鋰離子電池市場研究

執行摘要

There is an inevitable shift underway as the automotive industry transitions from traditional gasoline powered vehicles to more fuel-efficient, environmentally responsible modes of transport. At present, hybrid vehicles and EV’s are making inroads into the global marketplace, but the going is slow and the obstacles are many. As yet, these vehicles have not returned much profit for their manufacturers, but as battery technology improves, this is sure to change. The question is, how long will it take?

Lithium Ion batteries have seen increased use in recent years. With a battery market expected to exceed $33 billion by 2019 and $26 billion by 2023. The next few years should see a proliferation of pouch-style batteries, with companies such as LG Chem developing packaging materials which can withstand high temperatures, and are predicted to deliver a power density of 400 kWh in the near future. While wholly new fuel sources are in development, Lithium-Ion will continue to be the favored technology in the next five to ten years. Manufacturing costs will also continue to fall as much as 30% in that time period. Present day innovations will most likely be adopted by 2020, but larger breakthroughs aren’t expected until after 2025.

The success of Tesla and the announcement of a new GigaFactory in Nevada have generated a lot of excitement in the industry. Mass production of batteries could allow for further cost reductions and accelerated improvement in hybrid and EV range. Range anxiety continues to be a major problem for manufacturers as potential owners are dissuaded from purchasing by fears of not being able to travel far between vehicle charges and not having very many facilities for charging that are conveniently available.

Tesla’s cylindrical cell batteries, manufactured by Audi and Porsche, will increase in production as cylindrical development appears to be quite promising. In addition, NTA cathode production will also escalate as they were proven to have a higher density, and their capacity continues to rise. Silicon anodes will most likely dominate the market in the future as their popularity increases.

Hydrogen fuel cell technology is advancing rapidly, but is not expected to have a strong market impact until after 2020. In the meantime, lithium Ion batteries will continue to proliferate. As they do, their capacity is expected to improve at a rate of 5% per year while their power and energy density continues to advance. Better and more efficient battery sources are in R&D across the industry, but will not be implemented for at least 5-7 years.

A recent collapse of global oil prices has been particularly detrimental to the advancement of hybrids and EV’s in the marketplace. As drivers worry less about the cost of gas (especially in the U.S.) they are more inclined to purchase tradition gasoline-powered vehicles. Most feel oil prices are bound to rise again which will cause drivers to consider hybrid/EV’s once more. In the meantime, auto manufacturers are watching oil price developments anxiously to see what will transpire and battery developers remain at work, facilitating the advances that will be there when they are needed.

Another serious hurdle standing in the way of hybrid/EV sales is the lack of any significant infrastructure for charging stations. At present, they are few and far between, concentrated mostly on the coasts, and drivers are wary of buying an electric vehicle they cannot conveniently power-up when they want to. Of course, this will gradually change out of necessity. The question is, how fast? The advent of wireless charging will also help to ease charging times and make it easier for drivers to make green decisions regarding vehicle purchases. Ultimately, the demand for hybrid/EV’s will increase, most significantly in Europe and China. As demand increases, so will the demand for lithium ion batteries.

Not long ago, many predicted that plug-ins would comprise 30% of the market by 2020, but low oil prices have scaled back those expectations. Today, much interest is focused on who will take the lead in large-scale battery production and development, and where the manufacturing be geographically centered. China seems like a good candidate to lead the “battery pack,” as many potential U.S. locations are hindered by stricter environmental regulations regarding toxic metals. Korea and Japan also show competitive promise and are sure to emerge as major players. 2025 is looking more realistic as a target date for any significant advance of hybrid/EV’s in the international marketplace.

Closer to 2030 there will be more opportunities for the development of new products, including lithium-air. Battery costs will stay the same but energy density will double and power will not change. Lithium-polymer shows great promise, but not unless the lithium metal anode can be perfected. There are fire dangers associated with the technology that must be resolved.

