Quantitative Research Benefits

Most business leaders would rather be confidently wrong than uncertainly right.

This isn’t controversial. It’s just human psychology colliding with corporate reality.

This is precisely why quantitative research benefits aren’t just nice-to-have analytical tools—they’re the essential reality check that separates companies with sustainable success from those writing off millions in failed initiatives while blaming “market conditions” for their own decision-making failures.

Table of Contents

✅ Listen to this PODCAST EPISODE here:

Measurable ROI: The Financial Benefits of Quantitative Research

Cost-Saving Benefits of Informed Decision Making

Quantitative research benefits don’t just “help” decision-making. They fundamentally transform the economics of your entire business.

Every dollar poured into proper research saves ten—sometimes fifty—in misspent implementation. I’ve watched executives flush millions down the toilet on initiatives that fifteen minutes of survey data would have killed in the cradle. The math isn’t complicated, yet almost nobody gets it right.

And here’s the truly maddening part: when these catastrophic failures happen, nobody connects them back to the research shortcuts that virtually guaranteed disaster from day one. They blame “changing market conditions” or some other convenient fiction that lets decision-makers off the hook.

So, quantitative research isn’t a cost. It’s the cheapest insurance policy against executive delusion you’ll ever find.

Compounding Knowledge Benefits

Nobody talks about this, but it might be the most valuable benefit: quantitative insights compound like Warren Buffett’s portfolio.

Each data point you collect doesn’t vanish into the void—it forms part of an ever-growing intelligence network where historical patterns inform future understanding. Year one of systematic research delivers X value. But year three? You’re operating in a completely different league because you’ve built pattern recognition capabilities your competitors can’t touch.

The company faithfully tracking customer behavior for 36 months straight will absolutely demolish one just starting out—even if they’re using identical methodologies today. Knowledge compounds in ways budget spreadsheets never capture.

The tragic irony? Most organizations sabotage this exact benefit by changing methodologies every time leadership shuffles, rendering trend analysis impossible. Absolute madness.

Risk Reduction Benefits

Want to hear about the most valuable quantitative research benefit nobody measures? It’s the nuclear disasters you never experience.

The eight-figure product launch that never happened because early testing flagged fatal flaws? The reputation-destroying campaign that died quietly in a meeting room instead of publicly? The disastrous acquisition your board almost approved?

These avoided catastrophes never appear in ROI calculations. They’re invisible wins that finance departments haven’t figured out how to measure—yet they often represent the most valuable research outcomes of all.

Speed-to-Market Benefits

While your competitors are debating whether they can “afford” research, smart companies are leveraging quantitative approaches to literally bend time.

Modern methodologies have collapsed research timelines that once spanned quarters into days or even hours. This acceleration means you can test, learn, adjust, and launch while traditional companies are still drafting their first survey questions.

And timing is everything. Being first with 80% certainty almost always beats being third with 95% certainty. Markets don’t reward perfection—they reward presence.

The questions you should be asking: What’s the cost of being three months late? What market share evaporates while you’re still gathering data that was “good enough” weeks ago? What competitor is eating your lunch while you’re polishing research methodologies to a meaningless shine?

Quantitative Research Benefits During Market Disruption

When markets go into freefall and certainty evaporates, most executives slash research budgets to “conserve cash.”

This is the corporate equivalent of tearing out your GPS because the hurricane made the roads harder to navigate… And it explains why seemingly untouchable market leaders so often become case studies in how not to handle disruption.

Enhanced Decision Confidence

The key isn’t budget or resources. It’s mindset. Companies understand that some actual data, even limited data with acknowledged flaws, absolutely demolishes beautiful theories and executive gut feelings every single time.

The most valuable benefit of quantitative research during chaos isn’t perfect prediction. It’s the courage to act decisively when everyone else is paralyzed by uncertainty. When markets undergo tectonic shifts, the ability to move forward through the fog becomes an almost unfair competitive advantage.

Rapid Adaptation Benefits

When established patterns suddenly break, your historical data becomes a liability masquerading as an asset.

Those beautiful trend lines and correlation models that served you so well during stable times? They’re not just slightly off during genuine disruption—they’re actively misleading you into disaster.

