Bureauonderzoek

Bureauonderzoek is integral to any Market Intelligence and Market Research study. Also known as Secondary Research, it can help researchers understand a particular market or industry and ask intelligent questions during interviews.

Are you making the most of desk research in your business strategy? This often-overlooked method can provide a wealth of insights without needing expensive primary data collection… And it offers a cost-effective way to gather valuable data and enhance strategic decision-making.

What is Secondary Research?

Secondary Research is a technique that uses existing and publicly available data. It includes material published in research papers and other such documents. Desk research tends to be more affordable. Companies perform secondary research to assess low-cost, publicly-verified, and quick knowledge. It paves the way for primary research, helps companies analyze the external market environment, and identifies broad trends and shifts in an industry. It also gives insight into market information and regulation.

This type of research is particularly useful for obtaining a broad understanding of a market, identifying trends, and informing strategic decisions without the high costs associated with primary research methods. Desk research can address several issues, including:

- Marktanalyse: Understanding the current market landscape, including key players, size, and growth trends.

- Consumenteninzichten: Gaining insights into consumer behavior, preferences, and demographics.

- Concurrerende intelligentie: Identifying competitors and analyzing their strategies, strengths, and weaknesses.

- Regelgevende omgeving: Understanding the legal and regulatory framework that impacts the industry.

What Are the Benefits of Desk Research for Businesses?

Desk research, of secondary research, offers numerous benefits, making it an essential tool for businesses looking to gain a competitive edge and make informed decisions. Here are some key benefits of desk research, along with actionable tips:

1. Enhanced Strategic Planning

Desk research provides businesses with comprehensive market insights crucial for strategic planning. By analyzing existing data, companies can identify market trends, understand consumer behavior, and anticipate future developments. This helps formulate effective strategies that align with market conditions.

-

- Actionable Tip: Review industry reports and market analyses regularly to stay updated on emerging trends. Integrate these insights into your strategic planning sessions to ensure your business remains aligned with market developments.

2. Increased Revenue

With detailed market insights, businesses can identify opportunities to enhance their products and services, meeting the needs and preferences of their target audience. This can lead to increased customer satisfaction and loyalty, driving revenue growth.

-

- Actionable Tip: Conduct a competitive analysis using desk research to identify gaps in the market. Use these insights to innovate and improve your offerings, creating a unique value proposition that attracts more customers.

3. Risk Reduction

Desk research helps businesses identify potential risks and challenges in the market. Companies can anticipate regulatory changes, economic fluctuations, and competitive threats by analyzing data from various sources. This allows them to develop strategies to mitigate these risks and make more informed decisions.

-

- Actionable Tip: Develop a risk management framework incorporating desk research findings. Regularly update this framework to reflect new data and emerging risks, ensuring your business remains resilient.

4. Improved Marketing Efficiency

Secondary research provides valuable consumer behavior and preferences insights, helping businesses create more targeted and effective marketing campaigns. By understanding what drives consumer decisions, companies can optimize their marketing efforts, improving their return on investment.

-

- Actionable Tip: Utilize demographic and psychographic data from desk research to segment your audience. Tailor your marketing messages to each segment to increase relevance and engagement, leading to higher conversion rates.

5. Accelerated Growth and Innovation

Access to existing research and data can inspire new ideas and innovations. Desk research allows businesses to identify gaps in the market and explore new growth opportunities.

-

- Actionable Tip: Use desk research to identify emerging technologies and industry innovations. Incorporate these insights into your product development processes to stay ahead of the competition and drive growth.

6. Boosted ROI

Investing in desk research can lead to a higher return on investment. Through existing data, businesses can make informed decisions that drive success without the high costs associated with primary research. This cost-effective approach ensures that companies allocate their resources efficiently.

-

- Actionable Tip: Prioritize desk research projects that clearly impact your business objectives. Focus on areas where secondary research can provide the most value, ensuring a higher return on investment.

7. Comprehensive Market Understanding

Desk research offers a broad overview of key players, market size, and growth trends. This comprehensive understanding helps businesses position themselves strategically and identify areas for expansion or improvement.

-

- Actionable Tip: Create a market intelligence report consolidating insights from various desk research sources. Update this report regularly to maintain a current understanding of the market landscape.

Who Uses Secondary Research?

Startups and small businesses often operate with limited resources and budgets. Desk research provides a cost-effective way to gather valuable market insights without the high costs associated with primary research. Gevestigde bedrijven leverage desk research to stay competitive, identify new market opportunities, and refine their strategic plans. Large corporations can gain insights into emerging trends, consumer behavior, and competitive dynamics by analyzing existing data.