Exciting breakthroughs are on the horizon, but are still in R&D. Hydrogen fuel cell technology is perhaps closest to being realized with some practical application already in place. Further down the road, sophisticated technologies such as graphene/carbon nanotubes, aluminum-air, Zinc-air and many others, are all potentially viable ideas that are in development.

Upstart company, SAKTI3 in Michigan is developing a battery they claim will double the energy density of lithium-ion at one-fifth the cost. Could this be the technology that gives customers the price-point and driving range they need to switch to a green car? Sakti3 has amassed $30M in research funding from backers such as Japanese industrialists, Itochu, Khosla Ventures, General Motors, and the state of Michigan.

Another promising aspect of lithium-ion battery technology is EOL (end of life) repurposing. Once finished with its initial purpose of powering a hybrid or pure-electric vehicle, lithium-ion batteries can still be used for other purposes such as providing power for hospitals, buildings, and grid applications. In the second life of a battery, it can be used for another ten years and can then be recycled. After that, a portion could be harvested for other uses. To that end, some look to governments to mandate second-life provisions to extend the life of lithium-ion batteries.

The main drivers for the development of the Li-ion battery as we move toward 2020 are government incentives to help the EV/PHV industry grow, and environmental pressures from the Middle East, Europe, US, and Asia. Beyond that, growth will come from Gen-Y purchasers interested in owning green cars. Conventional applications such as lightweighting and increasing the efficiency of gasoline engines, diesel engines, and transmissions, can contribute to meeting fuel economy requirements, but not enough to meet government regulations for 2020.

Whatever obstacles stand in the way of hybrid/EV development, they will most certainly be overcome, as the future will demand more energy efficient and environmentally responsible vehicles. The global pursuit of the best possible battery is ongoing, and dramatic breakthroughs are on the verge of happening. Advancements are occurring rapidly as brilliant battery designers race to meet the demands of a rapidly evolving automotive marketplace.

Introduction

Though the hybrid vehicle and the full-electric vehicle have yet to become truly commonplace on the world’s roads, there is an inevitable shift underway as we transition from traditional gasoline powered vehicles to more fuel-efficient, environmentally responsible modes of transport. As this shift occurs, with it comes the innovation and rapid change driven by the need to find applicable technologies to facilitate such a dramatic transformation.

For years, the lead acid battery was the energy source for our vehicles and devices needing self-contained power supplies. Today, we see the advent of the lithium-ion battery. Powered by a readily available source of raw material, the lightest metal known to man, lithium has revolutionized the battery business and shows no sign of slowing in the years ahead.

It is expected that the lithium-ion battery market will continue to provide dependable growth opportunities until at least 2020. The end users driving such growth are automobile manufacturers, industrial goods manufacturers, consumer device vendors, the grid and renewable energy storage segment. The move to hybrid and electric vehicles has only served to accelerate the advent of lithium-ion battery development. Constantly working to improve upon existing technology, manufacturers strive to build batteries that are more lightweight and efficient, and can take vehicles further between charges. Breakthroughs occur constantly, promising a future filled with batteries that truly deliver in a way that meets the needs of business, the consumer, and the environment.

Beyond transportation, lucrative markets exist for lithium-ion in many other areas. Most notable are the healthcare industry, the world’s manufacturers, and military applications. Beyond that, it’s a battery-powered planet, in need of energy to keep it moving and revolving toward the future.

Navigating this ever-changing market of battery development is tricky, but investors and emerging players know the green light is on, and they are moving forward boldly to claim a piece of the action, seeing a regulated market ready for green energy sources and greater fuel efficiency. For those who best navigate the complexities surrounding this market, profit and success await.

Lithium-Ion battery advancement will continue as bolstered investment in research and development support improved battery performance and lower prices for consumers. From a competitive standpoint the market is segmented with providers such as battery-pack integrators and cell manufacturers. However, consolidation is bound to continue as smaller interests will not likely survive the large capital investment needed to meet R&D expenses and the trend of declining prices. Market demand for lithium- ion batteries is expected to be most significant in North America and the Asia-Pacific region. European countries will also be seeking similar alternative energy sources. Here’s a breakdown of anticipated percentage of global market share for lithium-ion battery use anticipated for the year 2020 by Frost and Sullivan:

IT, healthcare, and telecommunications will be sectors providing increased demand for lithium ion-based products. These, couples with consumer, grid, automotive, and renewable energy interests may well lead to a situation where demand exceeds supply.

