Hoe je een focusgroep organiseert

Simply stated, a Focus group is usually a group of between 6 and 12 individuals with similar demographics (e.g., car buyers, diabetes patients, new mothers) who are brought together to discuss a “focused” topic.

Have you ever wondered how to extract actionable insights directly from your target audience? At SIS International, we’ve seen firsthand how focus groups can be a game-changer in understanding the true sentiments and motivations behind consumer behavior.

As a CEO, I’ve had the privilege of working with major global brands including Samsung, Johnson & Johnson and Kraft Heinz, and can tell you that conducting a properly structured focus group is frequently what unlocks deep, meaningful insights. We’ve run focus groups for clients in many industries at SIS International—from healthcare to consumer goods—and we know firsthand how they reveal actionable insights that would otherwise remain dormant.

So… What’s a Focus Group?

They are discussions facilitated by a trained moderator who follows a guide to ensure that certain questions are asked about a product or service. The key to this qualitative technique is the open dialog and dynamic interaction among the participants.

In many cases, a physical item, a product prototype, or a concept is presented to the group. Then potential features, benefits or attributes, marketing messages or ads, or a mockup of a proposed website can be discussed. Projectors, flip charts and whiteboards are also available to provide stimuli for group reactions.

A focus group typically lasts 1-2 hours, with the norm being around 90 minutes. However, since the typical number of participants is 8-10, several such groups, often in different locations, are conducted to gather the broadest range of ideas and feedback.

Why Do Businesses Need to Know How to Conduct a Focus Group?

“Through open-ended discussions, you can uncover emotional triggers, motivations, and even challenges that your customers may not be fully aware of themselves.”

At SIS International, we’ve worked with both ends of the spectrum—from multinational giants like General Electric to cutting-edge startups breaking into emerging markets. It is clear that businesses that have the skill of how to conduct a focus group in the first place hold an advantage when it comes to customers’ insight and data-driven decision-making.

We need to adapt, as technology is moving fast, and consumer desires and behaviors are changing rapidly. These trends will continue to evolve, and focus groups will give businesses the agility they need to be cutting edge by offering insight into how new products, or a new marketing angle.

Without this understanding, companies run the risk of taking action based on incomplete or inaccurate information. As my work at SIS International has shown, focus groups do more than provide feedback—they reveal the foundations of consumer behavior, motivations, and preferences. Here are a few of the advantages we commonly emphasize to our clients:

- Rich Qualitative Insights: Focus groups allow for more detailed responses than traditional surveys.

- Uncover Hidden Needs and Concerns: Participants often express thoughts or concerns they might not have previously articulated.

- Real-time Feedback: Focus groups provide immediate, actionable insights.

- Testing Ideas and Concepts: Focus groups are the perfect environment to evaluate ideas and concepts before they hit the market.

- Enhanced Customer Relationships: By engaging directly with consumers in a focus group, businesses can build stronger relationships and trust.

- Geïnformeerde besluitvorming: Focus groups offer businesses a way to make more informed decisions about product development, marketing strategies, and customer engagement efforts.

When to use Focus Groups

Every market research method has its benefits, and a discussion group is no exception. Following are just a few things that make focus groups unique.

- There are times when “yes/no” or multiple-choice answers are not enough to understand consumer behaviors or attitudes. In these cases, a qualitative approach can be used to ask open-ended questions that cannot only help confirm project hypotheses but also result in unexpected and innovative answers.

- Nearly always, there is a viewing room for clients that allows them to witness firsthand and record the event unobtrusively from behind a 2-way mirror. From the back (viewing) room, they can instantly submit ad hoc questions and provide any necessary clarifications to the moderator.

The Evolution of Focus Groups

Over the past few years, variations of the traditional face-to-face focus group have arisen.

- In the online version, the moderator can expose questions and visual stimuli followed by rapid back-and-forth texting of answers and input. There is no live conversation.

- Another approach involves using web cams so that the faces of several (usually no more than 8) people can see each other simultaneously on their computer screens and more closely simulate an in-person interaction.

- These techniques permit the conduct of focus groups without regard to geography or time zones, which is helpful if the pool of recruits in a given area is too small. They also eliminate the costs of facility rental, travel, and refreshments.

