Wereldwijd onderzoek naar de energiemarkt: superkritische oplossingen voor onze energietoekomst

De energievraag van een groeiende wereld houdt nooit op. Helaas worden vroegere manieren om energie te leveren, met name steenkool, minder levensvatbaar vanwege de toegenomen regelgeving gericht op milieuzorgen en bescherming van de menselijke gezondheid. De steenkoolcentrales van vroeger raken verouderd nu de wereld zich richt op schaliegaswinning en schone energiebronnen zoals zon, wind en geothermische energie om te voldoen aan de wereldwijde energiebehoeften van morgen. Gecombineerde cyclustechnologieën vervangen steenkoolcentrales en creëren winstgevende markten voor gas- en stoomturbines. Ondertussen verbeteren we bestaande technologieën en ontdekken we nieuwe en opwindende manieren om de energiebronnen te leveren die de 21st Eeuw.

Is steenkool dood? Verre van dat. China, India en andere opkomende regio's hebben goedkope steenkool nodig om hun snelle ontwikkelingstempo te stimuleren, en nieuwe schone steenkooltechnologieën kunnen energie efficiënter en met minder impact op het milieu leveren. De proliferatie van CCGT-centrales en de heropleving van kernenergieproductie, na Fukushima, hebben een groeiende vraag naar stoom- en gasturbines gecreëerd. Nieuwe analyse van Frost & Sullivan, Wereldwijde markten voor gas- en stoomturbines, stelt vast dat de markt in 2013 een omzet genereerde van $32,51 miljard en schat dat dit in 2020 $43,49 miljard zal bedragen.1 Hernieuwbare energiebronnen zijn de toekomst, maar energiebronnen zoals wind en zon kunnen nog niet de hoeveelheid elektriciteit leveren die een wereld nodig heeft die hongert naar energie.

In dit rapport probeert SIS International Research de evoluerende energietrends bloot te leggen vanuit het oogpunt van een fabrikant van energieapparatuur, met name met betrekking tot kolenconsumptie. We zullen wereldwijde microtrends onderzoeken die verband houden met superkritische, ultra superkritische en geavanceerde superkritische stoomgeneratoren. We houden ook rekening met klimaatverandering, industriële consolidatie en overheidsbeleid over de evolutie van de energie-apparatuurindustrie. Ons CI-team heeft onlangs diepgaande gesprekken gevoerd met veel sleutelfiguren binnen de energiesector om te peilen wat hun visie is op de wereldwijde energietoekomst.

Welke factoren hebben de grootste invloed op de energiesector?

Het tijdperk van kolengestookte elektriciteitsopwekking is de afgelopen jaren gestaag afgenomen. Vroeger was steenkool goed voor ongeveer 55% van de Amerikaanse markt. Tegenwoordig is dat cijfer mogelijk minder dan 45%. Nieuwe regelgeving met betrekking tot CO2-uitstoot en de verbranding van fossiele brandstoffen heeft een uitgesproken impact gehad op de kolenindustrie en sommige kolencentrales zijn simpelweg te duur geworden om te exploiteren. In juni 2014 presenteerde de EPA een Clean Power Plan dat is ontworpen om "een betaalbaar, betrouwbaar energiesysteem te behouden, terwijl vervuiling wordt teruggedrongen en onze gezondheid en het milieu worden beschermd." 2 Het Clean Power Plan vereist dat centrales die fossiele brandstoffen verbranden hun koolstofemissies met 30% moeten verminderen in een poging klimaatverandering te vertragen. Tegenstanders van het plan vrezen dat het uiteindelijk kan leiden tot ontslagen en sluitingen van centrales.

Weer anderen vinden dat er een bredere paradigmaverschuiving moet plaatsvinden, mogelijk gerelateerd aan elektrische voertuigen en de energievraag die ze zouden creëren voor lithiumionproductie of waterstofcelproductie. Uiteindelijk slaat het momentum weg van op olie en gas aangedreven auto's. Het is een langzame transitie omdat benzine, ondanks de milieurisico's, een enorm nuttige transportbrandstof is gebleken.

Federale regelgeving zorgt voor veel onzekerheid

De VS ervaart momenteel een vertraging in orders voor de modernisering van kolencentrales, voornamelijk vanwege federale regelgeving. De alomtegenwoordige onzekerheid over federaal energiebeleid zorgt ervoor dat bedrijven aarzelen om te investeren in gecombineerde cyclustechnologie, ondanks de belofte ervan. Na Fukushima strekt deze aarzeling zich ook uit tot de nucleaire sector. Hernieuwbare energiebronnen zijn nog niet in staat om genoeg energie te genereren om aan de wereldwijde vraag te voldoen, dus een 30%-reductie in het gebruik van fossiele brandstoffen tegen 2030 lijkt onwaarschijnlijk.

De National Association of Clean Air Agencies steunt de voorgestelde regelgeving, maar waarschuwt dat “de regelgevings- en middelenuitdagingen die ons te wachten staan, ontmoedigend zijn.”3 Zoals te verwachten is, zijn de meningen vaak verdeeld langs politieke lijnen. Veel progressieve en milieubewuste wetgevers prijzen de maatregelen, terwijl conservatieven het mogelijke verlies aan inkomsten en banen betreuren.

Ongeacht deze meningen lijkt het duidelijk dat steenkool op de een of andere manier zal opveren om kernenergie, hernieuwbare energiebronnen, aardgas en gecombineerde cycli te versterken; allemaal in het belang van het voldoen aan de wereldwijde vraag naar energie. 15 jaar geleden was er een push richting gecombineerde cycli aardgasgestookte centrales, dus er waren veel stoomturbines en gastoepassingen. Sommigen noemen het Enron-debacle van 2001 als katalysator voor de daaropvolgende bouw van gemoderniseerde kolencentrales met nieuwe stoomturbineapparatuur en boilers. Er is ook een aanzienlijke modernisering van stoomcycli voor kerncentrales geweest, aangezien nutsbedrijven proberen zoveel mogelijk uit hun bestaande thermische energie en stoomcycluscapaciteiten te halen, maar er zal meer capaciteit nodig zijn. Investeerders wachten af of de industrie overstapt van centrale opwekking naar gedistribueerde, gelokaliseerde, kleinere, verpakte gasturbines of brandstofcellen.

Ongeacht deze meningen lijkt het duidelijk dat steenkool op de een of andere manier zal opveren om kernenergie, hernieuwbare energiebronnen, aardgas en gecombineerde cycli te versterken; allemaal in het belang van het voldoen aan de wereldwijde vraag naar energie. 15 jaar geleden was er een push richting gecombineerde cycli aardgasgestookte centrales, dus er waren veel stoomturbines en gastoepassingen. Sommigen noemen het Enron-debacle van 2001 als katalysator voor de daaropvolgende bouw van gemoderniseerde kolencentrales met nieuwe stoomturbineapparatuur en boilers. Er is ook een aanzienlijke modernisering van stoomcycli voor kerncentrales geweest, aangezien nutsbedrijven proberen zoveel mogelijk uit hun bestaande thermische energie en stoomcycluscapaciteiten te halen, maar er zal meer capaciteit nodig zijn. Investeerders wachten af of de industrie overstapt van centrale opwekking naar gedistribueerde, gelokaliseerde, kleinere, verpakte gasturbines of brandstofcellen.

Zelfs met koolstofafvangtechnologieën is de toekomst van de kolenproductie in de VS in beweging en veel hangt mogelijk af van de politieke windrichting in 2016. Een insider opperde dat er nog maar 200-250 gigawatt aan kolen over is. Concurrerende energieoplossingen zoals aardgas en hernieuwbare energiebronnen zullen uiteindelijk de vraag naar stoomgeneratoren in de VS afvlakken, maar veel opkomende regio's en landen zullen in de komende jaren wellicht naar kolen kijken als een goedkope energieoptie.

China's Ontwaken Milieu Bewustzijn

“Chinese wetgevers hebben de eerste amendementen op de milieubeschermingswet van het land in 25 jaar aangenomen, met de belofte van grotere bevoegdheden voor milieuautoriteiten en strengere straffen voor vervuilers. De amendementen … zullen autoriteiten toestaan om bedrijfsleiders 15 dagen vast te houden als ze geen milieueffectbeoordelingen uitvoeren of waarschuwingen om te stoppen met vervuiling negeren.” 4

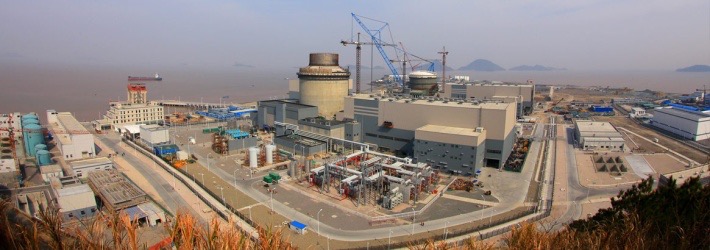

China is zich steeds meer bewust van milieuproblemen en zal de meest effectieve technologieën gebruiken om in de toekomst met klimatologische beperkingen om te gaan. Ze ontwikkelen snel infrastructuur om zo snel mogelijk stroom op het net te krijgen, wat op korte termijn een voortdurende afhankelijkheid van kolencentrales vereist. In het afgelopen decennium hebben Chinese nutsbedrijven veel materiaal gekocht voor stoomturbines, zoals scrubbers die zwaveldioxide en stikstof verwijderen. Er wordt verwacht dat ze meer superkritische centrales en technologieën moeten blijven ontwikkelen om de efficiëntie te verhogen.

De Chinezen zullen in de loop van de tijd meer kerncentrales bouwen en langzaam overstappen van de tussenoplossing van kolengestookte energieproductie. In de komende 25 jaar zullen ze agressief streven naar het doel om tot 50% van hun energievraag te dekken met kernenergie. Dit zal goede kansen bieden voor OEM's die China kunnen helpen om die capaciteitsdoelstelling in de toekomst te halen. Net als de VS zullen ze ook meer aardgas vinden en gebruiken door frackingactiviteiten uit te breiden. Uiteindelijk zullen aardgas en kernenergie de huidige afhankelijkheid van China van kolengestookte elektriciteitscentrales verminderen.

Het wereldwijde effect van schaliegas op de ontwikkeling van kolencentrales

In Noord-Amerika en China vormen milieuregels de toekomst van energieproductie. De schaliegashausse heeft nutsbedrijven ook geïnspireerd om kolencentrales om te bouwen naar gas of nieuw gasgestookte faciliteiten. De prijs van het boren naar aardgas in combinatie met de lage olieprijs zorgt echter voor problemen in de gassector. Volgens Bloomberg New Energy Finance, “Zelfs als de prijs van ruwe olie licht stijgt en stabiliseert op $75 per vat – wat Goldman Sachs ooit dacht dat het zou doen – 19 van de schaliegasreserves van het land zal niet langer winstgevend zijn.”