Lithium – The Lightest Metal

In Chile’s Atacama Desert there is thought to be 28.4 million tons of recoverable lithium, enough for an estimated 1.58 billion PHEV’s or 400 million electric vehicles. In addition, it is recyclable, and has uses down the road for other applications. Until something better comes along, lithium is the way of today and of the foreseeable future.

Industry forecasts paint a bright picture for the manufacturing and sales of lithium-ion batteries. In fact, these literal boom times exist in all sectors, including EV’s, energy storage, and consumer electronics. At the core of this growth is innovation. Globally, the global automotive lithium-ion battery market alone is estimated to generate $9.6 billion in business by 2015. It is projected to reach $33.1 billion by 2019, with an annual growth rate of 14.4% in the next seven years. By 2023, worldwide revenue from li-ion batteries will reach $26.1 billion. The proven reliability of lithium-ion batteries has allowed this to be so.

As innovation proliferates and the market expands, the cost of li-ion EV batteries continues to decrease rapidly. It is estimated they will shrink to $100/kWhr by the year 2025. Some skepticism exists. Lux Research anticipates $400/kWhr by 2020. Other sources cite a benchmark of $150 as a price-point that will make battery-electric vehicles viable for the public.

The persistent but measured growth of the lithium-ion battery market has made the going tough for some battery manufacturers. Along the way there have been bankruptcies or company shut-downs as bigger, more established firms hang on and wait for the EV drivetrain market to proliferate worldwide. Among the leaders are Johnson Controls, AESC, and LG Chemical. Meanwhile, research points to astounding leaps in battery capacities in the next few years and steadily increasing sales of hybrid and electric-powered vehicles on our roads, in the air, and on the sea – generating sales of over $533 billion by 2025.

新興技術

At present, hybrid cars are gaining a decent footing in the market and pure electrics are expected to follow suit in the next half-decade as technical issues are met and costs become more agreeable to consumers. So far, Toyota and Tesla have positioned themselves well, and some others are not far back in the rear-view mirror. Some will collaborate to improve their chances. At stake are untold billions for the survivors, and possible oblivion for the losers. All the while, technology keeps moving, thinking beyond lithium-ion, as nothing remains static. Here’s at look at some emerging technologies – their potential and their pitfalls.

Lithium-Air Batteries — IBM has been working on lithium-air batteries since 2009. Li-air provides improved energy density by altering battery chemistry, creating a resultant reaction that draws oxygen from the atmosphere and subsequently produces oxygen during recharge. Prognosticators see the technology as revelatory, imagining a day when cars could go thousands of miles without need of a charge. However, implementation is at least 5-15 years off.

Duel Carbon Batteries – Power Japan Plus — There are limitations to lithium-ion. Charge time is too long. They aren’t particularly “energy dense.” They are potentially volatile (heat, fires, and explosions). They also lose power after repeated charging. Dual carbon technology substitutes lithium-oxide terminals with plain carbon. They don’t get as hot and reputedly charge up to 20-times faster. Carbon is easily obtained and there is reduced degradation over time, as well.

Graphene Ultracapacitors – Tesla Shows Interest — In this instance, charged plates which are separated by resistors are utilized in lieu of batteries. Electricity is then retained in an electrostatic field to be discharged later. There are issues with storage and discharge that have yet to be resolved. With graphene, it’s possible to generate cells with massive capacitance and energy density with no degeneration over time. Charging is practically instantaneous. So far, prototypes have shown great promise. Elon Musk was inspired to predict that “the future isn’t batteries, but super capacitors.” Time will tell.

Lithium-Imide Batteries – Leydon Energies — Lithium-Imide has been shown to limit thermal expansion in extremely hot temperatures. Leydon has been making silicon-based anodes that facilitate greater energy density than carbon-based anodes.