Investors and venture capitalists also use desk research to evaluate market potential and make informed investment decisions. By analyzing market trends, competitive landscapes, and regulatory environments, they can assess the viability of investment opportunities. Moreover, government agencies and non-profit organizations can use desk research to understand social, economic, and environmental trends.

When to Conduct Desk Research

Identifying the right circumstances to conduct desk or secondary research is crucial in effectively leveraging its benefits. This research method is beneficial in various scenarios in a business’s lifecycle. Here are the situations when conducting desk research is most beneficial:

- Initial Market Exploration: When exploring new markets or industries, desk research provides a cost-effective way to gain an initial understanding before investing in more detailed primary research.

- Strategische planning: Secondary research offers valuable insights into market trends, consumer behaviors, and competitive landscapes before embarking on strategic planning processes.

- Productontwikkeling: In the early stages of product development, desk research helps identify market needs, trends, and potential customer preferences.

- Concurrentieanalyse: Desk research efficiently gathers information about competitors’ strategies, products, and market performance for ongoing monitoring.

- Investment and Expansion Decisions: When considering investment opportunities or planning for business expansion, secondary research provides an overview of the potential risks and rewards.

- In Response to Industry Changes: Desk research can provide timely insights into situations with significant industry shifts, such as regulatory changes or technological advancements.

- Crisis Management: In times of crisis or market upheaval, secondary research can quickly provide background information to help navigate the situation

Types of Desk Research

Desk research can be categorized into two main types: internal and external. Both types offer valuable insights but differ in their sources and applications.

1. Internal Desk Research

Internal desk research involves analyzing data already available within the organization. This data can include sales reports, customer databases, financial statements, and previous market research studies.

Examples of Internal Desk Research Sources:

-

- Sales Reports: Analyze sales trends, product performance, and customer purchasing patterns.

- Customer Databases: Understand customer demographics, preferences, and behavior.

- Financial Statements: Assess the company’s financial health and performance over time.

- Previous Market Research Studies: Leverage insights from past research efforts to inform current strategies.

Actionable Tip: Review internal data regularly to identify trends and patterns that can inform strategic decisions. Ensure that data is kept up-to-date and accessible for analysis.