Wereldwijd neemt de opwekking van elektriciteit uit kolen nog steeds toe, hoewel in een langzamer tempo dan in voorgaande jaren. India en China kijken nog steeds naar kolen als een kant-en-klare bron van goedkope energie en beide opkomende landen bieden fabrikanten van apparatuur een echte kans om winst te maken. In de komende 20 jaar zal India naar verwachting nog eens 150 GW aan op kolen gestookte elektriciteit toevoegen.

Europese paden naar energievoorziening

Er is geen definitieve consensus tussen Europese landen als het gaat om het voldoen aan toekomstige energiebehoeften. Elk EU-land heeft unieke energie-uitdagingen, zowel economisch als ecologisch. De meeste landen in Europa zijn tegen de verdere uitbouw van kolengestookte energiecentrales. Tegelijkertijd probeert Europa kerncentrales te "sluiten" na de nucleaire ramp in Fukushima. Helaas zullen hernieuwbare energiebronnen alleen niet voldoen aan de energiebehoeften van Europese landen, zoals Joachim Knebel, hoofdwetenschapper bij het prestigieuze Karlsruhe Institute of Technology in Duitsland, onlangs opmerkte toen hij zei: "Het is gemakkelijk om te zeggen: "Laten we gewoon voor hernieuwbaar gaan", en ik weet zeker dat we ooit zonder kernenergie kunnen, maar dit is te abrupt."6

Duitsland is van plan om kerncentrales in 2022 uit te faseren. Om het gat te dichten, hebben ze een enorme hoeveelheid zonne- en groene generatietechnologie gekocht en hopen ze hun windproductie aan te vullen met gecombineerde cyclus aardgasfaciliteiten. Bij gebrek aan veel zinvolle kolen- of kernenergieopwekking zijn de tarieven van nutsbedrijven in Duitsland omhooggeschoten. Er zijn ook tegenstrijdige en controversiële berichten dat Duitsland kernenergie importeert uit Frankrijk en/of Tsjechië. Omdat er niet genoeg energie kan worden opgewekt uit hernieuwbare bronnen, is er toenemende druk om meer kolen- en kernenergie te gebruiken. Alleen de tijd zal leren hoe het verhaal zich in Duitsland ontvouwt. Insiders in de industrie denken dat het nog wel 10 jaar kan duren voordat er echte oplossingen worden gevonden. De meeste experts verwachten uiteindelijk dat Frankrijk en Duitsland in de komende jaren meer gecombineerde cycluscentrales zullen toevoegen.

Groot-Brittannië gebruikt nog steeds veel gas en olie uit de Noordzee, maar net als de meeste landen in de EU hebben ze geen toegang tot wat de VS goedkoop aardgas zouden noemen. Omdat Groot-Brittannië niet dezelfde groei doormaakt als andere delen van de wereld, kunnen ze simpelweg een aantal van de oudere kolencentrales elimineren omdat ze niet hongerig zijn naar meer elektriciteit. Op dit moment worden ze voornamelijk gedreven door zorgen over het milieu en de veiligheid.

De energieafhankelijkheid van Europa van Rusland

“Vorig jaar sloot Rusland de gastoevoer naar Oekraïne af vanwege een geschil over onbetaalde rekeningen. De gastoevoer werd hervat nadat er een deal was bemiddeld door de (Europese) Commissie, die er groot belang bij heeft om de levering aan Oekraïne veilig te stellen, aangezien dit de belangrijkste doorvoerroute is voor Russisch gas naar de Europese Unie. De EU streeft ernaar om haar afhankelijkheid van Russisch gas, dat goed is voor ongeveer 30 procent van de EU-levering, te verminderen en ontwikkelt een route die bekendstaat als de Southern Corridor om Azerbeidzjaans gas en brandstof van andere niet-Russische leveranciers te verschepen.”7

Europa is sterk afhankelijk van Rusland om het van aardgas te voorzien. Ze hebben niet het voordeel van de goedkope aardgasvoorziening die de VS wel heeft; daarom zijn de prijzen daar drie of vier keer hoger. Europese landen zullen blijven zoeken naar alternatieve energieleveranciers om de invloed van Rusland in hun energietransacties weg te nemen. De meesten denken dat ze op zinvolle wijze kolengestookte energie zullen blijven mijden en in de toekomst naar hernieuwbare energiebronnen zullen blijven kijken als hun energiebron.

In maart 2015 meldde Bloomberg.com dat de Europese kolenprijzen daalden tot het laagste punt in zeven jaar vanwege een wereldwijd overschot aan brandstof, aangezien regeringen over de hele wereld steeds minder fossiele brandstoffen verbranden. Een afnemende vraag naar kolen vanuit China, de grootste consument, wordt gezien als een belangrijke reden voor de prijsdaling.

rt.com

De gevolgen van Fukushima voor de wereldwijde kernenergie Productie

“Japan, voorheen een van 's werelds grootste producenten van kernenergie, is sterk afhankelijk geworden van fossiele brandstoffen na de meltdown in Fukushima Dai-ichi en de daaropvolgende sluiting van de kerncentrale van het land. In 2013, toen bijna de gehele Japanse kerncentrale werd gesloten, bestond meer dan 86% van de Japanse opwekkingsmix uit fossiele brandstoffen. In 2014 was de kernenergieproductie in Japan nul. De Japanse overheid verwacht in 2015 een paar kerncentrales weer in bedrijf te nemen.”8

“Japan, voorheen een van 's werelds grootste producenten van kernenergie, is sterk afhankelijk geworden van fossiele brandstoffen na de meltdown in Fukushima Dai-ichi en de daaropvolgende sluiting van de kerncentrale van het land. In 2013, toen bijna de gehele Japanse kerncentrale werd gesloten, bestond meer dan 86% van de Japanse opwekkingsmix uit fossiele brandstoffen. In 2014 was de kernenergieproductie in Japan nul. De Japanse overheid verwacht in 2015 een paar kerncentrales weer in bedrijf te nemen.”8

De Japanners maken zich begrijpelijkerwijs zorgen over de openbare veiligheid in de toekomst. Helaas zijn ze erg afhankelijk van de productie van kernenergie voor hun energie, ondanks recente pogingen om de capaciteit van zonne- en windenergie te vergroten. Na Fukushima wilde Japan hun kernprogramma helemaal stopzetten en teruggaan naar andere bronnen van energieopwekking. Uit verder onderzoek is echter gebleken dat het economisch niet haalbaar is om kernenergie volledig te laten varen.

Nu Japanse kerncentrales weer online gaan, zullen ze de ontwerpen van de centrales aanpassen om toekomstige rampen te voorkomen. Nieuwere faciliteiten zullen passiever en veiliger zijn. De Westinghouse AP1000 is een reactor die is ontworpen om rampen zoals die waarmee Fukushima onlangs te maken kreeg, te weerstaan. Hoewel het voor Japan niet rendabel is om nieuwe kolengestookte energiecentrales of gasgestookte faciliteiten te bouwen, hebben Japan en Duitsland een belangrijke rol gespeeld bij de ontwikkeling van superkritische en ultra-superkritische kolenverbrandingstechnologieën om het proces goedkoper en concurrerender te maken.

Hervorming van het Japanse elektriciteitssysteem

Na Fukushima heeft het Japanse kabinet in april 2013 het beleid voor hervorming van het elektriciteitssysteem opgesteld. Dit beleid met drie niveaus richt zich op het uitbreiden van de werking van grootschalige elektriciteitsnetten, liberalisering van de detailhandelsmarkten en elektriciteitsopwekking, en wetsvoorstellen voor juridische structurele scheiding ter herziening van de Electricity Business Act, die in 2015 aan de Diet zullen worden voorgelegd.

Het beleid inzake hervorming van het elektriciteitssysteem scheidt nutsbedrijven van de distributie van elektriciteit en creëert een heel ander type markt dan die van de VS. Om de energie-infrastructuur van het land na Fukushima te stabiliseren, heeft de Japanse overheid strikte operationele regels opgelegd aan energiebedrijven in plaats van deze entiteiten met elkaar te laten concurreren. Op dit moment leveren Tokyo Electric Power Company en Kansai Power Company bijna 98% van de Japanse elektriciteit. Toegang krijgen tot hun transmissielijnen is moeilijk en maakt de toetreding tot de markt voor nieuwe bedrijven extreem moeilijk.

In de VS kunnen binnenkomende energieproducenten een nieuwe centrale installeren en nutsbedrijven moeten vaak de energie kopen die goedkoper is dan wat ze zelf kunnen produceren. Zoals altijd is er veel discussie tussen politici, de energiesector en het publiek over de relatieve voordelen van regulering versus deregulering van de energiesector. In dit geval is de energiesector een plek waar overheidsingrijpen nuttig kan zijn om de miljarden dollars te verstrekken die nodig zijn om het type grootschalige projecten te kapitaliseren en te creëren die miljoenen mensen van energie kunnen voorzien.

In de toekomst zal Japan wellicht aardgas en gecombineerde cyclustechnologie nastreven, waarbij turbines worden gebruikt om energie op te wekken. Het Land van de Rijzende Zon staat voor unieke geografische uitdagingen die een rol spelen in hun strategieën en beslissingen met betrekking tot energie. Het valt nog te bezien hoe de regulering van opwekking, transmissie en distributie de vooruitzichten van Japan in de komende jaren zal beïnvloeden. Soortgelijke regelgevingen zijn in Californië geïmplementeerd met wisselende resultaten. Sommige grote nutsbedrijven werden gedwongen hun transmissie- en distributieactiva te verkopen, waardoor er een stresssituatie ontstond met Pacific Gas and Electric, San Diego Gas and Electric en Southern California Edison.

China en India behouden nucleaire ambities

Het nucleaire incident in Fukushima in 2011 verlamde de grootschalige bouwplannen van de kernenergie-industrie. Sindsdien omarmen veel landen echter opnieuw kernenergie als een nog steeds levensvatbaar en noodzakelijk middel voor energieopwekking in de 21st Eeuw. Het persbureau Xinhua meldt dat de Chinese Staatsraad zojuist groen licht heeft gegeven voor twee nieuwe reactoren in de Hongyanhe-faciliteit van General Nuclear Power Group. De twee eenheden worden ontworpen door de China General Nuclear Power Company (CGNPC). China zal zijn nucleaire capaciteit tegen 2020 opvoeren tot 58 GW, aldus National Business Daily. Er worden momenteel 25 kernreactoren gebouwd in China. Sommigen voorspellen dat er in de komende 20 jaar wel 200 reactoren gebouwd kunnen worden.

