Product Sensory Testing in Market Research

Product sensory testing in market research is the unsung hero behind successful launches that captivate consumers from the first touch, taste, or smell.

Have you ever wondered why some products fly off shelves while others collect dust? This is not the result of flashy marketing campaigns or magic… But in something much more primal: how products engage our senses!

Table of Contents

✅ Listen to this PODCAST EPISODE here:

Understanding Product Sensory Testing in Market Research

The most powerful products create sensory experiences that become part of consumers’ identity and lifestyle. Product sensory testing reveals the invisible threads that connect physical attributes to emotional resonance.

Product sensory testing in market research is the scientific approach to evaluating how consumers perceive products through their five senses. It’s where psychology meets physiology meets profit. At SIS International Research, we’ve transformed this approach from a nice-to-have into an essential competitive advantage for brands that want to dominate their categories.

Consider this: humans process sensory information before rational thought kicks in. That split-second reaction often determines whether a consumer forms a positive or negative impression of your product. So, through carefully designed sensory panels and evaluation protocols, we can capture these instant reactions and translate them into actionable insights.

The Science Behind Sensory-Driven Decisions (That Your Competition Doesn’t Understand)

Did you know that 85% of purchase decisions happen subconsciously? Let that sink in. Your brain has already decided before you have.

Product sensory testing in market research taps directly into this subconscious decision-making process. While traditional market research can tell you what consumers want, sensory testing reveals what they’ll actually choose when standing in front of the shelf.

At SIS, our specialists have refined sensory testing methodologies that combine:

Key Methodologies in Product Sensory Testing

In today’s crowded marketplace, functional performance is just the price of entry. The real battleground is sensory appeal—how your product feels, tastes, smells, sounds, and looks to consumers. This is where lasting competitive advantage is created.

Methodology makes all the difference between superficial feedback and profound insights. At SIS International, we deploy several approaches depending on your specific objectives:

Descriptive Analysis

This gold standard in product sensory testing creates a comprehensive sensory profile of products. Our trained panels identify and rate the intensity of various attributes, from the brightness of citrus notes in a beverage to the softness gradient in fabric products.

For instance, I remember working with a premium skincare brand whose formula received mediocre consumer ratings despite expensive ingredients. Our descriptive analysis revealed their moisturizer had excellent hydration but poor “slip” attributes—it simply didn’t feel luxurious during application. After reformulation focusing on texture, their consumer satisfaction scores jumped 27%.

Discrimination Testing

Sometimes subtle differences matter enormously. Discrimination tests like triangle tests, duo-trio comparisons, and paired comparisons determine whether consumers can detect differences between similar products.

And we’ve been using this test for ages. When a major food manufacturer needed to reduce costs by changing ingredients, we conducted triangle tests to ensure consumers couldn’t detect the difference. This saved them millions while preserving product integrity.

Preference Testing

Beyond detecting differences, we need to understand what consumers like. Preference testing in product sensory testing directly measures consumer satisfaction and purchase intent. These methods include hedonic scales, preference ranking, and paired preference tests.

The insights are invaluable—we recently helped a coffee company select between three formula variations by identifying which version created the most desirable mouthfeel for their target demographic.

Why Most Product Sensory Testing Fails (And How We Fixed It)