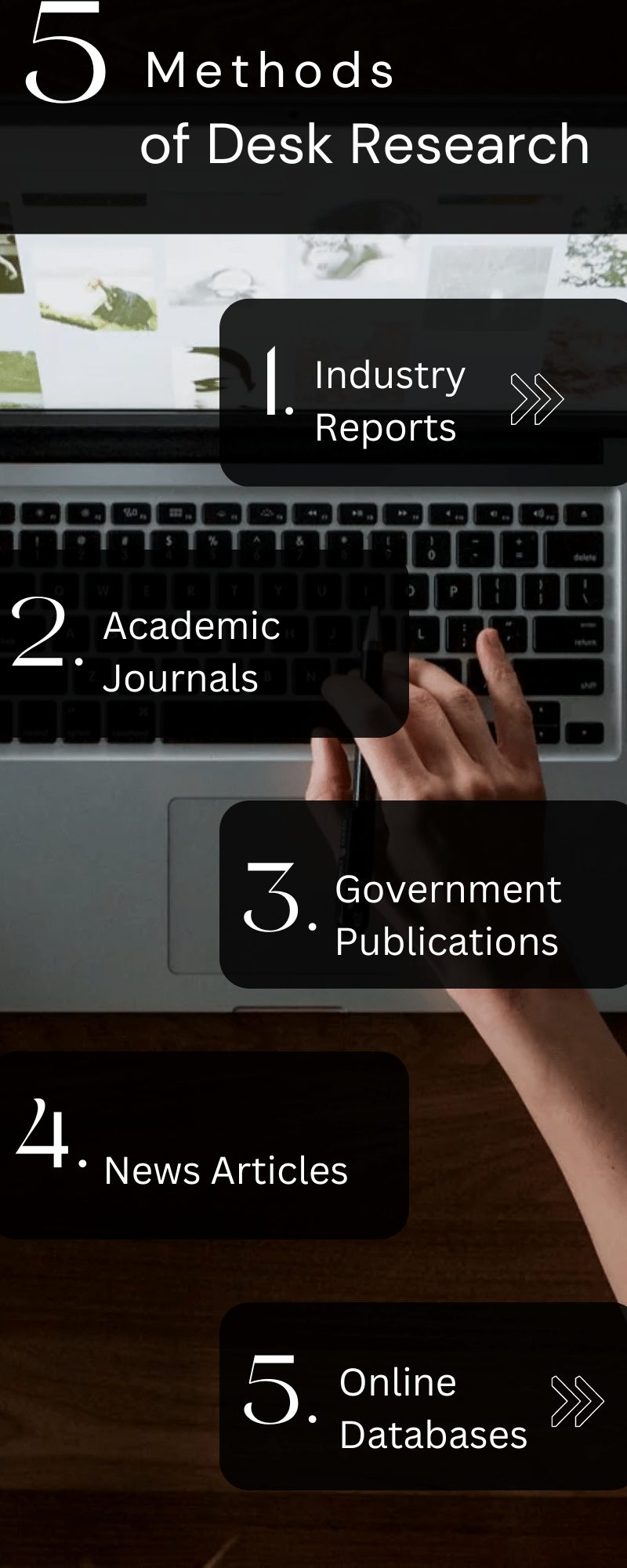

2. External Desk Research

External desk research involves gathering data from sources outside the organization. This can include industry reports, academic journals, government publications, news articles, and online databases. External data provides a broader perspective on the market, industry trends, and competitive landscape.

Examples of External Desk Research Sources:

-

- Industry Reports: Obtain insights into market size, growth trends, and key players.

- Academic Journals: Access the latest research findings and theoretical developments.

- Government Publications: Understand regulatory requirements, economic indicators, and policy changes.

- News Articles: Stay informed about recent developments, competitor activities, and industry events.

- Online Databases: Utilize comprehensive databases such as Statista, Euromonitor, and others for market data and statistics.

Actionable Tip: Develop a list of reliable external sources and regularly monitor them for new information. Cross-reference data from multiple sources to ensure accuracy and comprehensiveness.

Combining Internal and External Desk Research

Combining internal and external desk research is beneficial for a holistic understanding. This approach ensures that businesses can leverage internal insights while staying informed about external market conditions and trends.

Questions to Ask Before Conducting Desk Research

Before embarking on desk research, clarifying your objectives and gathering relevant and reliable data is essential. Here are key questions to ask before starting your desk research:

1. What specific information do you need?

Clearly define the research objectives and the specific information you need to gather. This will help narrow the focus and ensure that the research is relevant and actionable.

-

- Actionable Tip: Create a detailed research plan outlining the questions you want to answer and the data points you need to collect.

2. What are the most reliable sources for this information?

Identify the most credible and reliable sources for the data you need. This includes industry reports, academic journals, government publications, and reputable online databases.

-

- Actionable Tip: Develop a list of trusted sources and regularly review them for updated information. Verify the credibility of new sources before incorporating their data into your research.

3. How will the data be used in decision-making?

Understand how the collected data will be utilized in strategic planning and decision-making. This ensures that the research is focused on actionable insights that can drive business outcomes.

-

- Actionable Tip: Communicate with key stakeholders to understand their needs and expectations. Align the research objectives with the business goals and strategic priorities.

4. What are the limitations of the data sources?

Assess the potential limitations and biases of the data sources. This includes considering the publication date, geographic coverage, and the methodology used in data collection.

-

- Actionable Tip: Cross-reference data from multiple sources to validate findings and ensure a comprehensive market understanding. Acknowledge the limitations in your analysis and adjust your conclusions accordingly.

5. How will you ensure the accuracy and relevance of the information?

Implement measures to verify the accuracy and relevance of the data. This includes cross-checking information, reviewing the credibility of sources, and ensuring the data is current.

-

- Actionable Tip: Update your research regularly with the latest data and insights. Use data validation techniques to ensure the reliability of the information.

6. What is the scope and depth of the research?

Determine the scope and depth of the desk research. This includes deciding whether the research will provide a broad market overview or a detailed analysis of specific aspects.

-

- Actionable Tip: Define the scope and depth of the research in the planning phase. Ensure that the level of detail aligns with the research objectives and the needs of the stakeholders.

7. What is the budget and timeline for the research?

Establish a budget and timeline for the desk research. This will help manage resources effectively and ensure that the research is completed within the desired timeframe.

-

- Actionable Tip: Allocate sufficient time and resources for thorough desk research. Create a project timeline with key milestones and deadlines to keep the research on track.

How to Choose the Right Secondary Research Consulting Agency

Selecting the appropriate secondary research consulting agency is crucial for businesses seeking expert assistance in gathering and analyzing existing market and industry data. The right agency can provide valuable insights and save time and resources. Here are some key factors to consider when choosing a secondary research consulting agency:

- Deskundigheid en ervaring: Look for an agency with a proven track record and expertise in secondary research. Experience in your specific industry or similar projects can be a significant advantage.

- Customization and Flexibility: The agency should be able to tailor its services to your specific needs. Avoid one-size-fits-all solutions and opt for an agency that offers customized research services.

- Reputation and References: Check the agency’s reputation in the market. Look for client testimonials and case studies, and ask for references to gauge their credibility and the quality of their work.

- Confidentiality and Security: Ensure the agency has strict confidentiality and data security policies to protect sensitive information.

- After-Support and Consultation: Post-research support can be valuable. Check if the agency provides consultation or support after delivering the research findings.