Het nucleaire incident in Fukushima in 2011 verlamde de grootschalige bouwplannen van de kernenergie-industrie. Sindsdien omarmen veel landen echter opnieuw kernenergie als een nog steeds levensvatbaar en noodzakelijk middel voor energieopwekking in de 21st Eeuw. Het persbureau Xinhua meldt dat de Chinese Staatsraad zojuist groen licht heeft gegeven voor twee nieuwe reactoren in de Hongyanhe-faciliteit van General Nuclear Power Group. De twee eenheden worden ontworpen door de China General Nuclear Power Company (CGNPC). China zal zijn nucleaire capaciteit tegen 2020 opvoeren tot 58 GW, aldus National Business Daily. Er worden momenteel 25 kernreactoren gebouwd in China. Sommigen voorspellen dat er in de komende 20 jaar wel 200 reactoren gebouwd kunnen worden.

In India hebben onderhandelingen plaatsgevonden met Amerikaanse nucleaire belangen over de toekomstige bouw van kerncentrales, maar bedrijfsfunctionarissen zijn terughoudend om specifieke details te onthullen. Er is gemeld dat "de Indiase regering plannen om de binnenlandse capaciteit voor kernenergieopwekking tegen 2020-2021 te verdrievoudigen.”9 Ongeacht India's nucleaire ambities of milieuoverwegingen, bouwen ze nog steeds kolencentrales die ze nodig hebben om economische redenen. Ze zullen actief kolengestookte elektriciteitsopwekking toevoegen terwijl ze doorgaan met het bestuderen van manieren om de hoeveelheid vervuiling die ze gaan produceren te verminderen. Hoewel ze wat aardgas gebruiken, is het onwaarschijnlijk dat ze alleen op aardgas overstappen, tenzij het absoluut noodzakelijk is dat ze dat doen.

Schaliegas, Fukushima en het Amerikaanse nucleaire beleid

Het nucleaire beleid in de VS is absoluut meer beïnvloed door de komst van schaliegasproductie dan door enige industriële "fallout" van Fukushima. Met gasgegenereerde energie beschikbaar voor minder dan $20 per uur, is er momenteel niet veel reden om kernenergie na te streven. Het lijkt er ook op dat de prijs van aardgas in de nabije toekomst laag zal blijven. Dit wil niet zeggen dat nutsbedrijven niet geïnteresseerd zijn in kernenergie in hun portefeuilles, maar de voordelen zijn momenteel het risico niet waard. Op dit moment bieden gecombineerde cyclustechnologieën de beste winstmarges voor nutsbedrijven en aandeelhouders. Aardgasproductie zal de kernconstructie in de VS blijven vertragen, maar in andere delen van de wereld zal het toenemen.

De voortdurende marktpenetratie van hernieuwbare energiebronnen

Nu kolencentrales en kernenergie om veiligheids- en milieuredenen worden aangevallen, heeft een groeiende interesse in hernieuwbare energiebronnen geleid tot een nieuwe focus op wind-, zonne-, biomassa-, geothermische en hydro-elektrische energiebronnen. Natuurlijk heeft elk van deze bronnen zijn nadelen en huidige beperkingen. Europa loopt voorop bij de implementatie van groene energietechnologieën, maar hernieuwbare energiebronnen kunnen op dit moment geen energie opwekken zoals kolen en kernenergie dat kunnen. Ondanks de veiligheidszorgen die Fukushima heeft opgeroepen, zal kernenergie zeker deel uitmaken van de wereldwijde energieoplossing op lange termijn.

Nu kolencentrales en kernenergie om veiligheids- en milieuredenen worden aangevallen, heeft een groeiende interesse in hernieuwbare energiebronnen geleid tot een nieuwe focus op wind-, zonne-, biomassa-, geothermische en hydro-elektrische energiebronnen. Natuurlijk heeft elk van deze bronnen zijn nadelen en huidige beperkingen. Europa loopt voorop bij de implementatie van groene energietechnologieën, maar hernieuwbare energiebronnen kunnen op dit moment geen energie opwekken zoals kolen en kernenergie dat kunnen. Ondanks de veiligheidszorgen die Fukushima heeft opgeroepen, zal kernenergie zeker deel uitmaken van de wereldwijde energieoplossing op lange termijn.

Er is veel werk verzet om echte "schone steenkool" te verkrijgen. Toch geloven voorstanders van groene energie dat het leven niet in stand kan worden gehouden door voortdurend zwaveloxiden en andere vervuilende stoffen in de lucht te lozen. Steenkool is gemakkelijk verkrijgbaar en goedkoop, waardoor het een noodzakelijk alternatief is voor ontwikkelingslanden, maar de huidige trend richting aardgas en hernieuwbare energiebronnen laat zien dat het op de lange termijn wel eens mis kan gaan met steenkool. Terwijl het politieke debat over klimaatverandering voortduurt, is de trend richting hernieuwbare energiebronnen en schonere energiebronnen in beweging. De federale overheid heeft veel door de IRS beheerde, op belastingen gebaseerde prikkels aangeboden aan bedrijven om de inzet van hernieuwbare energieprojecten te stimuleren, waaronder de Renewable Electricity Production Tax Credit (PTC) en de Business Energy Investment Tax Credit (ITC).

Opduikende rapporten beweren dat de snel voortschrijdende mogelijkheden voor zonne-energie de schaliegashausse binnenkort kunnen doen ontsporen. "Over een paar jaar zullen zonne-energiecentrales de goedkoopste energie leveren die in veel delen van de wereld beschikbaar is. In 2025 zullen de kosten voor het produceren van energie in Midden- en Zuid-Europa zijn gedaald tot tussen de 4 en 6 cent per kilowattuur, en in 2050 tot slechts 2 tot 4 cent." Dit zijn de belangrijkste conclusies van een onderzoek van het Fraunhofer Instituut voor zonne-energiesystemen in opdracht van de Duitse denktank Agora Energiewende."10

Kernenergie, steenkool en het Clean Power Plan

De impact van de kernramp in Fukushima Daiichi in 2011 mag niet worden onderschat. Sommige landen, zoals Duitsland, hebben onmiddellijk een moratorium uitgevaardigd op toekomstige nucleaire ontwikkeling. Deze landen hebben echter ontdekt dat het opvullen van de capaciteitskloof zonder kernenergie geen geringe prestatie is. Langzaam wordt de bouw van nieuwe centrales opgevoerd in Oekraïne, Bulgarije, China, de VS, Groot-Brittannië en elders. De afhankelijkheid van Europa van Russisch aardgas zorgt ook voor een hernieuwde belangstelling voor kernenergie en biomassa op het continent. Politieke en economische problemen hebben er namelijk voor gezorgd dat de gaslevering onbetrouwbaar en economisch niet haalbaar is.

Er is momenteel vraag naar innovatie in de nucleaire industrie. Om dat doel te bereiken, worden er Generation Four-reactoren ontwikkeld en werken verschillende bedrijven aan kleine modulaire reactoren die wel eens de golf van de toekomst zouden kunnen zijn. Hoewel Fukushima de zaken in de nucleaire sector tijdelijk heeft vertraagd, wordt er de afgelopen vijf jaar meer geld uitgegeven aan onderzoek en ontwikkeling binnen de nucleaire industrie dan in de afgelopen drie decennia.

Tijdens de VN-klimaatconferentie in Kopenhagen in 2009 stemden de Verenigde Staten ermee in om de uitstoot van broeikasgassen tegen 2020 te verlagen tot 17% onder het niveau van 2005. Terwijl nutsbedrijven eraan werken om te voldoen aan de eisen van de Schoon Energie Plan, er worden nieuwe kerncentrales gebouwd in de VS en er worden er meer gepland voor de toekomst, om het energietekort op te vullen dat is ontstaan door de uitfasering van op kolen gebaseerde elektriciteitscentrales. "Volgens voorspellingen van de Amerikaanse Environmental Protection Agency (EPA) zou er tussen 2016 en 2020 bijna 50 GW aan basislastkolencentrales kunnen worden stopgezet vanwege het voorgestelde Clean Power Plan van het agentschap. Deze verwachte stopzettingen komen bovenop de bijna 70 GW aan fossiele brandstoffen waarvan de EPA erkent dat deze is stopgezet of ergens dit decennium zal stopzetten vanwege andere EPA-regelgeving. In totaal zal naar verwachting meer dan 120 GW aan geïnstalleerde capaciteit, of ongeveer 33 procent van alle kolencentrales, tegen 2020 worden stopgezet, wat genoeg elektriciteit is om 60 miljoen huishoudens van stroom te voorzien."11

Aanjagers voor de renovatie van kolencentrales

Van binnenuit hebben nutsbedrijven een dubbele motivatie als het gaat om het beslissen wat ze moeten doen met bestaande kolencentrales. Het Clean Power Plan streeft naar een 30%-reductie van de Amerikaanse CO2-voetafdruk in 2030 en roept staten op om de productie van broeikasgassen sterk te beperken. Om dit te bereiken, moeten kolencentrales worden gesloten of gerenoveerd. "Staten moeten uiterlijk 30 juni 2016 ten minste een eerste plan presenteren, maar ze mogen kiezen uit verschillende methoden, van het uitbreiden van het gebruik van hernieuwbare energie tot het opzetten van marktgebaseerde systemen voor koolstofhandel."12 Veel staten overwegen om samen te werken met hun regelgevende groepen voor de kwaliteit van de staatszorg om hun plan te verkrijgen in het belang van een compromis. Ze hopen dat ze aardgasfaciliteiten mogen bouwen als ze akkoord gaan met het afschaffen van steenkool. Het is een duidelijke trend die zich voordoet.

In veel gevallen kunnen kolencentrales worden gerenoveerd met nieuwe schone kolentechnologieën, maar dit proces is vaak te duur, waardoor bedrijven in plaats daarvan geheel nieuwe faciliteiten bouwen. De EPA is absoluut een van de sterkste motivators voor verandering binnen de Amerikaanse overheid en naarmate hun regels strenger worden, zullen ze kolen uit de algehele energievergelijking blijven duwen. Toch valt niet te ontkennen dat hernieuwbare energiebronnen nog niet in staat zijn om aan de wereldwijde energievraag te voldoen. Velen vinden dat de EPA de belangrijkste aanjager en katalysator voor verandering is, waardoor de meeste bedrijven gedwongen worden om naar aardgas of kernenergie te kijken als alternatieven.

