High Net Worth Financial Services

At SIS International Research, we understand that managing wealth is about securing a legacy, seizing opportunities, and navigating complexities with confidence. That’s where High Net Worth Financial Services come into play.

We craft tailored strategies to meet the unique needs of affluent individuals and families. These services are designed to preserve and grow wealth, no matter how challenging the financial landscape becomes.

What Are High Net Worth Financial Services?

This service caters to individuals with significant financial assets. These services go beyond standard offerings, addressing the intricate needs of clients whose wealth requires advanced planning, investment strategies, and risk management.

Wealth is a privilege, but let’s not sugarcoat it—it comes with its own set of headaches. Sure, the opportunities are endless… But so are the challenges. When you’re managing substantial wealth, the stakes are higher, the decisions more complex, and the consequences of a misstep far greater. That’s why high-net-worth individuals need specialized financial services tailored to their unique world.

Here’s what keeps many high-net-worth clients awake at night—and how the right financial strategies can offer peace of mind:

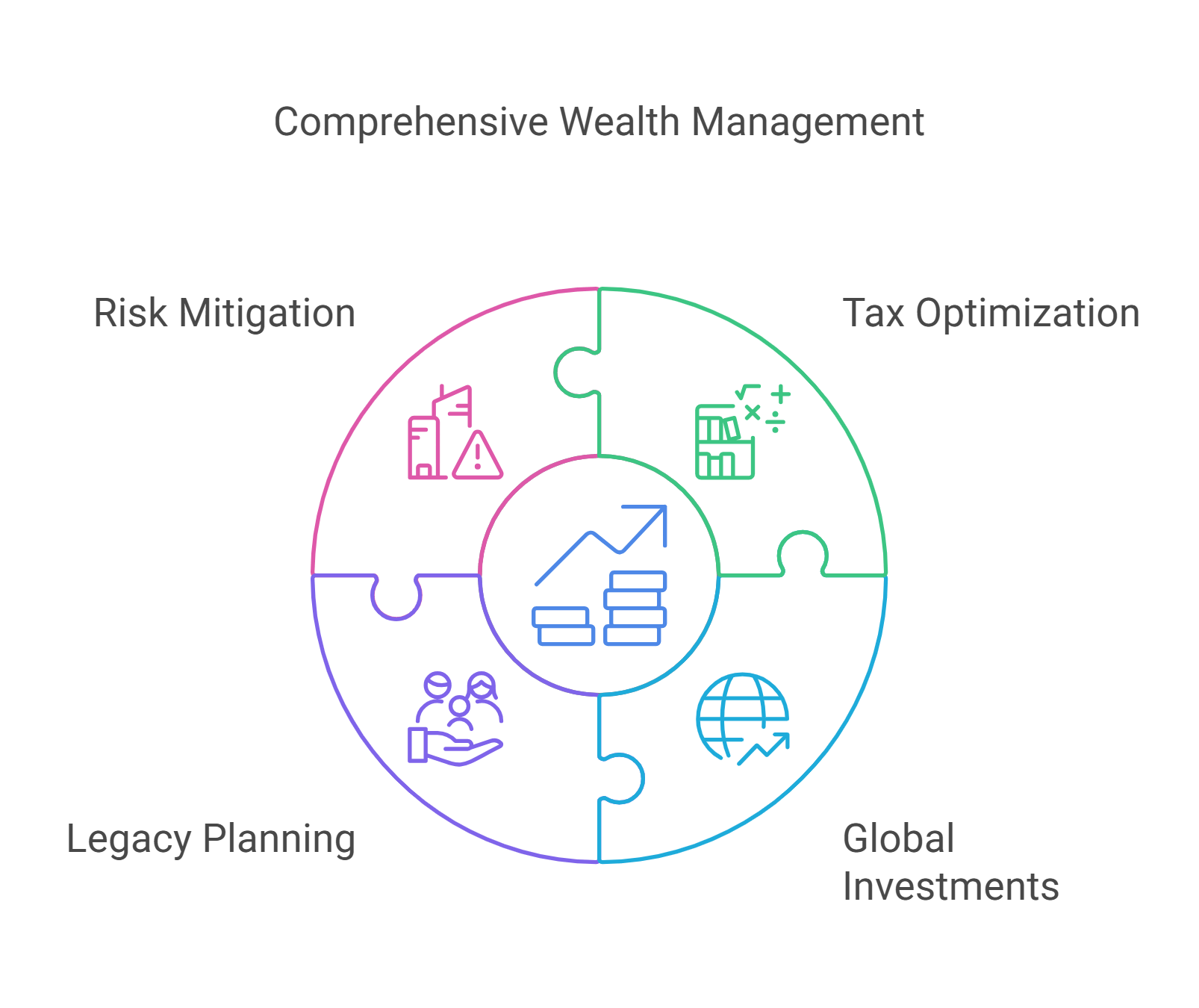

1. Tax Optimization: Keeping More of What You’ve Earned

Taxes can feel like a slow leak in your wealth. Specialized financial services help you navigate complex tax laws และ minimize liabilities while staying compliant across multiple jurisdictions. That means more money stays where it belongs: with you.

2. Global Investments: Playing the World’s Markets

Investing locally is one thing; managing a global portfolio? That’s a whole different ballgame. High-net-worth individuals are increasingly looking at international markets to diversify and grow their wealth. But here’s the catch—navigating currencies, regulations, and economic risks across borders is no small feat. Specialized services provide the expertise you need to make global opportunities work for you without the headaches.

3. Legacy Planning: Securing What Matters Most

Your wealth isn’t just about you—it’s about your family, your causes, and the legacy you want to leave behind. Specialized financial services ensure your vision is carried out seamlessly, preserving your wealth for generations.

4. Risk Mitigation: Protecting Against the Unpredictable

The markets can be volatile, and life can throw curveballs when you least expect them. Protecting your assets is just as important as growing them. Specialized services offer robust risk management strategies to safeguard your wealth against unforeseen events.