SuperPolymer 2.0 Lithium-Ion Batteries – Electrovaya, Inc. — This technology aids battery efficiency and power in many applications and beneficially eliminates N-Methyl Pyrrolidone (NMP), which has been shown to be hazardous to humans. SuperPolymer 2.0 is reputed to have improved fire-resistance and can operate within wide temperature parameters.

Silicon Carbide and Gallium Nitride Batteries — These have advantages that facilitate significant money saving potential. Known as wide bandgap materials (WBG), they are more efficient than silicon when used in power electronics. Devices that employ them can be made smaller and weigh less. It is anticipated that they may replace silicon in EV’s as soon as 2020.

Magnesium-Ion Batteries – Lawrence Berkeley National Labs — Touted as the possible “future of energy storage,” magnesium-ion has a charge of +2 (multivalention) as opposed to lithium-ion’s +1 (single electron). Magnesium is more abundant than lithium and not as likely to overheat. Despite initial reservations about conductivity issues and counter-ions which might hinder the battery’s efficiency, research has shown that conductivity is actually more efficient than lithium-ion due to a one-third smaller coordination sphere. Real world testing is next and if successful, Mg-ion batteries which are powerful, inexpensive, and safe, are sure to follow.

Silicon-Based Lithium-Ion Batteries – Amprius — The idea here is to use silicon instead of carbon as the electrode material in lithium-ion batteries. Stanford University announced a $30 million venture capital round which will aid Amprius in developing the idea at its Chinese facilities. Asian private equity firm, SAIF Partners, investors Kleiner, Perkins, Caulfield, and Beyers, Vantage Point Capital Partners, Chinergy Capital, Innovation Endeavors, And Trident Capital all have a stake in the outcome of current R&D. The aim is harness silicon’s tenfold energy density compared to carbon-centric lithium-ion batteries. Potential exists to boost the energy density presently available by up to 40%. Unfortunately, unlike carbon, silicon expands under lithium-ion insertion, making it fracture and degrade. The barrier is developing a way to manufacture nanotube structures commercially. Amprius is aiming for 2015 to get the batteries on the market, having already built 60,000 units for testing. Nokia and other Chinese and U.S. manufacturers are waiting. In the meantime, Amprius is hoping third-generation batteries will reach up to 500 watt-hours per kilo.

Sodium-Air Batteries — Sodium-Air capacity is admittedly lower than lithium-air, but it’s definitely higher than lithium-ion and much simpler to manufacture than lithium air. A sodium electrode sits on one end of the battery, where an electrolyte is placed underneath a carbon electrode that is oxygen-permeable. An electron circumvents the battery and the ionic metal dissolves in the electrolyte which travels to the carbon electrode and encounters oxygen. It’s still in the experimental stages, but researchers are encouraged. They’ve deduced that sodium-air holds a superior charge and charges easier than lithium-air, as well. The downside? Sodium-air can only be charged a few times before it dies. Scientists are trying to figure out why.

Aluminum-Air Batteries – Phinergy — Al-air generates electricity when oxygen in the air reacts with aluminum, creating a battery with tremendous energy density. They aren’t employed widely due to high anode cost and by-product issues when used with traditional electrolytes. For this reason, they are employed mainly for military applications. Potentially, an EV with aluminum-air batteries could deliver eight times the range of lithium-ion batteries while weighing far less. Also, al-air batteries are essentially non-rechargeable once immersed in water-based electrolytes. It is possible to recharge them with fresh aluminum anodes obtained by recycling the hydrated aluminum oxide. This would need to be the case if al-air batteries are to find wider use. Hybridization with traditional lead-acid batteries may be the answer. Recently, Phinergy demonstrated an electric car using aluminum-air cells which was able to log 330 km using a unique cathode and potassium hydroxide. Partnering with Alcoa, Phinergy recently tested a small EV which utilized lithium-ion and al-air batteries that displayed an astounding range of 1000 miles. Though not rechargeable, modular aluminum cartridges could be exchanged for new ones. Used as back-up power in tandem with a lithium-air battery, it could offer drivers a carbon-free alternative. In reality, al-air batteries provide performance comparable to gasoline extended vehicles, but they are cleaner. It’s a viable option and one that is surely on the table.