The ability to quickly validate or kill assumptions during shifting conditions separates adaptable organizations from dinosaurs watching the meteor approach with scientific curiosity.

Traditional research models demanding months of careful design become lethal during periods when market realities change weekly or even daily. Modern approaches compress what once took quarters into days, maintaining statistical rigor without sacrificing the velocity disruption demands.

Scenario Preparation Benefits

This delusional overconfidence during inherently uncertain periods has destroyed more shareholder value than any competitor ever could. It’s not just wrong—it’s irresponsible leadership.

Quantitative scenario testing allows organizations to rigorously assess likely outcomes across multiple possible futures, preparing contingency plans for each rather than betting the entire company on a single prediction. It transforms paralyzing uncertainty into manageable risk—a research benefit that directly translates to strategic optionality when competitors are making irreversible bets on futures that may never arrive.

Model Recalibration Benefits

Let me drop a terrifying truth most analytics teams won’t admit: Your existing models aren’t just slightly off during genuine disruption—they’ve become actively destructive.

The correlations and patterns that served you beautifully during stability don’t just weaken—they stop working entirely or worse, reverse direction. Like a pilot whose instruments show clear skies while flying directly into a thunderstorm, legacy models create dangerous false confidence that leads directly to organizational crashes.

The quantitative benefit here isn’t incremental improvement but fundamental recalibration—establishing new baselines, identifying emerging patterns, and rebuilding predictive frameworks that reflect current rather than historical realities.

The scariest part? Organizations without these capabilities don’t just make mistakes during disruption—they make them with absolute certainty, doubling down on increasingly dysfunctional approaches because “that’s what the data shows.” They’re technically right about what the data shows but catastrophically wrong about its continued relevance.

Accessibility Revolution: Democratized Quantitative Research Benefits

For decades, robust quantitative research benefits were locked behind specialized expertise, enterprise software, and six-figure minimum engagements. That world has been utterly demolished by an accelerating democratization revolution.

Cost-Efficiency Benefits

Tools that once required six-figure investments and specialized departments now operate on SaaS models accessible to virtually any business. Methodologies that demanded statistical PhDs now run automatically within platforms requiring minimal technical understanding.

This cost transformation means organizations of any size can now achieve insights quality previously available only to market leaders with massive research departments. The playing field hasn’t just been leveled—in many cases, it’s tilted in favor of nimble operators unencumbered by legacy approaches.

Expertise Accessibility Benefits

The expertise barrier has collapsed alongside the financial one. Modern platforms have effectively embedded PhD-level research design directly into their interfaces, offering scientifically validated templates, automatic analysis, and plain-language reporting that requires virtually no specialized knowledge to implement or interpret.

What once demanded advanced statistical understanding now requires only basic business comprehension and the ability to follow straightforward processes. The expertise that previously took years to develop is now effectively included with your monthly subscription fee.

Integration Benefits

Modern research platforms integrate directly with CRMs, marketing automation systems, product development tools, and virtually every other operational technology. This connection eliminates the implementation gap that previously prevented insights from creating measurable business impact.

Quantitative findings now flow directly into decision systems, creating closed-loop processes where insights automatically drive actions without human bottlenecks. The customer feedback from your survey doesn’t just generate a report—it automatically triggers support tickets, updates product roadmaps, or adjusts marketing messages based on predetermined thresholds.

Organizational Distribution Benefits

The democratization revolution isn’t just about companies—it’s about roles within them. No-code analytics platforms and simplified visualization tools have created “citizen data scientists” throughout organizations. Frontline managers without any statistical background can now access, analyze, and apply quantitative insights that would have required specialized analysts just a few years ago.

Breaking the Qualitative Addiction: Why Leaders Choose Comfort Over Truth

の illusion of understanding is perhaps the most dangerous barrier. Humans are storytelling creatures, and qualitative approaches deliver compelling narratives that create a powerful sense of customer understanding. The problem? These narratives are often wildly unrepresentative of your actual market.

Methodological intimidation presents another significant barrier. Many executives without statistical training find quantitative approaches intimidating and gravitate toward qualitative methods they can easily understand.