- Alignment with Business Goals: Ensure the agency’s approach aligns with your business goals and objectives. The research should be actionable and relevant to your strategic needs.

Best Practices for Secondary Research

To maximize the benefits of desk research, it’s important to follow best practices that ensure the information’s accuracy, relevance, and utility. Here are some key best practices:

1. Use Reliable Sources

Ensure that the data comes from credible and authoritative sources. This includes peer-reviewed journals, official government publications, reputable industry reports, and trusted news outlets.

-

- Actionable Tip: Create a list of trusted sources and regularly update it. Verify the credibility of new sources before incorporating their data into your research.

2. Cross-Check Information

Validate the accuracy of the data by cross-referencing multiple sources. This helps confirm the reliability of the information and provides a more comprehensive understanding of the topic.

-

- Actionable Tip: Use at least three sources to cross-check key data points. This reduces the risk of relying on incorrect or biased information.

3. Stay Current

Use the most recent data to ensure relevance and accuracy. Market conditions and trends can change rapidly, so relying on outdated information can lead to inaccurate conclusions.

-

- Actionable Tip: Prioritize sources published within the last two to three years. Set up alerts for new publications in your area of interest to stay updated.

4. Document Sources

Keep a detailed record of all sources used, including publication dates, authors, and URLs. This ensures transparency and allows you to reference and validate the information later.

-

- Actionable Tip: Use citation management tools like EndNote or Zotero to organize and document your sources systematically.

5. Analyze Context

Consider the context in which the data was collected and its implications for your research. This includes understanding the methodology, geographic scope, and potential biases.

-

- Actionable Tip: Review the methodology section of reports and studies to understand how the data was collected. This helps assess the reliability and applicability of the findings.

6. Focus on Relevance

Ensure that the data collected is directly relevant to your research objectives. Avoid gathering excessive information that does not add value to your analysis.

-

- Actionable Tip: Before starting your research, define specific criteria for data relevance. Then, regularly review the collected data to ensure it aligns with your research objectives.

7. Leverage Data Visualization

Use data visualization tools to present the data in a clear and understandable format. This helps identify patterns, trends, and insights more easily.

-

- Actionable Tip: Use tools like Tableau, Microsoft Power BI, or Excel to create visual representations of the data, such as charts, graphs, and dashboards.

8. Integrate Findings with Primary Research

Combine secondary research with primary research to gain a more comprehensive understanding. This approach leverages the strengths of both methods and provides more robust insights.

-

- Actionable Tip: Use secondary research to identify gaps and formulate hypotheses. Then, conduct primary research to test these hypotheses and gather specific data.

9. Regularly Update Your Research

Market conditions and trends evolve, so keeping your research updated is important. Regularly review and refresh your data to maintain its relevance and accuracy.

-

- Actionable Tip: Set a schedule for periodic reviews of your research data. Update your findings with the latest information to ensure ongoing accuracy.

Evaluating the Credibility of Sources

When conducting desk research or secondary research, it is crucial to ensure that the sources of information are credible, reliable, and relevant. Here are key steps and criteria to evaluate the credibility of sources:

1. Source Authority

-

- Author Credentials: Check the author’s qualifications, expertise, and reputation in the field. Look for academic degrees, professional experience, and previous publications.

- Institutional Affiliation: Consider the reputation and credibility of the institution or organization that published the data. Well-known universities, research institutions, and reputable companies are generally reliable sources.

Actionable Tip: Look for author profiles or bios on the publication’s website to verify their credentials and expertise.

2. Source Accuracy

-

- Evidence and References: Check if the source provides evidence for its claims, including data, citations, and references to other reputable works.

- Peer Review: For academic publications, ensure the work has undergone a peer review process, which adds a layer of credibility and scrutiny.

Actionable Tip: Cross-check the information with multiple sources to verify its accuracy and consistency.

3. Source Objectivity

-

- Bias and Objectivity: Assess whether the source presents information objectively without obvious bias. Be cautious of sources with a clear agenda or those sponsored by organizations with vested interests.

- Balanced Perspective: Credible sources present multiple viewpoints and avoid overly sensational or one-sided arguments.

Actionable Tip: Compare the information with other sources to identify potential biases and ensure a balanced perspective.

4. Source Timeliness

-

- Publication Date: Check the publication date to ensure the information is current and relevant. In fast-changing industries, such as technology or healthcare, outdated information may be less useful.

- Update Frequency: Consider how frequently the source is updated. Regularly updated sources are more likely to provide current and accurate information.

Actionable Tip: Prioritize sources published within the last two to three years, especially in rapidly evolving fields.

5. Source Relevance

-

- Direct Relevance: Ensure the source directly addresses your research question or topic. Irrelevant information can lead to inaccurate conclusions.