Zinc-Air Batteries — Also non-rechargeable, zinc-air batteries create power by oxidizing zinc with oxygen in the air. They offer high energy density and are cheap to produce. They are practical for small applications such as hearing aids and cameras. The batteries get much larger for use in EV’s. In discharge, zinc particles form a porous anode saturated with electrolyte. At the cathode, oxygen reacts and forms hydroxyl ions which migrate into the zinc paste and create zincate. This, in turn, allows electrons to travel to the cathode. Zincate decays to form zinc oxide and water returns to the electrolyte. Water and hydroxyl from the anode are recycled at the cathode, so the water is not ultimately consumed. The reactions produce 1.65 volts in theory, which is reduced to 1.35-1.4 volts in available cells. Zinc-air shares characteristics of batteries and fuel cells. Zinc serves as the fuel and the reaction is managed by a variance of air-flow. The oxidized zinc/electrolyte paste can be replaced with fresh product. If fully realized, Zinc-air batteries could be a viable energy source for EV’s and could be employed for utility-grade energy storage.

Gel Batteries — Gel cells are VRLA batteries in which electrolytes are gelified. Fumed silica is combined with sulphuric acid to form a gelatinous and immobile mass. They don’t have the inherent problems of wet-cell batteries (evaporation, corrosion, spills) and they are more resistant to temperature extremes, rod vibration and shocks. Unlike wet-cell batteries, the antimony in the lead plates is substituted with calcium and a recombination of gases can occur.

What’s Going On At …?

Panasonic

Demand for hybrid and plug-in batteries has been a boon for Panasonic, particularly regarding their partnership with Tesla. Panasonic recently touted a 39% market share followed by NEC at 27% and LG Chem with 9%. Panasonic broadened its battery making deal with Tesla in October of 2014.

Tesla’s big move, their planned $5B dollar Giga Factory to be constructed in Nevada, will focus on 35 GWh lithium-ion cell production. Panasonic is partnering with Tesla in this endeavor which some see as a high-risk enterprise. It remains to be seen if the investment makes sense and can truly lead to a breakthrough in making cheaper li-ion batteries. Some speculate that even if Tesla sells 240,000 EV’s in 2020, as they hope to do, Panasonic may experience low margins. Under present conditions, it’s easy to speculate that Tesla might be running at overcapacity which could be difficult to offset.

Meanwhile, Panasonic has recently entered into collaboration with a subsidiary of Polypore International, Celgard. They will team forces to develop uncoated and coated Celgard separators for the next generation of Panasonic battery cells. After the developmental stages, both firms hope to forge a long-term supply agreement. Battery separators enable the transference of lithium-ions while the separator creates a barrier between cathode and anode. Celgard currently uses polypropylene, polyethylene, or trilayer PP/PE/PP electrolytic membranes in their separators.

三星

Samsung started making lithium-ion batteries in 2000. Since then, they have established a leadership role through innovation and by developing quality products. They are recognized as the global leader in the lithium-ion battery market since 2010. Samsung makes prismatic battery cells that offer superior energy density and power while staying within standard battery dimensional parameters. The company will remain with prismatic, believing they are less problematic than laminates.

Experts expect costs to go down to $150US per kilowatt hour until 2020, with prices coming down more on the material side as opposed to the sell/design side. Once designs have advanced in manufacturing, costs will ultimately be reduced. To that end, Samsung is aggressive with cost-cutting measures.

The company is able to mass-produce several advanced auto battery cells, including the 5Ah-Class for hybrid electrics, the 20Ah for plug-ins, the 60Ah for pure electric vehicles, and the 4.0Ah/11Ah “Hi Cap” for micro/mild HEV’s. The Samsung 5.2Ah is the world’s smallest and most powerful cell while the 5.9Ah offers the highest power density of any in the industry and is presently in series production for mild(?) hybrid SUV’s and hybrid supercars.