Implementation challenges often become barriers even for organizations that recognize quantitative research benefits in theory. Proper quantitative research requires specific expertise, adequate sample sizes, and appropriate analytical tools that many organizations lack internally.

Confirmation bias presents perhaps the most insidious barrier to quantitative adoption. many executives actively seek qualitative input when quantitative findings challenge their preferred strategies—essentially shopping for supportive opinions to counterbalance statistical evidence that contradicts their instincts. To combat this, implement research governance processes that establish decision criteria before data collection begins.

Budget shortsightedness often becomes the final barrier as organizations balk at the perceived cost of rigorous quantitative research. you will see companies repeatedly hesitate to invest $100,000 in proper quantitative research to inform multi-million dollar decisions—essentially attempting to save pennies while risking dollars.

The Integration Secret: How to Combine Qualitative Depth with Quantitative Rigor

The most sophisticated approach to market research isn’t choosing between qualitative and quantitative methodologies—it’s integrating them strategically

After implementing hundreds of integrated research programs, the approaches maximize the combined impact of these complementary methodologies are:

Sequential integration typically delivers the highest value by using each methodology for its optimal purpose.

Explanatory integration addresses the “what” and “why” dimensions of market understanding.

Confirmatory integration validates qualitative hypotheses with quantitative evidence.

Iterative integration creates a continuous loop of deepening insight.

Segmentation-driven integration leverages quantitative methods to identify distinct customer types whose needs and behaviors can then be explored in depth through qualitative approaches.

Building Your Quantitative Toolkit: Essential Methods That Pay For Themselves

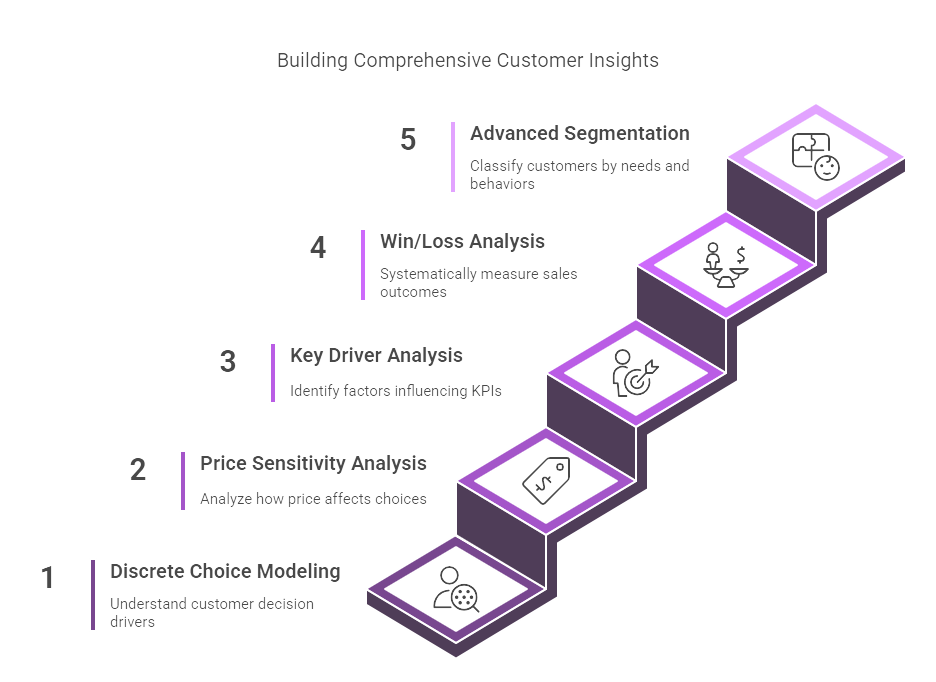

You don’t need a PhD statistician or a seven-figure data science team to start leveraging quantitative research benefits. You need exactly five properly implemented techniques that will make executives wonder why they’ve been shooting in the dark for decades.

Start with discrete choice modeling – hands down the most transformative method for understanding what actually drives customer decisions.