Key Components of High Net Worth Financial Services

We’ve identified the critical components that make these services essential for affluent clients:

1. Wealth Management

High-net-worth clients require specialized investment strategies to grow and protect their assets. This includes:

-

- Diversified portfolios tailored to risk tolerance.

- Access to exclusive investment opportunities, such as private equity and hedge funds.

- Regular portfolio reviews to adapt to market changes.

2. Estate and Legacy Planning

Preserving wealth for future generations is a top priority. Services include:

-

- Structuring trusts and wills to ensure a seamless wealth transfer.

- Philanthropic planning for charitable giving.

- Navigating inheritance laws across different countries.

3. Tax Strategy

Taxes can erode wealth if not managed carefully. High-net-worth clients benefit from:

-

- International tax planning for global assets.

- Structuring income to maximize tax efficiency.

- Staying compliant with evolving tax regulations.

4. Risk Management

Wealth protection is as important as wealth creation. Key strategies include:

-

- Insurance solutions for life, health, and property.

- Hedging strategies to mitigate market volatility.

- Contingency plans for unforeseen economic or personal events.

SIS’s Approach to High Net Worth Financial Services

When it comes to managing wealth, not all partners are created equal. At การวิจัยระหว่างประเทศของ SIS, we don’t just offer services—we deliver solutions that transform how you manage and grow your wealth. Here’s why working with SIS isn’t just a smart choice—it’s the right one:

1. We Tailor Everything to You

Let’s get one thing straight: cookie-cutter strategies don’t work for high-net-worth clients. Your wealth is unique, and so are your goals..

2. Global Reach, Local Expertise

Your wealth knows no borders, and neither do we. With a presence in financial hubs around the world, we provide insights that blend global trends with local expertise.

3. Data-Driven Decisions, Not Guesswork

We don’t do guesswork—period. Every recommendation we make is backed by rigorous data analysis and market research. That means you’re not just making decisions—you’re making informed decisions.

4. Access to Exclusive Opportunities

At SIS, we open doors that others can’t. From private equity to alternative investments, we provide access to exclusive opportunities that take your portfolio to the next level. Why settle for what everyone else has?

5. Proactive Risk Management

Our team uses advanced strategies to anticipate and mitigate risks before they become problems. From volatile markets to geopolitical disruptions, we help you stay one step ahead.