- Depth of Information: Evaluate whether the source provides sufficient depth and detail to support your research objectives.

Actionable Tip: Focus on sources that -relate to your research topic and provide comprehensive information.

6. Cross-Referencing and Corroboration

-

- Multiple Sources: Use multiple sources to verify the information and corroborate findings. Consistent information across various credible sources increases reliability.

- Primary vs. Secondary: Consider the difference between primary sources (original data) and secondary sources (analysis and interpretation). Whenever possible, refer to primary sources for the most accurate information.

Actionable Tip: Create a matrix to compare findings from different sources and identify common patterns and discrepancies.

7. Transparency and Accountability

-

- Clear Methodology: Credible sources explain their research methods and data collection processes. Transparency in methodology allows for the assessment of reliability.

- Accountability: Reputable sources take responsibility for their information and provide contact details for further inquiries.

Actionable Tip: Look for sources that disclose their research methodology and offer transparency about their data sources and processes.

Expected Results from SIS International’s Utilization of Secondary Research

SIS International leverages secondary research to deliver actionable insights and drive business success. Through meticulous analysis and strategic interpretation, businesses can anticipate several key outcomes such as:

- Geïnformeerde besluitvorming:

By tapping into a vast array of secondary sources, including industry reports, academic studies, and market analyses, SIS equips clients with the information needed to make informed decisions. Whether entering new markets, launching products, or refining strategies, clients benefit from data-driven insights that mitigate risks and maximize opportunities.

- Concurrentievoordeel:

SIS Internationaall’s utilization of secondary research enables clients to gain a competitive edge by staying abreast of market trends, consumer preferences, and competitor strategies. With comprehensive insights, clients can devise strategies that resonate with target audiences and outmaneuver rivals.

- Enhanced Market Understanding:

We delve deep into secondary sources to uncover hidden patterns, identify emerging trends, and elucidate consumer behaviors. This holistic understanding empowers clients to tailor their offerings to meet evolving market demands.

- Strategische aanbevelingen:

Beyond raw data, SIS synthesizes findings into actionable recommendations. Through meticulous analysis and expert interpretation, our team provides clients strategic guidance that drives business growth and fosters long-term success.

- Risicobeperking:

In an uncertain environment, informed decision-making is instrumental in risk mitigation. By harnessing the power of secondary research, SIS helps clients identify and assess potential risks, enabling proactive measures to mitigate adverse impacts and safeguard business interests.

Primary Vs. Secondary Research

Understanding the differences between primary and secondary research is crucial for businesses to effectively utilize these methods in their market research strategies. Both types of research offer unique benefits and can complement each other to provide comprehensive market insights.

Primary Research

Primary research involves collecting new, original data directly from respondents. This data is gathered specifically for the research objectives at hand and tailored to address the specific questions and needs of the business.

Methods:

-

- Enquêtes: Collecting data from a large group of respondents using structured questionnaires.

- Interviews: Conducting one-on-one or group discussions to gather in-depth insights.

- Focusgroepen: Facilitating discussions among small participants to explore their perceptions and opinions.

- Experiments: Conducting controlled tests to understand cause-and-effect relationships.

- Observations: Watching and recording behaviors in a natural setting.

Advantages:

-

- Specificity: Data is collected to address specific research questions, providing highly relevant insights.

- Control: Researchers control the data collection process, ensuring accuracy and relevance.

- Current Data: Information is up-to-date and reflective of current market conditions.

Disadvantages:

-

- Costly: Primary research can be expensive due to the resources required for data collection and analysis.

- Tijdrovend: Collecting and analyzing primary data takes time, which can delay decision-making.

- Complexity: Designing and conducting primary research requires expertise and experience.

Secondary Research

Secondary research, or desk research involves analyzing data already collected by other sources. Although this data is not specifically gathered for the current research objectives, it can still provide valuable insights.

Methods:

-

- Industry Reports: Analyzing reports published by research firms, industry associations, and market analysts.

- Academic Journals: Reviewing scholarly articles and research papers.

- Government Publications: Using data from government reports, statistics, and publications.

- News Articles: Gathering information from news outlets and media sources.

- Online Databases: Accessing data from comprehensive databases like Statista, Euromonitor, and others.

Advantages:

-

- Cost-Effective: Secondary research is generally less expensive than primary research as it uses existing data.

- Time-Efficient: Data can be gathered and analyzed quickly, allowing for faster decision-making.

- Broad Perspective: Provides a wide-ranging view of the market, industry trends, and competitive landscape.

Disadvantages:

-

- Relevance: Data may not be specific to the current research objectives, making it less relevant.

- Accuracy: Researchers have less control over the accuracy and reliability of the data.

