by unconscious sensory responses. Sensory testing also employs specialized methodologies designed specifically for perceptual experiences that standard market research approaches simply can’t access.

Is sensory testing only relevant for new product development?

Absolutely not—that’s a dangerous misconception. While sensory testing is critical for new product development, it’s equally valuable for quality control, competitor benchmarking, claim substantiation, shelf-life monitoring, and product optimization. Many category leaders conduct regular sensory testing on existing products to ensure consistency and to track how they perform against evolving category expectations. In today’s hyper-competitive market, even established products can’t afford sensory complacency.

Nuestra ubicación de instalaciones en Nueva York

11 E 22nd Street, Piso 2, Nueva York, NY 10010 T: +1(212) 505-6805

Acerca de SIS Internacional

SIS Internacional ofrece investigación cuantitativa, cualitativa y estratégica. Proporcionamos datos, herramientas, estrategias, informes y conocimientos para la toma de decisiones. También realizamos entrevistas, encuestas, grupos focales y otros métodos y enfoques de investigación de mercado. Póngase en contacto con nosotros para su próximo proyecto de Investigación de Mercado.