Kernenergie is duur om op te wekken en brengt risico's met zich mee voor de openbare veiligheid, zoals onlangs werd benadrukt door het kernincident in Fukushima. Nutsbedrijven willen kernenergie wel in hun portefeuille houden om in de toekomst een zekere mate van brandstofdiversiteit te behouden. Schaliegasproductie is zeer lucratief geweest, maar de infrastructuur voor de transmissie van aardgas wordt door sommigen als beperkt gezien. Op de lange termijn kan steenkool worden stilgelegd, tenzij effectieve technologie voor koolstofafvang echt kan worden gerealiseerd. Op dit moment is het nog niet commercieel haalbaar gebleken in een grootschalige elektriciteitscentrale en zijn demonstratieprojecten niet bijzonder succesvol geweest.

Internationaal zien fabrikanten en ontwerpers nabijheid als een belangrijke drijfveer om nieuwe contracten veilig te stellen. Om succesvol te zijn in landen als China en India, moeten bedrijven daar voet aan de grond hebben. Maar deze landen zijn niet alleen geïnteresseerd in het importeren van energie; ze willen het zelf creëren, dus fabrikanten realiseren zich het belang van het openen van afdelingen en activiteiten in grote markten waar klanten geïnteresseerd zijn om uiteindelijk eigenaarschap te nemen.

Vanuit een technisch perspectief hangt alles wat met kernenergie te maken heeft af van overheidsbeleid dat kritische veiligheidsfactoren bepaalt. Bedrijven als Areva, Westinghouse, Babcock en Wilcox, Adams Atomic, moeten de veiligheid van hun producten bewijzen. Het DOE zal projecten die zij de moeite waard achten financieel ondersteunen, en een extra $25 miljoen aan overheidsfinanciering helpt zeker als het gaat om reactoronderzoek.

Kleine modulaire reactoren bieden nieuwe energieoplossingen

“Reactorontwerpers ontwikkelen een aantal kleine lichtwaterreactoren (LWR) en niet-LWR-ontwerpen die gebruikmaken van innovatieve oplossingen voor technische problemen met kernenergie. Deze ontwerpen kunnen worden gebruikt voor het opwekken van elektriciteit in afgelegen gebieden of het produceren van proceswarmte met hoge temperaturen voor industriële doeleinden … De Amerikaanse Nuclear Regulatory Commission (NRC) verwacht al eind 2015 aanvragen te ontvangen voor personeelsbeoordeling en goedkeuring van kleine modulaire reactoren (SMR)-gerelateerde 10 CFR Part 52-aanvragen.”13

Sommige kleinere landen zoals Maleisië en Indonesië hebben niet de transmissienetwerkinfrastructuur of de ruimte om grootschalige nucleaire faciliteiten te ondersteunen. SMR's (small modular reactors) bieden een werkbare oplossing in situaties als deze. SMR's kunnen Groot-Brittannië ook helpen met hun koolstofarme toezeggingen en hen helpen hun netwerkcapaciteit te vergroten. Nieuwe SMR-ontwerpen worden ook ingezet in de Verenigde Staten, Japan en in veel ontwikkelingslanden over de hele wereld.

Velen in de industrie zijn behoorlijk optimistisch over de toekomst van SMR's. Verschillende versies worden al enige tijd gebruikt in de nucleaire industrie en verschillende bedrijven zoals New Scale en SCAMU werken momenteel aan de verdere ontwikkeling ervan in het belang van een licentie in 2020. De volgende stap zou zijn om klanten te vinden die bereid zijn om ze te kopen. SMR's worden in modulaire vorm gebouwd in een fabriek en worden naar hun inzetlocatie vervoerd. Hoewel ze wel gebruiksgemak en een compact ontwerp bieden, zijn onderhoud en hoge veiligheidsmaatregelen Zijn nog steeds vereist.

Beheer van kernafval en Yucca Mountain

Een insider omschreef het beheer van kernafval in de VS als "een puinhoop" en gaf de politiek de schuld. Het is waar dat typische rechts-linkse rancune een beslissing over de oprichting van een gecentraliseerde opslaglocatie heeft belemmerd. Tegenwoordig slaan de meeste nutsbedrijven hun afval op in droge vaten op hun eigen locaties, omdat er geen specifieke nationale opslagplaats is voor de opslag van kernafval. De Yucca Mountain in Nevada wordt al lang beschouwd als een voorkeurslocatie voor zo'n opslagplaats, maar publieke en politieke weerstand tegen het project heeft het tot nu toe buiten werking gehouden. Een meerderheid van de burgers van Nevada is tegen de locatie om veiligheidsredenen, zoals stralingsemissie; dit ondanks verzekeringen dat elke blootstelling aan radioactiviteit ruim binnen de vastgestelde veiligheidslimieten zou vallen.

In augustus 2013 werd de Amerikaans Hof van Beroep voor het District van Columbia bestelde de Nucleaire Reguleringscommissie om “de aanvraag van het ministerie van Energie voor de nooit voltooide afvalopslagplaats bij Yucca Mountain in Nevada goed te keuren of af te wijzen.” In het oordeel van de rechtbank werd gesteld dat de NRC “gewoon de wet overtrad” in haar eerdere actie om de Obama-regering om de plannen om de voorgestelde afvallocatie te sluiten voort te zetten, aangezien een federale wet die Yucca Mountain aanwijst als de opslagplaats voor kernafval van het land nog steeds van kracht is.” 14

Belangrijke spelers in de turbineproductie

Turbine-gebaseerde generatoren en motoren zullen naar verwachting $162 miljard aan verkopen genereren op de wereldmarkt in 2016. Dit weerspiegelt een jaarlijkse stijging van 6,4%. De grootste groeisector is windturbines. Een toenemende vraag naar gasturbines is ook duidelijk zichtbaar op de internationale markt.

GE, Siemens, Alstom, Mitsubishi, Hitachi en Solair domineren de huidige turbine-industrie. Deze bedrijven steken boven de concurrentie uit als het gaat om gas, stoom, turbines en boilers. Er wordt aangenomen dat GE een groter marktaandeel heeft voor gasturbines. Hun geplande aankoop van Alstom SA ter waarde van $15,6 miljard omvat de hoog aangeschreven heavy duty gasturbine-activiteiten van dat bedrijf. Door kernenergie, kolengestookte energie, gasturbines of waterkracht te combineren, wordt gedacht dat GE ongeveer 25% van de energie in de wereld produceert. Als het doorgaat, zal de fusie van GE en Alstom zeker het gezicht van het marktaandeel veranderen en GE's internationale voetafdruk vergroten.

"Een spaak in het wiel steken,De Europese Commissie gaat een diepgaand onderzoek instellen naar de fusie tussen GE en Alstom om te beoordelen of deze in strijd is met de mededingingsregels. Het onderzoek zal 90 dagen duren en de definitieve beslissing wordt verwacht op 6 augustus 2015.”15 De Commissie heeft haar bezorgdheid geuit dat de verkleining van de concurrentie op het gebied van gasturbines kan leiden tot hogere prijzen, minder innovatie en minder keuzemogelijkheden voor klanten.

Ondertussen fuseerden Mitsubishi en Hitachi in 2014 tot Mitsubishi Hitachi Power Systems, Ltd. (MHPS). “De twee bedrijven hebben hun respectievelijke wereldwijde thermische elektriciteitsopwekkingsactiviteiten voor het eerst aangekondigd op 29 november 2012 en hebben hun respectievelijke wereldwijde thermische elektriciteitsopwekkingsactiviteiten overgebracht naar een nieuwe joint venture via een bedrijfssplitsing, waarbij MHI nu een aandelenbelang van 65% heeft en Hitachi 35% in de nieuwe gefuseerde entiteit.”16 Door de fusie krijgen beide bedrijven de beschikking over een groter portfolio aan energieproducten en beschikbare oplossingen.

In wereldwijde stoomturbines heeft Siemens een marktaandeel van 4% in jaarlijkse verkopen. Grotere belangen in stoom zijn Bharat Heavy Electricals uit India (BHEL) met 18%, Toshiba met 10% en Harbin Electric uit China met 7%. Bij het beoordelen van de verkoopcijfers van 2015 heeft CEO Joe Kaeser van Siemens gezegd dat gas en elektriciteit nodig zijn “een meer omvattend concept om terug te keren naar historische marges op langere termijn.”

De drang om te fuseren

China Power Investment Corporation fuseert naar verluidt met de staatskernenergietechnologiecorporatie. Tegelijkertijd fuseert de China National Nuclear Power Corporation met China General Nuclear Power. Deze fusies zouden deze entiteiten de financiële kracht moeten geven die nodig is om wereldwijd te gaan. In de VS ondersteunt het DOE een deel van de leningen voor de bouw van nieuwe kerncentrales, maar China heeft financiële kracht nodig om zichzelf te positioneren op een wereldwijde markt. China hoopt te concurreren en uiteindelijk de nucleaire industrie wereldwijd te leiden, aangezien ze meer reactoren bouwen en meer technologie verwerven. Ze geven meer uit aan kernenergie dan enig ander land ter wereld. In de VS gevestigde Progress Energy fuseerde in 2012 met Duke Energy. Daarmee is Duke Energy het grootste elektriciteitsbedrijf van het land als je de opwekkingscapaciteit, het aantal klanten en de marktkapitalisatie meetelt.

De AB1000, EBWR's en de nucleaire vooruitzichten

De experimentele kokendwaterreactor (EBWR) van General Electric wordt ontwikkeld voor nucleaire toepassingen. Naar verluidt verloopt het ontwerp ervan voorspoedig en zou het binnenkort klaar moeten zijn voor commerciële toepassing.

De experimentele kokendwaterreactor (EBWR) van General Electric wordt ontwikkeld voor nucleaire toepassingen. Naar verluidt verloopt het ontwerp ervan voorspoedig en zou het binnenkort klaar moeten zijn voor commerciële toepassing.

De marktleider op dit moment is een reactor die in de jaren '80 door Westinghouse werd ontworpen en die oorspronkelijk de AP600 heette. Deze eenheid werd groter gemaakt en kreeg uiteindelijk de naam AP1000. Deze worden gebouwd in Savannah, Georgia, samen met CB&I (Chicago Bridge and Iron). De AP1000 is een drukwaterreactor die een ouder type EBWR bevat dat is ontworpen door GE en dat extra vermogen nodig heeft om de koelsystemen te onderhouden en de reactor uit te schakelen in geval van een probleem. Verwijzend naar het nucleaire incident in Fukushima, hadden technici daar geen noodstroom van dieselgeneratoren. Hierdoor konden ze de centrale niet afkoelen en brak er een ramp uit.