- Outdated Information: Existing data may be outdated and not reflect current market conditions.

Differences in Conducting Secondary Research in Emerging Markets and Mature Markets

Secondary research in emerging markets versus mature markets presents distinct challenges and considerations due to differences in market structures, data availability, and economic conditions. Here are some key differences:

Data Availability and Reliability

-

- Opkomende markten are often characterized by limited reliable data availability. Sources such as government statistics, market reports, and academic studies are less comprehensive or updated less frequently.

- Volwassen markten typically have a wealth of reliable, regularly updated data from various sources like government agencies, reputable market research firms, and established academic institutions.

Market Dynamics

-

- Opkomende markten are marked by rapid changes, high volatility, and unpredictable consumer behavior. This dynamism can quickly make historical data outdated. Political instability and regulatory changes can also significantly impact market conditions.

- Volwassen markten generally exhibit more stable and predictable market dynamics. Trends and consumer behaviors evolve slowly, making historical data more relevant for extended periods.

Infrastructure and Technological Penetration

-

- Opkomende markten have less developed infrastructure and lower levels of technological adoption, affecting how data is collected and analyzed.

- Volwassen markten have advanced infrastructure and higher technological penetration, providing a broader range of digital data sources, such as online consumer behavior, social media trends, and e-commerce metrics.

Economic Indicators and Metrics

-

- Emerging Markets’ economic indicators may not fully capture the market’s dynamics due to the significant informal sector and rapid changes. Alternative indicators and creative methodologies might be needed to understand the market.

- Mature Markets: Standard economic indicators and metrics generally reflect the market conditions, making conducting comparative and trend analyses easier.

Sources of Secondary Research

Secondary research draws upon diverse sources, offering researchers a wealth of information to analyze and interpret. Here are some familiar sources of secondary research:

- Academic Journals: Peer-reviewed academic journals publish scholarly articles and research findings across various disciplines. These journals provide authoritative and rigorously vetted information on various topics, making them valuable secondary research sources.

- Industry Reports: Market research firms and analysts publish comprehensive reports and analyses covering specific sectors, markets, and trends. These reports offer insights into market dynamics, consumer behaviors, competitive landscapes, and emerging opportunities, serving as valuable resources for secondary research.

- Government Publications: Government agencies produce a wealth of data and reports on topics ranging from demographics and economic indicators to health and environmental trends. Sources such as the U.S. Census Bureau, Bureau of Labor Statistics, and World Bank provide reliable and up-to-date statistics and research findings for secondary analysis.

- Trade Publications: Trade publications cater to specific industries or professions, offering insights, trends, and best practices relevant to practitioners. These publications often feature articles, case studies, and industry analyses, providing valuable secondary data for researchers.

- Company Websites and Annual Reports: Companies publish a wealth of information on their websites, including press releases, financial reports, and product descriptions. Annual reports offer detailed insights into a company’s performance, strategies, and outlook, making them valuable secondary research sources for industry analysis and competitive benchmarking.

- Online Databases: Specialized databases such as PubMed, JSTOR, and ProQuest provide access to a vast repository of academic literature, research papers, and publications across disciplines. These databases offer researchers access to various secondary sources for literature reviews and in-depth analysis.

Comparing Desk Research Across Industries

Desk research varies significantly across different industries due to the unique nature of each sector, its specific needs, and the types of data available. Here is a comparison of how desk research is applied in various industries:

1. Gezondheidszorg

Application:

-

- Markttrends: Analyzing industry reports and academic journals to understand emerging trends in medical technologies, treatments, and patient care practices.

- Regelgevende inzichten: Reviewing government publications and regulatory guidelines to ensure compliance with healthcare standards.

- Concurrentieanalyse: Studying competitor strategies, product launches, and innovations to stay ahead in the market.

Benefits:

-

- Helps in identifying new treatment methods and technologies.

- Ensures compliance with stringent regulatory requirements.

- Provides insights into competitive positioning and market opportunities.

2. Technology

Application:

-

- Innovation Tracking: Monitoring technology trends and advancements through tech publications and online databases.

- Consumenteninzichten: Analyzing user reviews and forums to understand consumer preferences and pain points.

- Marktanalyse: Using data from industry reports to forecast market growth and identify new opportunities.

Benefits:

-

- Keeps businesses updated on rapid technological changes.

- Provides valuable consumer feedback for product improvement.

- Aids in strategic planning and market entry decisions.

3. Retail

Application:

-

- Consumentengedrag: Analyzing market reports and consumer surveys to understand shopping habits and preferences.

- Trendanalyse: Reviewing fashion and lifestyle magazines to identify emerging trends.

- Competitor Insights: Studying competitor strategies, product offerings, and marketing campaigns.

Benefits:

-

- Helps in tailoring products and services to meet consumer demands.