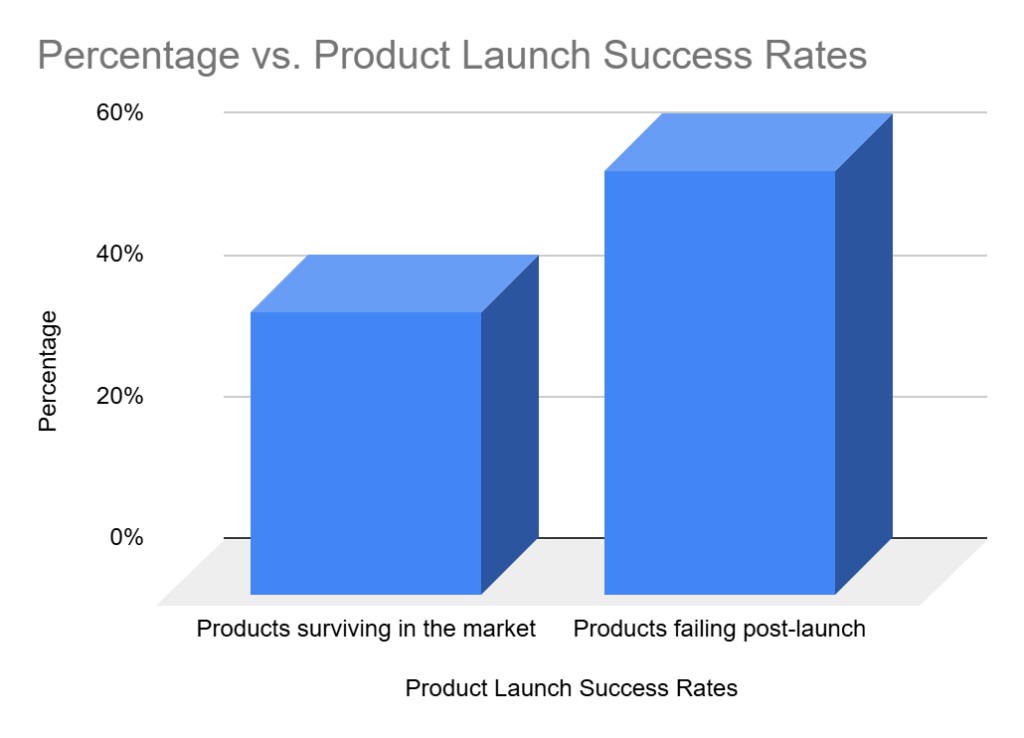

Here’s a painful truth: most companies are wasting money on incomplete product sensory testing in market research.

- They test too late in development. By the time most products reach sensory testing, companies have already invested so heavily that they’re resistant to necessary changes.

- They use amateur panels. Genuine product sensory testing in market research requires trained evaluators who can articulate subtle differences that average consumers feel but can’t express.

- They ignore cultural context. What tastes “rich” in Germany might taste “overwhelming” in Japan. Product sensory testing in market research must account for cultural expectations.

- They separate sensory testing from brand experience. Your product doesn’t exist in isolation—its sensory properties must align with your brand promises.

- They collect data without actionable insights. Mountains of sensory data are useless without clear paths to product improvement. This is why our strategy consulting services always integrate with research findings.

Source: BusinessDasher

We learned this lesson dramatically when working with a household cleaning product manufacturer. Their initial product sensory testing showed consumers loved the cleaning efficacy but hated the experience. The product worked brilliantly but smelled medicinal—triggering associations with hospitals rather than “clean home.”

Product Sensory Testing Applications Across Industries

The versatility of product sensory testing in market research makes it invaluable across diverse sectors:

Nourriture et boisson

This is where product sensory testing originated and remains most established. Beyond basic taste testing, we evaluate complex attributes like mouthfeel, aftertaste, and aroma compounds. We helped a craft brewery identify precisely which hop varieties created the “juicy” quality their target consumers craved. This resulted in a formulation that won three industry awards and increased distribution by 45% in one year.

Personal Care and Cosmetics

Texture, scent, absorption rate, and skin feel critically influence consumer loyalty in this sector. When a luxury skincare brand struggled with high return rates, our product sensory testing revealed their expensive moisturizer absorbed too slowly for time-pressed American consumers compared to competitors. A simple formulation adjustment reduced returns by 22% while maintaining efficacy claims.

Textiles et vêtements

How fabric feels against skin directly impacts perceived quality and comfort. We’ve pioneered methods to quantify attributes like softness, drape, and recovery that previously relied on subjective assessment. For a major athletics brand, we identified the precise fabric texture that conveyed “performance” to their target market, helping them outperform competitors on comfort ratings despite similar materials.

Automotive and Durables

Even in hard goods, sensory attributes create powerful impressions. The sound of a car door closing, the tactile feedback of controls, and the perceived temperature of surfaces all contribute to quality perception. Our work with an automotive manufacturer revealed their premium model’s door handles felt “cheap” despite their actual durability—a finding that prevented a potentially costly market disappointment.

Cultural Variations in Sensory Preferences

One of the most fascinating aspects of product sensory testing in market research is discovering how sensory preferences vary dramatically across cultures. These differences can make or break international product launches.

Taste Preferences

Sweetness perception and preference vary dramatically worldwide. North American consumers typically prefer significantly higher sweetness levels than European or Asian markets.

Texture Expectations

Mouthfeel preferences show fascinating cultural patterns. In many Asian markets, consumers appreciate textures Western consumers might find unappealing—from the slipperiness of natto to the springiness of fish balls.

Fragrance Associations

Scent preferences and associations are perhaps the most culturally influenced sensory dimension. Fragrances that connote “clean” in one market may signal “medicinal” in another.

The Future of Product Sensory Testing in Market Research: Where We’re Headed

À SIS International, we’re pioneering several approaches that will define the next generation of sensory research:

✅Biometric Response Integration – Combining verbal feedback with physiological measurements to capture unconscious responses

✅Virtual Reality Sensory Environments – Creating controlled testing environments that simulate real-world contexts

✅ AI-Powered Sensory Prediction Models – Developing algorithms that can predict consumer sensory preferences based on demographic and psychographic profiles

✅Cross-Modal Sensory Mapping – Understanding how sensory experiences in one domain (like sound) influence perceptions in another (like taste)

The companies that embrace these advanced approaches to product sensory testing in market research will create products that don’t just satisfy consumers—they create deep emotional connections that drive loyalty, premium pricing power, and sustainable competitive advantage.

What Makes SIS International a Top Product Sensory Testing in Market Research Provider?