Het ontwerp van de Westinghouse AP1000 is voorzien van een passief systeem dat gebruikmaakt van zwaartekracht en thermische convectie om de fabriek uit te schakelen, zelfs als er geen externe stroom beschikbaar is. De units die nu door Southern Company worden gebouwd, zijn de eerste die in 30 jaar in de VS worden gebouwd en worden 'Fukushima Proof' genoemd.

Tegelijkertijd bouwt Toshiba een stoomturbinegenerator die zeer concurrerend is in termen van efficiëntie bij het gebruik van een nucleaire stoombron. Westinghouse en Toshiba zullen de markt opgaan om hun reactoren te promoten. Sommigen vinden dat Westinghouse de overhand heeft met een superieur waterreactorontwerp en een aanzienlijke voorsprong in termen van het binnenhalen van orders op nationaal en internationaal niveau. Ze hebben veel meer geavanceerde engineering en standaardisatie van het ontwerp gedaan, zodat het aanvragen van een exploitatievergunning eenvoudiger en minder kostbaar zal zijn; iets dat China's State Nuclear Power Technology Corp (SNPTC) aansprak.

Beide bedrijven gaan naar het Verenigd Koninkrijk, Bulgarije, China en India; vrijwel overal waar ze de AP1000- of EDWR-reactoren kunnen verkopen. Natuurlijk was Toshiba's nucleaire bedrijf jarenlang het belangrijkste element van het bedrijf totdat Fukushima al hun binnenlandse kernreactoren sloot, waarvan er veel niet opnieuw zijn opgestart. Het is nog steeds een heel sterk onderdeel van het bedrijf, niet zozeer vanuit een zakelijk oogpunt als wel vanuit een cultureel oogpunt. Ze zullen nog steeds sterk worden gesteund door Toshiba's senior management. Dit is een cruciaal moment voor de kernenergiesector en de komende vijf of tien jaar zullen cruciaal zijn om te zien waar het naartoe zal leiden. Sommigen denken dat kleine modulaire reactoren de toekomst zijn en verwachten dat sommige grote bedrijven de nucleaire sector verlaten of andere markten betreden.

Inzicht in de energiewaardeketen

"Volgens de US Energy Information Administration zullen de totale binnenlandse uitgaven voor energiediensten naar verwachting groeien van ongeveer $1,2 biljoen in 2010 tot meer dan $1,7 biljoen in 2030. De groeiende consumentenvraag en innovatie van wereldklasse, gecombineerd met een concurrerende beroepsbevolking en een toeleveringsketen die in staat is om alle energietechnologieën te bouwen, installeren en onderhouden, maken de Verenigde Staten de meest aantrekkelijke markt ter wereld in de wereldwijde energiesector van $6 biljoen."17

Waar is het geld? Bij het onderzoeken van de waardeketen van de energiesector springen sommige gebieden eruit als lucratiever dan andere. De gasturbine-combinecyclus is misschien wel de beste geldmaker, omdat de investeringskosten voor installatie nog steeds behoorlijk concurrerend zijn. Op de Amerikaanse markt concurreren commerciële leveranciers van elektriciteit met andere leveranciers op basis van wat het kost om een incrementele megawatt op de markt te brengen. Deze variabele productiekosten zijn in feite een berekening van de brandstofkosten en de kosten van het omzetten van de brandstof in elektriciteit.

Kernenergie bevindt zich aan de onderkant van de curve wat betreft variabele productiekosten, maar de kapitaalinvestering die nodig is om kernenergie te installeren is astronomisch hoog. Op dit moment worden er veel gecombineerde cycluseenheden samengesteld omdat de omzetting van aardgasbrandstof naar elektriciteit in gecombineerde cycluscentrales inefficiënt is. De kapitaalkosten zijn voorspelbaar en begrijpelijk. Tegenwoordig is er een enorme verschuiving naar gecombineerde cyclus, omdat nutsbedrijven willen profiteren van de lage kosten van aardgas en concurrerender willen zijn op de elektriciteitsmarkt. Nogmaals, de komende jaren zullen bepalen waar de meeste winstgevendheid zal liggen. Reactortechnologie is erg lucratief, maar het kost miljarden aan investeringskapitaal. Als ontwikkelaars die technologie verkopen, kunnen ze veel geld verdienen, als ze dat niet doen, kunnen ze veel geld verliezen. Afvalbeheer zal naar verwachting de komende jaren extreem winstgevend zijn. De productie lijkt ook winstgevend te zijn, maar het grootste deel hiervan zal waarschijnlijk in het buitenland plaatsvinden.

De uraniumprijzen zijn momenteel zo laag dat zodra een kerncentrale operationeel is, de kosten voor het omzetten van uraniumbrandstof in elektriciteit extreem concurrerend zijn. De risicofactor op de nucleaire markt is de mogelijkheid dat er iets gebeurt waardoor de prijs van uranium stijgt. Een kerncentrale is slechts iets duurder dan een waterkrachtcentrale als het gaat om de kosten voor het produceren van elektriciteit, dus kernenergie is kosteneffectief als de uraniumprijzen stabiel blijven.

Bundeling en langetermijn servicecontracten

De Chinezen hebben onlangs financiële steun aangeboden om potentiële energieklanten te overtuigen contracten te tekenen. Andere bedrijven geven er de voorkeur aan bundel de verkoop van apparatuur met een langetermijn servicecontract. Wat zijn de belangrijkste succesfactoren voor het ontwikkelen van nieuwe business op verschillende locaties? Velen in de industrie vinden het belangrijk om langetermijnprogramma's en -diensten te bundelen, en veel grote spelers in de energiesector doen dat al. Eigenaars/exploitanten in de VS zijn vaak niet zo afhankelijk van dit soort diensten, maar wereldwijd zijn langetermijn servicecontracten gebruikelijker. Daarom is het belangrijk dat binnenlandse energiebedrijven een fysieke aanwezigheid hebben en relaties met internationale klanten die externe service nodig hebben. Zodra klanten vertrouwd zijn met de nieuwe technologie, is het mogelijk dat ze het servicecontract niet meer nodig hebben.

De Chinezen hebben onlangs financiële steun aangeboden om potentiële energieklanten te overtuigen contracten te tekenen. Andere bedrijven geven er de voorkeur aan bundel de verkoop van apparatuur met een langetermijn servicecontract. Wat zijn de belangrijkste succesfactoren voor het ontwikkelen van nieuwe business op verschillende locaties? Velen in de industrie vinden het belangrijk om langetermijnprogramma's en -diensten te bundelen, en veel grote spelers in de energiesector doen dat al. Eigenaars/exploitanten in de VS zijn vaak niet zo afhankelijk van dit soort diensten, maar wereldwijd zijn langetermijn servicecontracten gebruikelijker. Daarom is het belangrijk dat binnenlandse energiebedrijven een fysieke aanwezigheid hebben en relaties met internationale klanten die externe service nodig hebben. Zodra klanten vertrouwd zijn met de nieuwe technologie, is het mogelijk dat ze het servicecontract niet meer nodig hebben.

Aankoopbeslissingen in de VS zijn meestal gebaseerd op prijs en prestaties in tegenstelling tot uitgebreide onderhoudsplannen. Het is begrijpelijkerwijs een zeer competitieve markt. Japanse bedrijven zoals Hitachi vereisen vaak geen betalingen totdat een fabriek is voltooid; zoals een winkel dat zou doen - geen rente, geen betalingen, totdat het werk is gedaan. In Europa is het niet ongebruikelijk dat kopers pakketten kopen en relaties met Siemens of Alstom voortzetten. Financieringspakketten zijn meestal van toepassing op minder ervaren eigenaren of mensen die meer vertrouwd zijn met financiën dan met de daadwerkelijke werking van een fabriek. Technologisch geavanceerdere bedrijven willen hun faciliteiten zelf exploiteren en belangrijke aankoopbeslissingen nemen over wiens onderdelen ze kopen en wat ze ervoor betalen. Dergelijke beslissingen zijn in de eerste plaats gebaseerd op economische factoren.

Om de recente economische crisis te doorstaan, hebben veel bedrijven nul winst of zelfs verlies geleden, en hun klanten beloofd dat ze hun capaciteit zouden behouden en hun personeel zouden trainen. Dingen werden gestructureerd met als doel onderhoudscontracten te verkrijgen en marktaandeel veilig te stellen. Historisch gezien hadden OEM's de voordelen, maar een deel daarvan kan verdwijnen naarmate de markten volwassener worden.

Hoe ver staan we met de technologie voor koolstofafvang?

Koolstofafvangtechnologie werd oorspronkelijk gebruikt om de winning van gas en olie te verbeteren, maar wordt de laatste tijd ook ingezet om milieuredenen. Energiecentrales op fossiele brandstoffen zijn verantwoordelijk voor de meeste CO2-uitstoot. In de toekomst zouden verbeterde methoden voor koolstofafvang het opvangen en veilig opslaan van CO2 mogelijk moeten maken. Op dit moment is het opvangen ervan duur. Geschat wordt dat het opvangen van CO2 van een 500-megawattcentrale een scheidingsfaciliteit van $400 miljoen vereist. Bovendien kan de energie die nodig is om de katalytische separator te laten draaien een derde van de energie verbruiken die een centrale produceert. Dit economische plaatje is niet rooskleurig. Sommigen hebben het gehad over subsidiëring, Cap and Trade of regelgeving die mensen zouden kunnen motiveren om de CO2-uitstoot te verminderen. Uiteindelijk is er nieuwe technologie nodig die katalytische scheidingsinstallaties kan vervangen en tot nu toe zijn de voorgestelde concepten voor koolstofafvang te duur gebleken.

Mensen werken aan het probleem. Babcock en Wilcox bijvoorbeeld. Er zijn technisch uitvoerbare plannen, maar nogmaals, ze zijn te duur. Naast de economische horde is het van groot belang om CO2 veilig op te slaan, omdat elk falen ernstige gezondheids- en milieuproblemen kan veroorzaken. De hoge kosten en opslagproblemen van koolstofafvang zorgen ervoor dat veel nutsbedrijven opnieuw naar kernenergie kijken als mogelijk de beste wereldwijde energieoplossing op lange termijn. Uiteindelijk staat de technologie voor koolstofafvang nog in de kinderschoenen en zijn er meer gegevens en onderzoek nodig om de risico's en voordelen ervan te analyseren.