- Identifies emerging trends for timely product launches.

- Provides a competitive edge through strategic insights.

4. Finance

Application:

-

- Economic Indicators: Reviewing government economic reports and financial publications to understand economic trends and forecasts.

- Marktanalyse: Analyzing stock market data and financial reports to assess market conditions.

- Naleving van regelgeving: Keeping abreast of financial regulation and policy changes through regulatory publications.

Benefits:

-

- Provides insights into economic conditions affecting financial markets.

- Aids in investment decisions and risk management.

- Ensures compliance with financial regulations.

5. Education

Application:

-

- Educational Trends: Analyzing reports on educational standards, methodologies, and outcomes.

- Policy Insights: Reviewing government education policies and funding reports.

- Concurrentieanalyse: Studying other educational institutions’ programs and initiatives.

Benefits:

-

- Identifies best practices and emerging trends in education.

- Informs policy development and strategic planning.

- Provides competitive insights for program development.

Desk Research in Crisis Management

Desk research plays a crucial role in crisis management by providing timely and relevant information to help organizations prepare for, respond to, and recover from crises. Here’s how desk research can be effectively utilized in different stages of crisis management:

1. Preparedness

Desk research helps organizations anticipate potential crises by analyzing historical data, industry reports, and expert analyses. This proactive approach enables companies to develop contingency plans and mitigate risks.

Applications:

-

- Risk Assessment: Reviewing past crises within the industry to identify common triggers and impacts.

- Trendanalyse: Monitoring emerging trends and potential threats through news articles, industry reports, and government publications.

- Scenarioplanning: Using secondary data to develop various crisis scenarios and corresponding response strategies.

2. Response

During a crisis, desk research provides critical real-time information that aids in effective response and decision-making. Organizations can adapt their strategies to the evolving crisis by continuously monitoring the situation.

Applications:

- Situational Awareness: Gathering real-time data from news sources, social media, and official statements to understand the scope and impact of the crisis.

- Stakeholder Analysis: Identifying key stakeholders and their concerns through secondary data to tailor communication strategies.

- Toewijzing van middelen: Reviewing previous crisis case studies to determine the most effective allocation of resources.

3. Recovery

In the recovery phase, desk research helps organizations evaluate the effectiveness of their crisis response and identify areas for improvement. It also aids in rebuilding reputation and trust with stakeholders.

Applications:

- Post-Crisis Analysis: Analyzing reports and case studies of similar crises to evaluate response effectiveness and identify best practices.

- Reputation Management: Monitoring media coverage and public sentiment to assess the impact on the organization’s reputation and guide recovery efforts.

- Policy Development: Using insights from secondary research to develop policies and procedures to prevent future crises.

Opportunities in Secondary Research for Businesses

Secondary research offers a range of opportunities for businesses to enhance their strategic planning and decision-making processes. By leveraging existing data and insights, businesses can capitalize on several fronts. Here are some key opportunities that secondary research currently presents:

- Concurrentieanalyse: Businesses can use secondary research to gather intelligence on competitors, understand their strategies, and identify areas where they can gain a competitive advantage.

- Identification of New Business Opportunities: By analyzing market reports and industry studies, businesses can identify new growth opportunities, such as unexplored market segments or emerging consumer needs.

- Benchmarking: Businesses can use secondary data to benchmark their performance against industry standards or competitors, identifying areas for improvement.

- Global Market Understanding: Secondary research provides an understanding of global market dynamics, consumer preferences, and regulatory environments for businesses looking to expand internationally.

- Productontwikkeling en innovatie: Information on current market trends and consumer preferences can guide product development and innovation strategies.

- Geïnformeerde besluitvorming: Secondary research equips business leaders with the necessary information to make more informed and strategic business decisions.

Challenges of Secondary Research for Businesses

Desk research is a valuable tool for businesses that comes with its own set of challenges. Thus, successfully navigating these challenges is key to leveraging the full benefits of secondary research. Here are some common obstacles businesses may encounter:

- Relevance and Timeliness: It is crucial to ensure relevant and up-to-date data, as outdated or irrelevant information can lead to misguided decisions.

- Gegevensoverbelasting: With the vast amount of information available, businesses may face the challenge of filtering through and identifying what is most pertinent to their needs.

- Quality and Credibility of Sources: Assessing the credibility and quality of the data sources is vital since relying on unverified or biased sources can lead to inaccurate conclusions.

- Lack of Specificity: Secondary data may not always be specific to a business’s unique questions or scenarios, requiring additional primary research for tailored insights.

- Costs Associated with Paid Sources: While secondary research is generally more cost-effective than primary research, some valuable data sources, like certain market reports or databases, may have high access costs.