Next, add price sensitivity analysis using methods like van Westendorp or Gabor-Granger. But for God’s sake, don’t use the catastrophically simplistic “what would you pay?” question that yields answers about as reliable as asking toddlers for investment advice.

Third technique: key driver analysis using multivariate approaches to identify which factors actually influence your KPIs versus the hundred things you’re wasting resources on because “they might matter.”

For B2B companies, implement quantitative win/loss analysis immediately. Your sales team is lying to you – not maliciously, but they’re human. They blame losses on price when it’s actually your implementation timeline. They credit wins to relationships when it’s your configuration flexibility. Only systematic measurement will reveal the truth.

ついに、 build basic segmentation that goes beyond lazy demographic groupings to identify customer types based on needs, behaviors, and values.

The Quantitative Culture: How Data-Driven Organizations Think Differently

Having brilliant quantitative insights means absolutely nothing if your organization can’t convert them into action. This is the graveyard where most data initiatives die.

True quantitative cultures don’t just use different tools; they operate with fundamentally different mental models that create almost unfair advantages over competitors still running on executive intuition and HiPPO decision-making (Highest Paid Person’s Opinion).

In conventional companies, authority dictates reality. The SVP’s gut feeling outweighs a data scientist’s analysis. Experience trumps evidence. Confirming data gets circulated while contradicting data mysteriously disappears before reaching executive floors.

By contrast, quantitative cultures flip these dynamics entirely. Evidence supersedes authority regardless of title. Systematic measurement outweighs individual experience, no matter how extensive. And most radically, disconfirming data is actively sought and celebrated rather than suppressed or ignored.

Quantitative cultures also relate to uncertainty completely differently. Traditional organizations pathologically seek certainty and become paralyzed when it’s unavailable (which is nearly always). They demand definitive answers to inherently probabilistic questions, forcing teams to fake certainty they don’t have.

Evidence-driven organizations take the opposite approach. They accept uncertainty as inevitable but make it measurable and manageable. They don’t pretend to eliminate it; they quantify it and incorporate it directly into decision frameworks.

A financial services firm transformed their innovation process by implementing expected value decision-making that explicitly incorporated probability estimates. When evaluating potential new products, they didn’t ask the intellectually dishonest question “Will this succeed?” but instead asked “What is the probability distribution of possible outcomes, and what’s the expected value given those probabilities?”

This approach allowed them to make rational decisions under uncertainty rather than either avoiding uncertainty altogether (missing opportunities) or proceeding as if certainty existed where it didn’t (walking blindfolded through minefields). Teams were evaluated not on whether individual initiatives succeeded or failed, but on whether portfolios of decisions delivered expected value over time.

The Future of Quantitative Research: What’s Coming Will Blow Your Mind

What’s coming next isn’t just better research—it’s research that makes today’s “cutting edge” look like cave paintings.

Machine learning is creating prediction capabilities that border on witchcraft. While traditional analysis explains what happened yesterday, these systems forecast tomorrow with accuracy that would’ve seemed hallucinatory five years ago. They don’t just spot patterns; they detect invisible relationships buried in noise that human analysts would miss in a thousand years of looking.

の continuous intelligence revolution is already killing the quarterly research cycle. Real-time analytics have transformed insights from occasional snapshots to always-on monitoring systems that detect shifts the moment they happen, not months later when the damage is done. Companies still waiting for quarterly reports to make decisions are already functionally dead—they just don’t know it yet.

NLP algorithms are performing alchemy on mountains of unstructured text, extracting quantifiable signals from sources that used to require armies of qualitative researchers. Customer comments, support tickets, social posts—they’re all becoming mineable for mathematical patterns, not just anecdotes.

And synthetic data generation? It’s solving the sample size problem that’s plagued researchers forever. These systems create virtual respondents that behave statistically identical to real ones, turning 300-person samples into 30,000-person datasets with mathematical validity that would make your college statistics professor weep with joy.

の behavioral-attitudinal data marriage is finally happening too. The gap between what people say and what they actually do is disappearing as systems connect survey responses to purchase histories, app usage, and even physical movement patterns. The days of respondents lying to researchers (and themselves) are numbered.