“Chemici van UC Berkeley hebben een grote sprong voorwaarts gemaakt in de technologie voor koolstofafvang met een materiaal dat koolstof efficiënt kan verwijderen uit de omgevingslucht van een onderzeeër, net zo gemakkelijk als uit de vervuilde emissies van een kolengestookte elektriciteitscentrale. Het materiaal geeft vervolgens de koolstofdioxide af bij lagere temperaturen dan huidige koolstofafvangmaterialen, wat mogelijk de energie die momenteel in het proces wordt verbruikt, met de helft of meer kan verminderen. De vrijgekomen CO2 kan vervolgens ondergronds worden geïnjecteerd, een techniek die sequestratie wordt genoemd, of, in het geval van een onderzeeër, in de zee worden uitgestoten.” 18

Superkritisch versus gecombineerde cyclus – de opties afwegen

Superkritische en ultra-superkritische technologieën verbranden steenkool onder druk bij extreem hoge temperaturen om efficiënte energieproductie en sterk verminderde CO2-uitstoot te verkrijgen. Bovendien stoten gecombineerde cycluscentrales veel minder zwaveldioxide en stikstofoxiden uit, die een negatieve invloed hebben op de luchtkwaliteit. Ultra-superkritische eenheden die in Denemarken, Duitsland en Japan worden ontwikkeld, zouden nog efficiënter moeten kunnen werken en de brandstofkosten moeten verlagen. Hooggelegeerde staalsoorten die corrosie remmen, kunnen in de nabije toekomst leiden tot een snelle toename van superkritische en ultra-superkritische toepassingen.

IGCC (Integrated Gasification Combined Cycle) technologie “maakt gebruik van een kolenvergassingssysteem om kolen om te zetten in een synthesegas (syngas) en stoom te produceren. Het hete syngas wordt verwerkt om zwavelverbindingen, kwik en fijnstof te verwijderen voordat het wordt gebruikt om een verbrandingsturbinegenerator van brandstof te voorzien, die elektriciteit produceert. De warmte in de uitlaatgassen van de verbrandingsturbine wordt teruggewonnen om extra stoom te genereren. Deze stoom, samen met die van het syngasproces, drijft vervolgens een stoomturbinegenerator aan om extra elektriciteit te produceren.”19

Economisch gezien zijn superkritische kolencentrales concurrerend wanneer de prijs van aardgas ongeveer $5 per miljoen BTU bedraagt. Op dit moment is de verwachte prijs van aardgas in de VS $3 tot $4 per miljoen BTU. Dus zelfs als er geen zorgen waren over CO2-uitstoot, zou het financieel redelijk zijn om een gecombineerde cycluscentrale te bouwen. Dit is de reden waarom er over het algemeen geen nieuwe kolencentrales worden gebouwd, behalve in India, China en Vietnam. Brazilië en Chili waren onlangs geïnteresseerd in de ontwikkeling van nieuwe kolencentrales, maar de verbetering van de gecombineerde cyclustechnologie heeft ervoor gezorgd dat die landen alle ambities voor kolencentrales hebben opgegeven. Dezezelfde houding is wijdverbreid in de meeste landen over de hele wereld.

Prognoses voor aardgasprijzen

De aardgasprijzen zullen naar verwachting in de komende 10 jaar in het bereik van $2,50 tot $4 per miljoen BTU blijven. Als dit echter waar zou zijn, lijkt het erop dat meer centrales zouden overstappen op gecombineerde cyclustechnologie en de huidige markt laat zien dat dit niet het geval is. Sommige nutsbedrijven gebruiken de strategie om een aantal kolengestookte nutsbedrijven te behouden als een "hedge" tegen schommelingen in de aardgasprijs. Problemen in Oekraïne kunnen er bijvoorbeeld voor zorgen dat de aardgasprijzen in Europa stijgen tot 4$ tot $6 per miljoen BTU. In zo'n geval zou de VS het op schepen kunnen zetten en daarheen kunnen sturen. Leidinggevenden van nutsbedrijven zijn vaak terughoudend om grote beslissingen te nemen over veranderingen in het belang van het behoud van hun banen.

Velen die verwachten dat de aardgasprijzen zo laag blijven als ze nu zijn, geloven dat die prijzen zullen komen door een voortzetting van de huidige winningstechnologieën. Maar de bedrijven die deze methodologieën gebruiken, beweren dat ze niet kunnen blijven profiteren van de lage schaliegasprijzen die ze nu hebben. De CEO van Exxon Mobil zei vorig jaar: “We verliezen ons hemd” door aardgas tegen zulke lage prijzen te verkopen. Voorspellingen voor veel lagere olieprijzen zouden ook verliezen op nieuwe putten voor de meeste olieproducenten vertegenwoordigen.”20

Dus hoewel er enige conversie naar gecombineerde cyclus is, is er geen 100%-verbintenis geweest. De slinger slaat misschien om in het voordeel van aardgas, maar nutsbedrijven willen graag enige flexibiliteit behouden om "terug te schakelen" als dat nodig is. Ondertussen vinden er nog steeds meer fusies plaats en zijn er steeds minder nutsbedrijven, een trend die eruitziet alsof die zich kan voortzetten.

De voordelen van de Aziatische fabrikanten

Aziatische landen hebben het voordeel dat ze financiering kunnen aanbieden met hun producten. Hoewel Azië snel vooruitgaat, heeft de VS nog steeds een technisch voordeel ten opzichte van Aziatische fabrikanten. China heeft doorgaans een clausule in hun contracten met westerse bedrijven die technologieoverdracht eist, dus ze zijn altijd bedreven geweest in het verzamelen van technologische informatie van hun leveranciers die ze toepassen op projecten in China. Hun vermogen om hun valuta te manipuleren is misschien wel hun grootste kracht. Aan de andere kant hebben sommigen in de VS een negatieve indruk van Chinese bedrijven, omdat ze het gevoel hebben dat ze niet goed omgaan met technische of garantiekwesties. Eigenaren kunnen later problemen krijgen met transformatoren en andere soorten grote apparatuur.

China en India hebben wel de mogelijkheid om hun eigen boilers te maken. Aanvankelijk leenden ze hun ontwerpen en gelicentieerde technologie van dominante bedrijven zoals Babcock en Wilcox en Alstom, maar naarmate de tijd verstreek, hebben Chinese en Indiase bedrijven de mogelijkheid ontwikkeld om hun eigen boilers te maken met hun eigen technologie. Veel Aziatische fabrikanten hebben overeenkomsten waarin staat dat ze geen royalty's hoeven te betalen als ze het ontwerp van iemand anders overnemen. Als een bedrijf op zoek is naar een nieuwe boiler en ze vragen om biedingen, kunnen ze deze uiteindelijk kopen van een Koreaans bedrijf dat een ontwerp uit de Verenigde Staten overneemt. Veel westerse bedrijven bieden zelfs geen biedingen aan een potentiële klant als ze weten dat een Chinese of Indiase fabrikant ook een bod uitbrengt, omdat ze niet qua prijs kunnen concurreren.

De meeste gefabriceerde boilers en boileronderdelen komen tegenwoordig uit China of Vietnam, waar het werk vaak wordt uitbesteed omdat er geen veel bedrijven maken deze producten nog steeds in de VS. Europa kan nog steeds een aantal dingen concurrerend produceren, maar China is de go-to voor kosteneffectiviteit. Zelfs Hitachi en Mitsubishi nemen materialen op die uit China worden uitbesteed om concurrerend te zijn. Ondanks de mogelijkheid van repercussies in de toekomst, omvatten interacties van grote kapitaalondernemingen met Chinese bedrijven vaak joint venture-overeenkomsten die bepalen dat een overdracht van technologie moet in de loop van de tijd plaatsvinden. In de niet al te verre toekomst zullen de Chinezen dezelfde technologie kunnen produceren zonder een kapitaalpartner in te schakelen. Natuurlijk is de Chinese markt enorm, dus westerse industrieën willen er graag in doordringen, maar dit gaat niet zonder potentiële kosten voor toekomstige verkopen. Het aanbieden van kapitaalprikkels in verschillende regio's, verpakkingsdiensten, verpakkingsordervolume; als tien eenheden tegen een iets lagere prijs aan Chinese klanten verkocht kunnen worden, is dat erg aantrekkelijk voor hen.

Zoals eerder vermeld, hebben veel Aziatische bedrijven licenties om westerse technologieën te gebruiken. Korea en China gebruiken ketelontwerpen van fabrikanten zoals Foster Wheeler, Babcock en Alstom. Tot voor kort gebruikten deze landen vaak technologieën die een generatie achterlopen en ze konden goed concurreren omdat de software veilig was en al tientallen jaren bestond. De Chinezen hebben hun lokale markten en lage productieprijzen, maar hun technologie komt traditioneel van westerse ontwerpers. India wordt door velen gezien als een land dat bijzonder snel groeit. Hun uitstekende beheersing van technologie kan hen op basis van betrouwbaarheid, efficiëntie en referentieplannen boven anderen verheffen. Voorlopig is het voordeel van westerse bedrijven gebaseerd op hogere technologie en betere productiecontrole, maar dat zal misschien niet lang zo blijven, aangezien Aziatische bedrijven steeds technisch vaardiger en capabeler worden.

In de VS zijn de mensen op de nucleaire markt extreem voorzichtig en risicomijdend. Chinese technologie wordt soms gezien als onvolwassen. Internationale klanten vertrouwen erop dat Amerikaanse en Japanse fabrikanten technische ondersteuning bieden voor de levensduur van de eenheden die ze maken, maar ze denken niet hetzelfde over Chinese fabrikanten. Daarom zijn ze vrij voorzichtig met het doen van grote technologische aankopen zonder het vertrouwen te hebben dat ze ondersteund kunnen worden voor de levensduur van 40 tot 60 jaar van een elektriciteitscentrale. Noord-Amerika en Europa zijn meer volwassen markten. Het meeste wat daar nodig is, zijn vervangende onderdelen en service. Aziatische leveranciers kunnen deze gaten mogelijk opvullen, omdat standaardonderdelen vaak niet zo geavanceerd zijn en geen OEM-tekeningen vereisen. De belangrijkste concurrentie zal zijn voor onderdelen en componenten.

Hinkley Point C en de Chinese controverse

Het Hinkley Point C-project in het Verenigd Koninkrijk heeft voor de nodige controverse gezorgd. Het is ontworpen om twee nieuwe reactoren naar de noordelijke Somerset Coast in Engeland te brengen en is de eerste nucleaire faciliteit van de "nieuwe generatie" in het Verenigd Koninkrijk. Het project belooft werk te bieden aan 900 mensen met 25.000 potentiële banen tijdens de bouw in het komende decennium. Bedrijven bieden op £ 16 miljard dat zal worden geïnvesteerd in de bouw van het project. Naast voorspelbare zorgen over het milieu en de volksgezondheid, zijn er zorgen over de betrokkenheid van China bij Hinkley Point.