Choosing the Right Participants for Your Focus Group

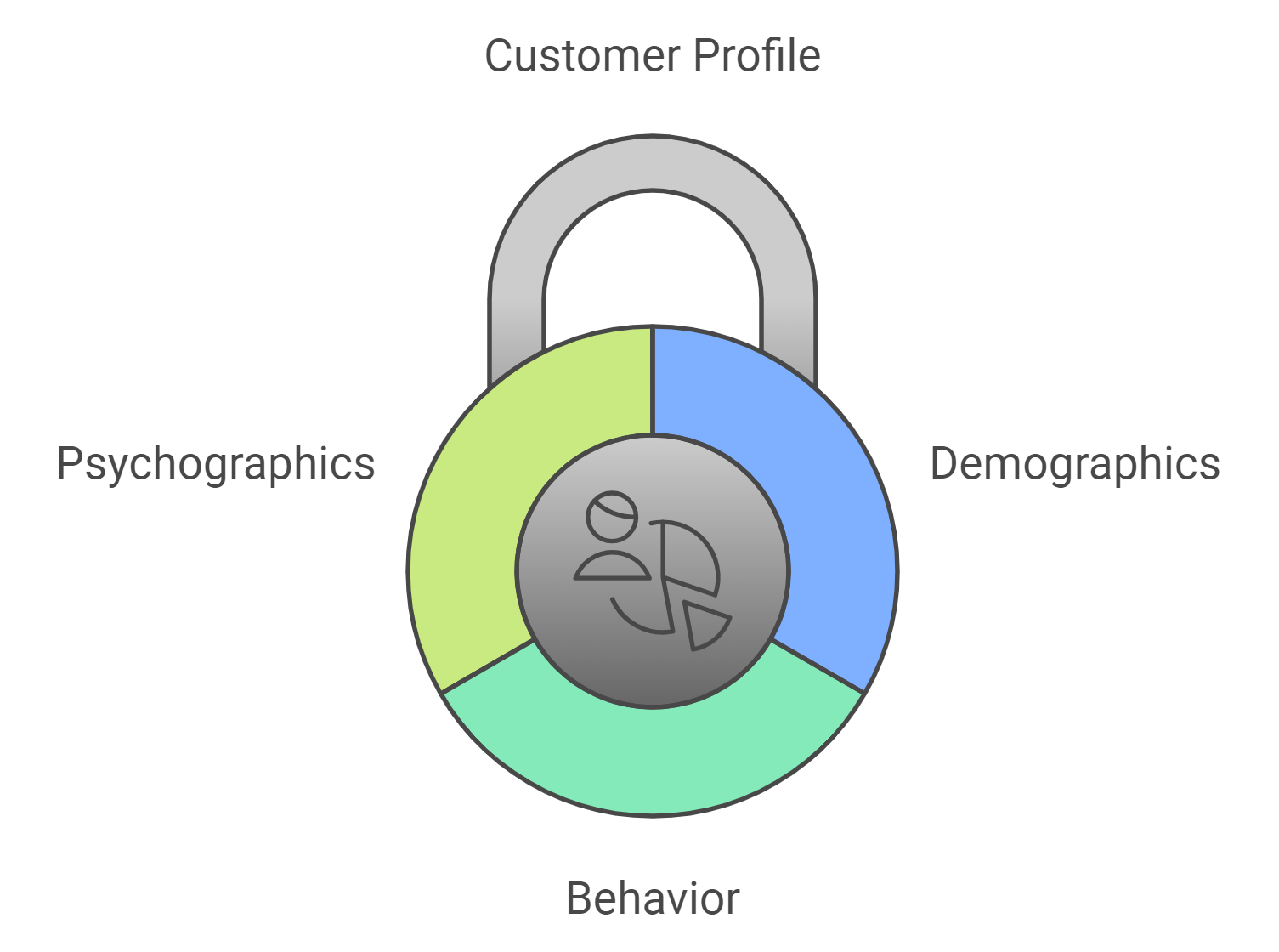

Selecting the right participants is the first crucial step in organizing a successful focus group. It ensures they are representative of your target market. At SIS International, our team works closely with clients to identify participants who match specific demographics, behaviors, and psychographics. For example, if a client is testing a new luxury product, we would focus on individuals who not only fit the right income bracket but also exhibit attitudes and behaviors aligned with luxury consumption.

When choosing participants, consider the following:

- Demografie: Age, gender, income level, education, and location.

- Gedrag: Past purchase behaviors, usage habits, or specific interests that align with your product.

- Psychographics: Personality traits, values, and lifestyle preferences that may influence their responses.

This tailored approach helps ensure that the feedback you collect is relevant and can be directly applied to your business strategy.