6. Transparency You Can Trust

Managing wealth requires trust. That’s why we keep everything transparent, clear, and easy to understand. No hidden fees. No jargon. Just straightforward advice that puts your interests first.

7. A Team That Works กับ You

At SIS, we don’t just serve clients—we partner with them. We listen, collaborate, and adapt to your evolving needs, ensuring our strategies grow with you. When you succeed, we succeed—it’s that simple.

8. Legacy Planning Done Right

We specialize in crafting legacy strategies that preserve your wealth for generations while aligning with your personal values and philanthropic goals.

9. Unmatched Industry Expertise

With four decades of experience across industries like finance, technology, and real estate, SIS brings a depth of knowledge that few can match. We understand the complexities of high-net-worth wealth management—and we know how to navigate them.

10. Long-Term Value, Not Short-Term Fixes

We don’t chase quick wins; we build sustainable success. At SIS, our focus is on creating long-term value that grows with your wealth. From portfolio performance to family office solutions, we’re here for the long haul.

One standout example is a family office we worked with in Europe. They wanted to expand their investments into emerging markets but lacked the local insights to do so confidently. Through our research and strategy development, they achieved a 21% return on their investments within two years while mitigating risks.

Trends Shaping High Net Worth Financial Services

The landscape of High Net Worth Financial Services is constantly evolving. Here are some key trends we’re tracking:

- การลงทุนอย่างยั่งยืน: Affluent clients increasingly prioritize ESG (Environmental, Social, and Governance) investments.

- การเปลี่ยนแปลงทางดิจิทัล: Technology enhances service delivery, from AI-driven financial planning tools to secure digital platforms.

- Global Diversification: With markets becoming interconnected, high-net-worth clients are looking for opportunities beyond their home countries.

- Philanthropic Focus: Many clients align their financial strategies with social impact goals, creating a lasting legacy.

The SIS Approach and High Net Worth Financial Services

Our High Net Worth Financial Services lie in innovation and personalization. As financial markets grow more complex, clients will demand:

- Greater transparency and control over their assets.

- Advanced analytics for real-time decision-making.

- Customized solutions that adapt to their changing needs.

At SIS, we’re committed to staying ahead of these trends, ensuring our clients receive the highest level of service and expertise.

คำถามที่พบบ่อย

Q: What are high net worth financial services?

High net worth financial services are specialized solutions designed for individuals with substantial financial assets. These services include advanced investment strategies, tax optimization, legacy planning, and risk management to address the complex needs of affluent clients.

Q: Why do high net worth individuals need specialized financial services?

High net worth individuals face unique challenges, including complex tax structures, global investments, and legacy planning. Our specialized services provide tailored strategies to manage these complexities effectively while preserving and growing wealth.

Q: How does SIS customize financial strategies for high net worth clients?

At SIS, we assess your unique goals, risk tolerance, and financial situation to craft strategies that align with your vision. Our solutions are designed to address your specific needs and objectives.

Q: What makes SIS different from other wealth management firms?

SIS stands out with its global reach, data-driven insights, and tailored solutions. We combine decades of expertise with a client-centric approach, ensuring transparency, collaboration, and measurable results.

Q: How can SIS help with legacy planning?

Our legacy planning services ensure seamless wealth transfer to future generations while aligning with your philanthropic goals. We specialize in structuring trusts, wills, and charitable strategies to preserve your wealth and values for the long term.

สถานที่ตั้งโรงงานของเราในนิวยอร์ก

11 E 22nd Street, ชั้น 2, นิวยอร์ก, NY 10010 T: +1(212) 505-6805

เกี่ยวกับ เอสไอเอส อินเตอร์เนชั่นแนล

เอสไอเอส อินเตอร์เนชั่นแนล เสนอการวิจัยเชิงปริมาณ เชิงคุณภาพ และเชิงกลยุทธ์ เราให้ข้อมูล เครื่องมือ กลยุทธ์ รายงาน และข้อมูลเชิงลึกเพื่อการตัดสินใจ นอกจากนี้เรายังดำเนินการสัมภาษณ์ การสำรวจ การสนทนากลุ่ม และวิธีการและแนวทางการวิจัยตลาดอื่นๆ ติดต่อเรา สำหรับโครงการวิจัยการตลาดครั้งต่อไปของคุณ