Een leidinggevende van EDF heeft bevestigd dat het bedrijf vertrouwen heeft in een investeringsdeal voor het Hinkley Point-project in Engeland eind maart. “In principe is iedereen aan boord,” vertelde Song Xudan, CEO van EDF in China, aan de Financial Times. … De £24,5 miljard kernenergie project vertegenwoordigt de eerste overzeese onderneming voor China General Nuclear Power Corp., dat heeft onderhandeld met Chinese bedrijven om een aandeel te krijgen in de levering van componenten voor het project.”22 De Chinezen willen ook een groot deel van de leveringscontracten en het eigendom van een andere nucleaire site in Bradwell, waar ze van plan zijn om hun eigen kernreactor te bouwen. Deze eisen hebben de lopende onderhandelingen in Hinkley Point belemmerd.

Kostenbesparingen zijn zeker een grote factor voor het VK bij de onderhandelingen met China. Sommigen vinden dat financiële overwegingen vaak een grotere rol spelen dan ze zouden moeten bij dit soort beslissingen en dat politici eerder dan ze zouden moeten inkopen bij Chinese technologie omwille van politiek opportunisme. Er wordt niet gedacht dat China onmiddellijk een diepere betrokkenheid bij projecten in ontwikkelde landen zal nastreven. In plaats daarvan zullen ze zich waarschijnlijk richten op opkomende markten waar kosten een grote invloed hebben op de besluitvorming. De wereldwijde nucleaire gemeenschap is klein, dus iedereen zal kijken hoe de zaken zich ontwikkelen, zoals ze altijd doen met nieuwe energiecentrales.

Kosten, kwaliteit en risicomijding beïnvloeden aankoopbeslissingen

Beslissingen over kerncentrales variëren van land tot land, afhankelijk van economische en kwaliteitsoverwegingen. Opkomende landen zijn eerder geneigd om kosteneffectieve oplossingen te zoeken en minder geneigd om zaken te doen met grotere, meer gevestigde bedrijven die meer rekenen voor hun diensten. Uiteraard beïnvloeden overheidsvoorschriften ook de keuze van welke bedrijven zaken ontvangen.

Risicomijdendheid speelt ook een grote rol in de koopneigingen van landen die geïnteresseerd zijn in het verkrijgen van kerncentrales. De VS wordt beschouwd als bijzonder gevoelig voor risico. Dit kan komen door NEIL (Nuclear Electric Insurance Limited), “een onderlinge verzekering bedrijf dat alle verzekeringen verzorgt kerncentrales in de Verenigde Staten en ook enkele faciliteiten internationaal. Het bedrijf is gevestigd in Wilmington, Delaware, en is geregistreerd in Bermuda. Het werd in 1980 opgericht als reactie op de Ongeluk op Three Mile Island.”23 Progress Energy, verantwoordelijk voor een uitbetaling aan de beschadigde Crystal River-kerncentrale in Florida, wilde aanvankelijk een schikking van $1,9 miljard, wat schokgolven door de aangesloten bedrijven van NEIL stuurde. Het geschil werd uiteindelijk voor veel minder geschikt; $835 miljoen, maar het incident heeft blijvende gevolgen gehad en heeft geleid tot een risicomijdend gedrag in de sector dat nog steeds voortduurt.

Interne/externe onderhoudsbeslissingen

Voor sommige bedrijven komt de winst in de nucleaire industrie voort uit operationele en onderhoudscontracten. Bedrijven zoals URS en andere werken op basis van een lage marge. Ze maken geen astronomische winsten, maar genereren een respectabele omzet zonder marge. Kleinere bedrijven hebben over het algemeen niet de mankracht om het onderhoud van grote inspecties zelf uit te voeren, dus moeten ze het werk extern uitbesteden. Entergy is van alles zelf doen overgegaan op het vormen van enkele allianties met fabrikanten. Ze zijn in staat om een kerncompetentiegroep te onderhouden die het werk kan beheren dat wordt gedaan voor onderhoud tijdens tankcycli.

In de VS bestaan er twee categorieën nutsbedrijven: ofwel handelsbedrijven zoals Exelon onderhoudt, of gereguleerde nutsbedrijven zoals Duke die kosten moeten rechtvaardigen en een redelijk rendement moeten krijgen van de regelgevende instanties op die uitgaven. In Duitsland hoeven ze in principe alleen hun kosten te verantwoorden, dus hebben ze daar een meer beschermde markt. Ze kunnen een deel van het werk zelf doen en het is makkelijker voor hen om hun kosten te bevestigen. Het hangt er dus vanaf hoe de markt is gestructureerd en in wat voor generatieomgeving het nutsbedrijf zich bevindt.

China – Licenties en intellectuele eigendomsrechten

In de meeste gevallen hebben Chinese fabrikanten licenties om Amerikaanse producten te verkopen, maar deze licenties bepalen dat producten alleen verkocht mogen worden in de landen waar ze geproduceerd worden. Sommigen beweren dat Chinese bedrijven hebben geprobeerd om gelicentieerde apparatuur te verkopen aan andere landen en dat China alleen intellectuele eigendomsrechten zal respecteren wanneer ze op het punt zijn gekomen dat ze hun eigen intellectuele eigendom ontwikkelen dat het waard is om te beschermen.

Er is ook scepsis over de kwaliteit van Chinese producten die vandaag de dag nog steeds bestaat. Veel Amerikaanse bedrijven besteden de productie van onderdelen uit aan China en er is voortdurende bezorgdheid over de integriteit van die producten. Sommige bedrijven sturen vertegenwoordigers naar China om Chinese fabrikanten 24 uur per dag te observeren, om er zeker van te zijn dat ze geen shortcuts nemen. Dit kan betekenen dat ze inferieure materialen vervangen, verkeerd lassen of anderszins de aangewezen procedures niet correct volgen. Zelfs vandaag de dag hebben Chinese fabrikanten het moeilijk om hun reputatie van het afsnijden van hoeken ten koste van de veiligheid en/of prestaties van zich af te schudden.

Uiteindelijk zal China de benodigde technologie en knowhow verwerven om op het wereldtoneel te kunnen concurreren met fabrikanten als Westinghouse, GE en Toshiba. Op sommige markten zullen ze zelfs domineren. Terwijl de VS op dit moment misschien risicomijdend is wat betreft Chinese producten, zullen andere landen naar China kijken omdat ze kosteneffectief zijn. Ze zullen ook het feit waarderen dat China technologieën in licentie heeft, of dat ze deel hebben uitgemaakt van technologieoverdrachten met gerespecteerde westerse bedrijven. Sommigen zijn van mening dat zodra een technologie aan de Chinezen is overgedragen, geen enkel bedrijf de Chinese innovatie of de manier waarop ze hun producten produceren, zal kunnen controleren.

Zullen Chinese joint ventures doorgaan?

Er zijn tegenwoordig veel onderzoekscentra in India en China die joint ventures tussen die landen en verschillende westerse bedrijven omvatten. Dit type internationale technologiedeling en -diversificatie zal doorgaan. Wat China betreft, zij lopen technologisch nog steeds achter, maar ze maken terrein goed. Er wordt over het algemeen gedacht dat ze de komende vijf tot tien jaar zullen inhalen en het misschien wel alleen zullen doen. Veel hiervan zal afhangen van de vraag of westerse belangen waarde blijven toevoegen aan joint ventures met de Chinezen. Als dit niet gebeurt en westerse bedrijven alleen maar geld willen, is het onwaarschijnlijk dat de joint ventures verder zullen gaan.

Uiteindelijk wil China de zelfredzaamheid op het gebied van kernreactortechnologie, -productie en -ontwerp maximaliseren, hoewel internationale samenwerking en technologieoverdracht ook worden aangemoedigd. drukwaterreactoren zoals de ACPR1000 en de AP1000 zijn de mainstream technologie in de nabije toekomst. Halverwege de eeuw snelle neutronenreactoren worden gezien als de belangrijkste technologie. Meer langetermijnplannen voor toekomstige capaciteit zijn 200 GW in 2030 en 400 GW in 2050. Snelle neutronenreactoren moeten naar verwachting 1400 GW bijdragen in 2100. China is gepositioneerd om een reactorexporteur te worden, door de ontwikkeling van de Reanimatie-1000.”24

Veel zal afhangen van de financiële prestaties van Aziatische bedrijven wat betreft hun toekomstige succes op de wereldwijde nucleaire markt. Op dit moment is er nog veel onzekerheid. Over het algemeen is er echter een gevoel dat landen van de Pacific Rim en de BRIC-landen (Brazilië, Rusland, India en China) fundamentele componenten zullen zijn van de verwachte industriële groei in de komende jaren.

Waarom India?

Velen zien India als een technisch centrum dat vertrouwen wekt. Als een grote fabrikant op zoek is naar een low-cost centrum en besluit een technisch kantoor in Calcutta te vestigen, en een concurrent besluit een faciliteit in Calcutta te openen, dan hebben ze al een relatief geschoolde beroepsbevolking waar ze talent van kunnen krijgen. Wanneer er echter een derde bedrijf komt en besluit om daar een winkel te openen, ontdekken ze binnen vijf of zes jaar dat wat een low-cost productiecentrum was, nu arbeidskosten heeft die vergelijkbaar zijn met die van de VS en Europa. Dit geldt met name als je de kosten van zakendoen in die regio's meerekent. De voordelen beginnen te eroderen. Soortgelijke situaties hebben zich voorgedaan in Boedapest en Delhi. Het kan de aard van het bedrijf zijn. Sommigen spreken van onshoring banen weer; ze terugbrengen naar de Verenigde Staten, aangezien de voordelen van globalisering en goedkope offshorecentra in de loop van de tijd zijn uitgehold. Als dit feit vandaag de dag nog niet duidelijk is, zal het over 25 jaar veel herkenbaarder zijn.

Sommige investeerders zijn teleurgesteld dat de uitbouw in India niet zo uitgebreid is als gehoopt. China domineert nog steeds in dat deel van de wereld. India heeft het nadeel dat er geen directe aanvoer van aardgas is, waardoor ze afhankelijk zijn van inheemse brandstoffen, kernenergie en, nog belangrijker, steenkool.