Screening Process

Using screening surveys or interviews is vital to assess whether potential participants fulfil the requisite criteria. However, conduct screening questionnaires that would help select only those who are most relevant to the research objective. For example, questions about whether they have prior experience of similar products, preferences, attitudes that fit with the aim of your study.

Designing Effective Focus Group Questions

The success of a focus group largely depends on how questions are structured. The goal is to encourage open-ended discussions that provide deep insights. When designing questions, avoid yes/no questions, and instead, ask questions that prompt participants to elaborate on their thoughts and feelings.

Some best practices for framing effective focus group questions include:

- Use open-ended questions: For example, instead of asking “Do you like this product?”, ask “What do you like most about this product?”

- Ask follow-up questions: Questions like “Can you explain why?” or “How did that make you feel?” encourage participants to delve deeper into their responses.

- Vary the question types: Start with general, broad questions to warm up the group, and then move into more specific, targeted questions.

Avoiding Bias

We have to remain neutral as moderators and convey things in a transparent way to get true reflections from the participants. Formal bias exists as well, such as asking leading questions. For example, rather than asking, “How much do you love this new feature? ask, “What do you think of this new feature?”

Here are a few strategies to avoid bias:

- Use neutral language: Ensure questions are phrased in an impartial manner.

- Don’t influence answers: As a moderator, it’s crucial not to steer the conversation in any particular direction. Your role is to facilitate, not dictate, the discussion.