At SIS International, we’ve spent decades refining our approach to sensory evaluation, creating methodologies that combine scientific rigor with practical business applications. Here’s why leading brands partner with SIS International for their sensory research needs:

✔ GLOBAL REACH: Our sensory panels span 120+ countries, allowing us to identify cultural differences in sensory preferences that might make or break your international launches.

✔ 40+ YEARS OF EXPERIENCE: Since our founding in 1984, we’ve conducted product sensory testing in market research across virtually every product category. We’ve tracked evolving sensory preferences across generations, helping clients stay relevant as consumer expectations shift.

✔ GLOBAL DATABASES FOR RECRUITMENT: Our proprietary recruitment system includes over 20 million profiled consumers worldwide, enabling rapid assembly of specialized sensory panels matched to your exact target demographic.

✔ IN-COUNTRY STAFF WITH OVER 33 LANGUAGES: Sensory preferences are profoundly cultural and often challenging to articulate. Our native experts conduct evaluations in respondents’ primary languages, capturing nuanced feedback that would be lost in translation with less experienced teams.

✔ GLOBAL DATA ANALYTICS: Our specialized sensory data analysis tools identify patterns across markets, product categories, and periods.

✔ AFFORDABLE RESEARCH: Our efficient methodologies deliver robust sensory insights without unnecessary expenses. We eliminate costly over-engineering of studies while still providing comprehensive understanding.

✔ CUSTOMIZED APPROACH: We design sensory evaluation protocols specifically for your product category, competitive context, and research objectives.

Summary: Key Insights About Product Sensory Testing in Market Research

If you’re skimming this article (and let’s be honest, who isn’t these days?), here are the mission-critical takeaways about product sensory testing in market research:

Integration Is Key: Sensory testing isn’t an isolated activity—it must connect directly to product development, marketing, and brand strategy to deliver maximum value.

The Subconscious Rules: 85% of consumer purchase decisions happen below conscious awareness, which is why sensory testing taps into what customers actually do rather than what they say.

Multisensory Matters: Successful products don’t just perform well—they create coherent sensory experiences that align with brand promises and cultural expectations.

Early Testing Saves Millions: Companies waste enormous resources by conducting sensory testing too late in development when changes become prohibitively expensive.

Cultural Context Is Critical: Sensory preferences vary dramatically across markets—what works in one region may fail spectacularly in another.

ROI Is Measurable: Our clients routinely see 30%+ improvements in market performance through comprehensive sensory testing programs.

Frequently Asked Questions About Product Sensory Testing in Market Research

What exactly is product sensory testing in market research?

Product sensory testing is a scientific approach to evaluating how consumers experience products through their five senses (taste, touch, smell, sight, and sound). It measures actual physiological and psychological responses to product attributes, helping predict real-world consumer behavior more accurately.

How is sensory testing different from focus groups or surveys?

While focus groups and surveys capture what consumers say they want, sensory testing reveals what they’ll actually choose based on unconscious preferences. Focus groups are excellent for concept testing, but sensory testing is essential for product formulation, packaging design, and overall experience optimization.

How long does the sensory testing process typically take?

A comprehensive sensory testing program usually takes 6-12 weeks from initial design to final recommendations. Rush programs can be completed in 3-4 weeks for urgent needs, though we recommend allowing adequate time for multiple testing phases to optimize results.

Can sensory testing be done remotely or must it be in-person?

While some aspects of sensory testing require controlled in-person environments, we’ve developed hybrid methodologies that combine remote and in-person components. Our global research network allows us to conduct in-person testing across multiple markets simultaneously, while digital tools enable broader sample coverage for certain sensory attributes.

When in the product development process should sensory testing occur?

Ideally, sensory testing should be integrated throughout the product development lifecycle, from concept phase through post-launch optimization. Early testing identifies opportunities and prevents costly mistakes, while ongoing testing ensures the final product delivers the intended sensory experience consistently.

How does sensory testing apply to digital products or services?

Great question! While physical products have obvious sensory components, digital experiences also create powerful sensory impressions. From the sound of notifications to the tactile feedback of interactions to the visual design, digital products benefit enormously from sensory optimization. We’ve helped tech companies increase engagement by 40%+ through digital sensory experience mapping.

What industries benefit most from product sensory testing?

While food, beverage, personal care, and household products are obvious candidates, we’ve successfully applied sensory testing methodologies to automotive interiors, medical devices, packaging, retail environments, hospitality experiences, and even financial service touchpoints. Any product or service with a sensory component (which is virtually everything) can benefit from strategic sensory testing.

Notre emplacement à New York

11 E 22nd Street, étage 2, New York, NY 10010 Tél. : +1(212) 505-6805

À propos de SIS International

SIS International propose des recherches quantitatives, qualitatives et stratégiques. Nous fournissons des données, des outils, des stratégies, des rapports et des informations pour la prise de décision. Nous menons également des entretiens, des enquêtes, des groupes de discussion et d’autres méthodes et approches d’études de marché. Contactez nous pour votre prochain projet d'étude de marché.