Het lokaal houden

In bepaalde landen gelden lokale inhoudelijke vereisten om ervoor te zorgen dat ze niet worden uitgebuit en dat banen en arbeid in hun land van herkomst blijven. Deze situatie wordt vaak aangepakt via joint ventures. In India, lokale bedrijven krijgen vaak de contracten voor nieuwe orders. Daarom moeten externe belangen samenwerken met lokale belangen om succesvol te zijn bij het bieden. Op de Indiase markt zijn er enkele grootschalige boilerbedrijven die licentieovereenkomsten hebben met in de VS gevestigde bedrijven. De interne Indiase boilerbedrijven zijn erg moeilijk te verslaan, dus er zou een kans kunnen zijn voor een bedrijf om een kans te wagen en te bieden tegen (bijvoorbeeld) Bharat Heavy Electricals –BHEL – zoals sommige bedrijven hebben gedaan. Natuurlijk is India erg aantrekkelijk omdat de arbeidskosten daar extreem laag zijn en de kosten om op de markt te komen goedkoop zijn.

Verder kijken naar joint ventures

De fusie van GE en Alstom blijft fascineren in de nucleaire sector. Er was een vermoeden dat GE nooit in de boilerbusiness wilde zitten omdat hun marketingoutreach effectiever was met stoomturbines. Anderen vonden dat GE geïnteresseerd was in een partnerschap met iemand in de boilerbusiness of in het kopen van een heel ander bedrijf. Uiteindelijk zou GE zich verzetten tegen deze impulsen in de boilerbusiness uit angst dat er niet genoeg winst in het idee zat.

Uiteindelijk zijn alle fusies gebaseerd op het bod; wie koopt en wat kopen ze? Wat zijn de evaluatiefactoren? Natuurlijk zijn dit soort beoordelingen met betrekking tot strategie moeilijk te maken op macroniveau. Ironisch genoeg kunnen allianties voor het ene project werken, maar bij het volgende project kan een bondgenoot een directe concurrent worden. Het lijkt erop dat geen enkel bedrijf alles heeft. Ze hebben allemaal hun sterke punten. De meesten zien dit als een belangrijk en gezond aspect van het bedrijf.

Babcock en Wilcox spin-off

“… Energie dienstverlener, The Babcock & Wilcox Company … zette een eerste stap in zijn plan om zijn Power Generation-bedrijf af te splitsen. Babcock & Wilcox Enterprises Incorporated, een nieuw opgerichte dochteronderneming die zal bestaan uit de power generation-activiteiten van het bedrijf, heeft een eerste Form 10 Registration Statement ingediend bij de Amerikaanse Securities and Exchange Commission (SEC). Industrial Info volgt $5,69 miljard aan B&W-projecten bij elektriciteitscentrales die worden gestookt met steenkool, aardgas en afval, en $10 miljoen aan projecten bij een kernbrandstofcentrale die de Amerikaanse marine bevoorraadt.”25 Er wordt gespeculeerd dat deze spin-off een komende consolidatie met iemand anders zou kunnen voorafgaan, en als dat gebeurt, zou het een trend volgen die elders in de industrie al gaande is. De beslissing is waarschijnlijk onderdeel van de bedrijfsontwikkelingsstrategie van B&W, aangezien ze een kerncentrale van 50-100 MW hebben die ze zeer actief proberen te vermarkten.

De ontwikkeling van nucleaire producten is nog een relatief nieuwe onderneming voor B&W. De jury is er nog niet uit of ze succesvol kunnen zijn met hun kleinere kerncentrale. Op dit moment is TVA het enige nutsbedrijf dat er serieus naar lijkt te kijken. Hun opwekking ligt momenteel in de buurt van 30 duizend megawatt en de eenheid die wordt besproken is slechts een 100mw-eenheid. In zekere zin helpt TVA B&W om te zien of de technologie levensvatbaar is. Een kleinere centrale is inherent minder gevaarlijk als het gaat om nucleaire ontwerpen en is veel minder vatbaar voor problemen met straling die in de lucht, de grond of het water lekt. Op dit punt in de geschiedenis van de VS is het een gloednieuwe zakelijke onderneming die de markt betreedt op een moment dat mensen aardgas als de dominante energiebron voor de nabije toekomst beschouwen.

Als de schaliegasprijzen de komende tien jaar rond de $2 per miljoen BTU blijven, zal de meeste nieuwbouw zich concentreren rond aardgascentrales. Als die prijzen stijgen tot $8 per miljoen BTU, zullen nutsbedrijven moeten kiezen tussen steenkool, koolstofreductie en kernenergieopwekking. Op termijn kan kernenergie inderdaad het ultieme antwoord zijn, omdat het levensvatbaarder zou zijn als de gasprijzen uiteindelijk stijgen. Insiders speculeren dat dergelijke beslissingen waarschijnlijk pas over 10-12 jaar worden genomen. Ondertussen is Southern Company bezig met het toevoegen van twee kerncentrales aan zijn vloot. Aanvankelijk hadden ze er vier gepland, maar de kosten bleken hoger dan verwacht. Ze hebben kerncentrales, gecombineerde cyclus- en kolencentrales gebouwd, terwijl ze er ondertussen op letten hun portfolio in evenwicht te houden. Als de energieprijzen zouden fluctueren, is de kernproductie redelijk voorspelbaar, omdat de meeste kosten die ermee gepaard gaan, zitten in de bouw van de centrale zelf. De brandstofkosten zijn erg laag, dus zodra een centrale draait, zijn de operationele productiekosten voor kernenergie vrij laag.

Toshiba en Westinghouse delen nucleaire ambities

In 2006 zag het er beter uit in de kernenergiesector. Toshiba besloot samen te werken met IHI Corporation om Westinghouse te kopen voor een gerapporteerde $5,4 miljard. Hierna moest Toshiba nog eens $1 miljard afstaan om een controlerend belang in Westinghouse veilig te stellen toen Marubeni Corporation koude voeten kreeg en zich wilde terugtrekken, wat de deal bedreigde. Sindsdien heeft het nucleaire incident in Fukushima ervoor gezorgd dat potentiële investeerders zich ten minste tijdelijk afkeerden van kernenergie. Uiteraard had Toshiba zo'n wending niet verwacht en geloofden ze dat kernreactoren op een hoger niveau zouden zijn dan ze nu zijn.

Op 22 januarien, In 2015 startte Toshiba onderhandelingen om apparatuur te leveren voor veel Chinese kernreactoren en extra centrales in Kazachstan.Toshiba heeft al een leidende positie op de Chinese markt voor kernenergie en wil deze positie verder uitbouwen via zijn divisie Westinghouse Electric. Opkomende economieën kijken steeds meer naar kernenergie als een manier om de CO2-uitstoot, die bijdraagt aan de opwarming van de aarde, te beteugelen, hoewel een dalende olieprijs op de lange termijn een aantal van die prikkels zou kunnen veranderen.”26

Ondertussen is Westinghouse gretig om reactoren te leveren voor een potentiële fabriek in Gujarat, India, in het kielzog van de vooruitgang die is geboekt met betrekking tot de Liability Act. Nu er een deal operationeel is tussen de VS en India, onderzoekt Westinghouse de mogelijkheid om componenten te leveren aan Gujarat terwijl Toshiba, hun holdingmaatschappij in Japan, wordt omzeild. Vanwege de India-Japan civiele nucleaire deal kan Toshiba niet betrokken worden bij de transactie.

Westinghouse noemt zijn AP1000 PWR “de veiligste en meest economische kerncentrale die wereldwijd op de commerciële markt verkrijgbaar is.”27 Ze roemen de ongeëvenaarde betrouwbaarheid, het efficiënte ontwerp en de concurrerende kosten. De AP1000 was de eerste generatie drie reactoren voor het DOE en werd beschouwd als het toppunt van technologisch ontwerp toen het voor het eerst werd gelicentieerd. Het wordt nog steeds gezien als een van de meest geavanceerde reactoren ter wereld. De AP1000 heeft ook zijn tegenstanders. In 2010 riepen verschillende milieuorganisaties op tot een onderzoek naar wat zij zagen als zwakke punten in het containmentontwerp van de reactor. John Ma, een senior constructeur bij de NRC, stelde ook dat delen van de stalen huid van de reactoren gevoelig waren voor de impact van een vliegtuig of projectielen die door stormen werden voortgestuwd. Experts van Westinghouse waren het daar niet mee eens.

Steeds meer bedrijven bundelen hun krachten

De trend richting industriële consolidatie zal zich in de wereldwijde energiesector voortzetten. GE is een samenwerking aangegaan met Alstom. Mitsubishi en Hitachi hebben hun krachten gebundeld. Het Duitse Siemens heeft onlangs zijn voorbeeld gevolgd met een aantal eigen schaakzetten. In 2014 namen ze de energietak van Rolls-Royce over en fuseerden vervolgens met Dresser-Rand Group, een internationale leverancier van aftermarketonderdelen, diensten en apparatuuroplossingen. De deal was naar schatting $7,6 miljard waard.Siemens is van plan Dresser-Rand te exploiteren als de olie- en gastak van het bedrijf, met behoud van de merknaam Dresser-Rand en het uitvoerende leiderschapsteam. Bovendien is Siemens van plan een aanzienlijke aanwezigheid in Houston te behouden, wat de hoofdvestiging zal zijn van de olie- en gastak van Siemens.”28

Sommigen geloven dat Siemens hoopt te profiteren van de bloeiende Amerikaanse olie- en schaliegasmarkt en tegelijkertijd zijn energiebedrijfsrivaal GE wat concurrentie wil bieden. GE heeft echter een monolithische aanwezigheid op de Amerikaanse markt, dus Siemens zal in de nabije toekomst een inhaalslag moeten maken. GE heeft sinds 2007 meer dan $14 miljard in gas en olie gestoken. Siemens is wat laat met de dans, maar hun overname van Rolls-Royce' energiebedrijf ter waarde van $1,3 miljard in mei 2014 werd gedaan in de hoop de kloof met GE te dichten. Het is moeilijk voor bedrijven om zelfstandig hun voeten op straat te zetten. Ongeacht het geduld van een bedrijf of het vermogen om een lange termijnvisie te behouden, zijn partnerschappen de regel van de dag geworden. In China is het een no-brainer. In andere Aziatische markten is het buitengewoon moeilijk voor bedrijven om hun bedrijf organisch te laten groeien.

Consolidaties en verwarrend Amerikaans energiebeleid

Sommige consolidaties worden aangegaan met schaliegasproductie in gedachten. Maar het stoomturbinesegment is niet alleen afhankelijk van gas om winstgevend te zijn. Als er een kolenuitbreiding is, of als kernenergie weer in zwang komt, zullen de meeste bedrijven nog steeds producten voor die brandstoffen leveren. In de gasturbinebranche zullen de meeste bedrijven die op zoek zijn naar optimale efficiënties een bottoming cycle hebben met een stoomturbine erop. Op deze manier kan er een gecombineerde cyclus zijn met gasturbines en stoom. De meeste OEM's en hun partners proberen gecombineerde cyclustechnologie te verkopen in plaats van een eenvoudige cyclus.