Moderating a Focus Group

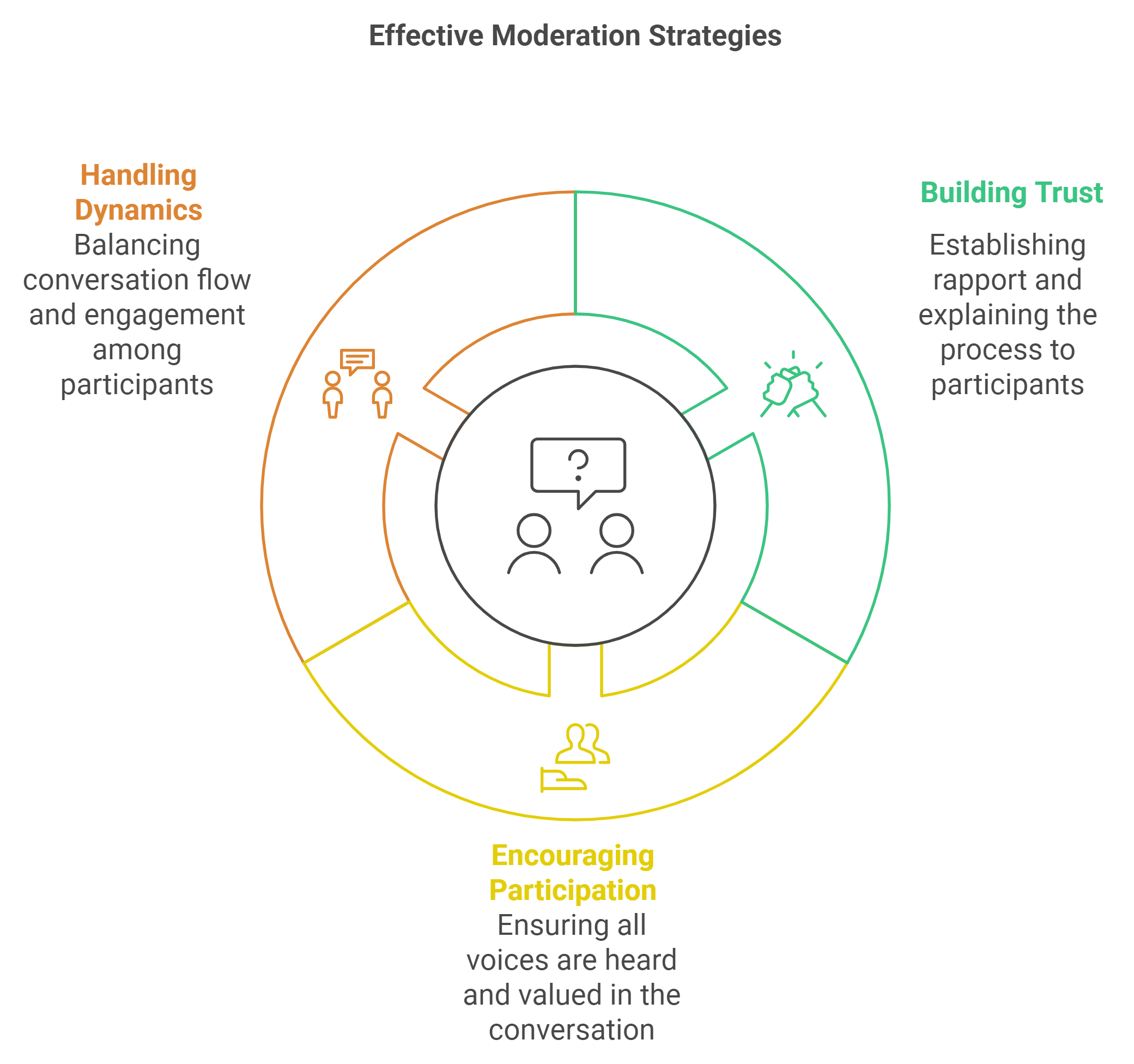

The success of a focus group relies heavily on the moderator’s ability to facilitate the conversation without influencing the participants. At SIS International, we’ve trained our moderators to guide discussions in a way that makes participants feel comfortable, heard, and able to express their thoughts freely.

A moderator’s primary responsibilities include:

- Keeping the discussion on track: While it’s important to allow participants to speak freely, the moderator must ensure the conversation stays relevant to the research objectives.

- Encouraging participation: It’s essential that all members have a chance to contribute. A skilled moderator will draw out quieter participants and make sure their voices are heard.

The moderator should also be neutral and empathetic, creating an atmosphere where participants feel comfortable sharing their true feelings and experiences.

Creating an Inclusive Environment

Participants must feel that their opinions are valued and that they can speak openly without fear of judgment. At SIS, we focus on:

- Building trust: Start by establishing rapport with participants, introducing yourself, and explaining the process.

- Encouraging equal participation: Sometimes, dominant participants can overpower the conversation. A good moderator will tactfully redirect the conversation to ensure everyone is involved.

- Handling group dynamics: It’s important to maintain a balance between allowing the conversation to flow and ensuring that all participants remain engaged.

Analyzing Focus Group Data

After the focus group session, the data gathered needs to be transcribed and coded. Transcription is the process of converting audio or video recordings into text format, and coding involves categorizing the data into meaningful themes.

The coding process involves:

- Identifying key themes: We group similar responses together to identify patterns or recurring ideas.

- Categorizing data: Based on the research objectives, we categorize the responses (e.g., positive vs. negative feedback, emotional vs. rational responses).

Extracting Actionable Insights

Once the data is transcribed and coded, the next step is to analyze it to extract actionable insights. This is where the real value of a focus group emerges. At SIS, our team of experts reviews the data for key patterns and insights that are relevant to our clients’ business needs. We look for:

- Emerging trends: What new preferences, behaviors, or challenges are participants expressing?

- Customer pain points: Are there any common complaints or issues that need to be addressed?

- Opportunity areas: Based on feedback, are there areas where the company can improve or innovate?

Finally, we provide our clients with a detailed report that not only includes raw data but also actionable recommendations that can directly inform marketing strategies, product improvements, or customer engagement efforts.

Costs and other tradeoffs of Focus Groups

Recruiting is one of the most important and difficult steps in conducting a focus group. It is challenging and time-consuming to contact and attract the right people. Careful screening questions can improve the odds that a person who is invited is truly “qualified” and not a “professional.”

Adequate compensation (cash always works best) is a strong inducement to ensure attendance and cooperation but adds to the research’s expense. Hiring and meeting with a trained facilitator/moderator will impact time and budget. However, the experience of such a person trained to listen, digest, and provide an objective analysis of findings is a justified expense. In addition, the moderator will usually handle recruiting and renting a facility and oversee video and audio recordings of the sessions.

One must factor in travel, lodging, meals and related costs for internal staff plus the moderator. As such, focus groups should only be the method of choice when no other means exist to satisfy research objectives.

FAQ: How to Conduct a Focus Group

1. What is a focus group, and why is it important?

A focus group is a qualitative research technique that involves a small group of individuals discussing their views, experiences, and perceptions related to a particular product, service, or concept. It’s valuable because it enables businesses to gain deep insight that quantitative data (such as surveys) can’t offer.

2. How do I select the right participants for a focus group?

To select the right participants, start by defining your target audience based on demographics (age, gender, income), behavior (past purchase habits, usage patterns), and psychographics (values, lifestyle). Screening questionnaires or interviews help ensure that participants match your research objectives. This ensures that the feedback you receive is relevant and valuable to your business goals.