But the most revolutionary shift? Embedded experimentation that doesn’t just suggest causation—it proves it. While yesterday’s research identified correlations, tomorrow’s systems are building causality detection directly into business operations. Every transaction becomes a controlled experiment. Every customer interaction generates causal understanding, not just observations.

The quant research gap between leaders and laggards isn’t just widening—it’s becoming an unbridgeable canyon. And most executives have no idea they’ve already fallen behind.

The SIS advantage

While most research vendors sell overpriced PowerPoints destined to collect dust, SIS International offers something radically different.

Prices that won’t make your CFO pass out

戦略情報システム delivers Fortune 500 insights without the Fortune 500 invoice. While traditional firms charge premium rates for basic methodologies, SIS offers sophisticated quantitative approaches at prices that won’t trigger an emergency board meeting.

A New York location that actually matters

SIS deliberately prime Manhattan location gives us access to the most diverse respondent populations and industry expertise on the planet. When you need to understand real people in real markets, geography isn’t just a detail — it’s a methodology.

Experience that can’t be faked

SIS researchers have actually evolved through decades of methodology revolution — from the survey dark ages to the machine learning renaissance. We’re not just experienced; we’re battle-scarred veterans of methodological transformation.

Custom research that actually fits your problems

Most firms pretend to customize while selling the same template-driven approaches to every client. SIS designs every engagement from scratch because we’ve learned the painful lesson that business problems are like fingerprints — no two are exactly alike. Our methodologies fit your specific decision requirements, not our convenience.

Global reach when you actually need it

SIS delivers true global intelligence through methodological continuity across cultures — ensuring you’re comparing apples to apples even when researching across continents.

よくある質問

Do we really need quantitative research?

If you’re making six-figure decisions based on what three customers said in a focus group last month, you’re essentially gambling with your company’s money. Quantitative research becomes essential when being wrong costs more than the research itself. For decisions involving substantial investment or strategic shifts, operating without it is corporate malpractice.

What’s the real ROI?

It varies wildly. Some clients see 5x returns. Others see 100x when research kills a doomed product before launch. The best frame: what’s the cost of being wrong about your biggest decision this year? That’s your potential ROI.

How long does it actually take?

The honest answer nobody gives: it depends on what you’re trying to learn. Anyone promising “insights in 48 hours!” for complex strategic questions is selling snake oil. That said, modern approaches have collapsed what once took quarters into weeks. Most SIS projects deliver actionable intelligence in 2-4 weeks, with rapid protocols available for urgent needs.

What makes SIS different from cheaper options?

We won’t be the cheapest bid you get. Firms undercutting everyone are running automated surveys with zero quality control, then dropping data dumps on your desk disguised as “insights.” SIS combines methodological rigor with business pragmatism — translating complex findings into clear, actionable recommendations that drive measurable outcomes.

Do we need statisticians on our side?

While we love collaborating with data-savvy teams, most clients rely entirely on our expertise. We translate statistical complexity into English and focus recommendations on business outcomes, not p-values and correlation coefficients.

Can this help during market chaos?

This is precisely when it becomes most valuable. When markets implode and certainty evaporates, systematic data collection is your navigation system in the fog. Our disruption methodologies help clients identify emerging patterns and quantify scenario probabilities when historical models break down.

What business questions can you actually answer?

If it’s a business question that matters, there’s likely a quantitative approach to answer it. Pricing optimization, feature prioritization, market segmentation, positioning, messaging effectiveness, satisfaction drivers, competitive vulnerability — the list is nearly endless. The better question: what decision are you currently making based on guesswork that could benefit from actual evidence?

ニューヨークの施設所在地

11 E 22nd Street、2階、ニューヨーク、NY 10010 電話: +1(212) 505-6805

SISインターナショナルについて

SISインターナショナル 定量的、定性的、戦略的な調査を提供します。意思決定のためのデータ、ツール、戦略、レポート、洞察を提供します。また、インタビュー、アンケート、フォーカス グループ、その他の市場調査方法やアプローチも実施します。 お問い合わせ 次の市場調査プロジェクトにご利用ください。