- Sector-Specific Challenges: Depending on the industry, specific data may be limited, hindering the depth of analysis.

Advantages and Disadvantages of Secondary Research

| Advantages | Disadvantages |

|---|---|

| Cost-Effective | Data Relevance |

| Secondary research is generally less expensive than primary research since it uses existing data. | The data may not be specific to the current research objectives, leading to potential misalignment. |

| Time-Efficient | Data Accuracy |

| Data can be gathered and analyzed quickly, allowing for faster decision-making. | The accuracy and reliability of secondary data can be difficult to verify, leading to potential inaccuracies. |

| Access to a Wide Range of Information | Outdated Information |

| Provides a broad range of information from various sources, offering comprehensive market insights. | Secondary data might be outdated, especially in fast-changing industries, leading to inaccurate conclusions. |

| Historical Data Analysis | Lack of Specificity |

| Includes historical data, allowing businesses to analyze trends over time and forecast future trends. | Often provides broad, general insights rather than specific, detailed information needed for particular research questions. |

| Benchmarking and Competitive Analysis | Limited Control Over Data Collection |

| Invaluable for benchmarking performance against competitors and conducting competitive analysis. | Businesses have no control over how secondary data was collected, which can affect its relevance and accuracy. |

| Supplementing Primary Research | Potential Bias |

| Can complement primary research by providing a broader context and background information. | Secondary data may be subject to biases based on the original purpose of the data collection. |

| Reducing Bias | Incomplete Data |

| Collected by third parties, which can reduce potential bias present in primary research conducted by the business itself. | Secondary sources may not cover all aspects of a topic comprehensively, leading to incomplete analyses. |

| Enhancing Market Understanding | Data Overload |

| Provides a comprehensive understanding of the market landscape, including key players, market size, and growth trends. | The abundance of available information can lead to data overload, making it challenging to sift through large volumes of data to find relevant information. |

Future Outlook of Desk Research for Businesses

Evolving technologies, changing data landscapes, and the growing need for strategic insights will likely shape the future of desk research in the business world.

- Advanced Data Analytics Integration: Sophisticated data analytics tools and AI are expected to become more prevalent in desk research, allowing for a more profound and insightful analysis of existing data.

- Greater Emphasis on Real-Time Data: As markets and consumer behaviors change rapidly, the demand for real-time data and insights will increase, influencing how secondary research is conducted and utilized.

- Increased Digital and Online Sources: The reliance on digital and online sources for secondary research will grow, with businesses leveraging social media analytics, online consumer reviews, and digital publication archives more extensively.

- Combination with Big Data: Integrating secondary research findings with big data insights will offer a more comprehensive view of market trends, consumer behaviors, and competitive landscapes.

- Customization and Niche Focus: Customized secondary research services tailored to specific industries or business needs will likely become more popular, offering more targeted and relevant insights.

- Emergence of Specialized Research Firms: Specialized secondary research firms that cater to niche markets or specific business functions may emerge, offering expert insights and tailored analysis

Hoe de diensten van SIS International bedrijven helpen

SIS provides comprehensive market research and consulting services tailored to businesses’ unique needs and objectives across industries. Through a strategic blend of primary and secondary research methodologies, we deliver actionable insights and strategic guidance to drive business growth and success.

Market Entry Feasibility and Sizing Studies: SIS assists businesses in evaluating market entry opportunities by conducting in-depth feasibility and sizing studies. By leveraging secondary research to analyze market dynamics, competitive landscapes, and consumer behaviors, our team helps businesses assess the viability and potential risks of entering new markets.

Strategisch advies: SIS International offers strategic consulting services to help businesses formulate and implement winning strategies. Through a combination of secondary research, market analysis, and industry expertise, we provide clients with strategic recommendations and actionable insights to capitalize on market opportunities, overcome challenges, and achieve sustainable growth.

Market Intelligence and Competitive Analysis: SIS delivers comprehensive market intelligence and competitive analysis services to help businesses stay ahead. Through rigorous secondary research and competitive benchmarking, SIS International provides clients valuable insights into competitor strategies, market trends, and emerging opportunities, enabling informed decision-making and strategic positioning.

Oplossingen op maat: SIS International offers customized research solutions for specific challenges and objectives. Whether it’s conducting industry studies, market segmentation analyses, or customer satisfaction surveys, our experts collaborate closely with clients to design research initiatives that deliver actionable insights and drive tangible results.

Over SIS Internationaal

SIS Internationaal biedt kwantitatief, kwalitatief en strategisch onderzoek. Wij bieden data, tools, strategieën, rapporten en inzichten voor besluitvorming. Wij voeren ook interviews, enquêtes, focusgroepen en andere marktonderzoeksmethoden en -benaderingen uit. Neem contact met ons op voor uw volgende marktonderzoeksproject.