3. How should I prepare questions for a focus group?

The key to a successful focus group is asking open-ended questions that prompt detailed responses. Avoid yes/no questions and aim to gather qualitative data by asking about participants’ feelings, experiences, and opinions. It’s also important to ensure that questions are neutral to avoid bias. For example, instead of asking, “What do you think of this product’s amazing new feature?” try “What are your thoughts on this new feature?”

4. What does the role of the moderator entail?

The moderator is responsible for guiding the conversation while ensuring that all participants have the opportunity to contribute. They should be neutral, ensuring the discussion stays on track without influencing the responses. A skilled moderator creates an inclusive and comfortable environment where participants feel free to share their honest opinions, even if they are hesitant or disagree with others.

5. How do I analyze focus group data?

Transcribing and Coding the Data After the focus group. Transcription is the process of transforming the recorded conversation into written text, while coding involves categorizing responses into themes. Once the data has been classified, the next step is to formulate actionable insights — trends, pain points, and possible improvements. At SIS, we make sure that these insights are directly aligned with your business goals and lead to actionable recommendations.

6. How long does a focus group session typically last?

A focus group session usually lasts between 60 to 90 minutes. This is enough time for participants to discuss the topics in depth without causing fatigue. The length may vary depending on the scope of the research or the number of topics being covered, but it’s important to keep the session engaging and productive.

7. How many participants should be in a focus group?

Focus groups typically consist of 6 to 12 participants. This size is ideal because it’s small enough for everyone to contribute, but large enough to generate diverse perspectives. If the group is too small, you may not capture a broad range of opinions; if it’s too large, it may be difficult to manage and ensure everyone participates.

8. Can focus groups be done online?

Yes! Online focus groups have become common and more importantly in the world that we live in today. Virtual sessions can be done via video conferencing which enables participants from different geographic locations to jump to the discussion. Facilitated properly using well-prepared technology, online focus groups can work effectively as their in-person counterparts.

9. What types of businesses benefit from focus groups?

Focus groups are useful for businesses across a wide range of industries, including consumer goods, technology, healthcare, En entertainment. They are especially beneficial for companies launching new products, entering new markets, or testing marketing strategies. At SIS International, we’ve worked with clients like Nike, Unilever, En Johnson & Johnson, helping them understand consumer perceptions and refine their products or messaging.

10. How do I ensure that the focus group feedback is reliable?

To receive effective feedback, it is crucial to build a comfortable and non-judgmental environment in which participants feel that their feedback is valued. No leading the conversation, and no taking sides. Also, carefully selecting participants that make sense for the research and effective screening can ensure that the feedback is relevant yet reliable.

What Makes SIS International a Top Focus Group Company?

Bij SIS Internationaal, we’ve been leading the way in market research for over 40 years, helping some of the world’s most iconic brands gain deeper insights into their customers. Having conducted countless focus groups over the years we have honed our approach to a methodology that consistently produces actionable insights for our clients.

Central Location and Global Reach:

Our headquarters, strategically located in the heart of New York, allows us to easily serve both North American and international markets. Our central location means that we can efficiently organize focus groups in major cities worldwide, helping global brands stay connected to diverse consumer groups across different regions.

Affordability without Compromising Quality:

We believe that high-quality research should be accessible to businesses of all sizes. Our cost-effective solutions ensure that you get the best value for your investment, making us a trusted partner for many global businesses.

Proven Expertise and Experience:

With over four decades of experience in market research, we’ve refined our focus group methodologies to ensure the most accurate and insightful results. We’ve had the privilege of working with top brands like Pfizer, Kraft Heinz, En Johnson & Johnson, helping them make critical business decisions based on the valuable feedback gathered from our expertly moderated focus groups.

Customized Approach for Every Client:

What sets SIS apart is our ability to adapt our focus group research to meet the specific needs of each client. We don’t believe in one-size-fits-all solutions, our team ensures that the focus group is tailored to the exact objectives of the project.

Global Expertise in Market Insights:

We pride ourselves on our ability to gather not only feedback from your customers but insights that span cultural, regional, and demographic boundaries.

Onze vestigingslocatie in New York City

11 E 22nd Street, 2e verdieping, New York, NY 10010 T: +1(212) 505-6805

Over SIS Internationaal

SIS Internationaal biedt kwantitatief, kwalitatief en strategisch onderzoek. Wij bieden data, tools, strategieën, rapporten en inzichten voor besluitvorming. Wij voeren ook interviews, enquêtes, focusgroepen en andere marktonderzoeksmethoden en -benaderingen uit. Neem contact met ons op voor uw volgende marktonderzoeksproject.