Looking to the future, Samsung has targeted goals through the end of the decade for technological battery advancements. By 2016, a new (NCM) Nickel Cobalt Manganese battery will deliver an energy density of 130 wh/kg. By 2019, Samsung has plans for an advanced NCM providing 250 wh/kg. With many in the industry forging towards implementation of the lithium-air fuel cell, Samsung wants to get there by 2020. The battery they have in mind would have an energy density of +300 wh/kg.

In addition, Samsung’s EV 60Ah-class battery has the industry’s highest volumetric energy density and is presently in series production for European and US OEM’s. The 26Ah and 28Ah have the industry’s highest volumetric power and energy density. A stackable and compact design allows for cell modularity and ease in packaging. These are in production for European OEM’s.

Expect Samsung to continue making nickel batteries with no dramatic changes in chemical combinations in the next 2-3 years. Technological developments could see a doubling of amp/hour using existing materials. No significant changes to anodes are on the horizon as the company continues to experiment with additives and separators. Security permissions will negate any significant changes before 2020. Samsung anticipates more opportunity for product development, including lithium-air, closer to 2030. Samsung has the ability to reduce costs and increase battery energy density by using chemicals from their 1850 in a square battery, but Chinese government regulations do not allow it.

By 2020, Samsung expects an increase in demand for both high-voltage 48 and low-voltage lithium batteries to achieve CO2 levels in accordance with Horizon 2020 goals. At present, they are second to Nissan Leaf. A partnership with BMW may increase market share numbers and place them in the Top 3.

Meanwhile, Ford has been working in tandem with Samsung SDI to create hybrid technology centered on regenerative braking that can retain up to 95% of energies commonly lost during vehicle braking. Seen as a short-term solution for reducing carbon dioxide emissions, the system works together with Ford’s Auto Start-Stop which turns off the engine when the vehicle is halted to preserve fuel. A special battery powers internal systems and accessories until the brake is released, at which point the engine restarts. In the long-term, Ford and Samsung SDI are developing an ultra-lightweight lithium-ion battery which is up to 30% smaller than existing hybrid batteries. It’s composed of nickel-metal-hydride and can potentially supply up to three times the power. Employing weight-reduction strategies in a concept vehicle, the end result could provide increased performance and efficiency. Ford has invested $135M for production, design, and engineering of the necessary battery components and subsequent testing procedures. In addition, Ford is supporting ongoing energy storage research at the Lawrence Berkeley National Laboratory. Ford is interested in End of Vehicle Life Solutions (ELVS) that involves management of toxic substances and recyclability of defunct batteries. Customers can now bring their old batteries to participating dealers for no-cost recycling.

Samsung “Bendable” Batteries – Samsung SDI unveiled a new rollable, bendable, battery at the 2014 InterBattery convention in South Korea. Capable of bending into a U-shape or being wrapped around a cup, it’s more likely this battery will find a home on people’s wrists in wearable form, like the curved 210mAh cell found inside their Gear Fit fitness band. At this time, the batteries are still in development to improve reliability and safety and it may be some time before they are available to the public. LG Chem is also interested in wearables and they have similar batteries in development, though their recent emphasis has been on battery-making for electric vehicles.

Sakti3

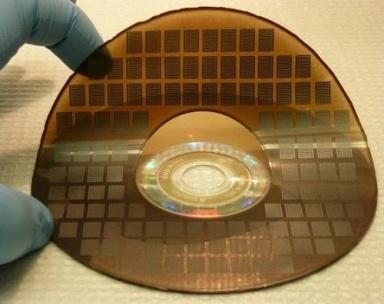

This emerging Michigan start-up aims to manufacture lithium batteries as efficiently and affordably as computer chips. The brainchild of CEO and founder Ann Marie Sastry, Sakti3 announced in 2014 that was on the verge of major breakthroughs in battery technology. They are developing a battery they claim will double the energy density of lithium-ion at one-fifth the cost. Could this be the technology that gives customers the price-point and driving range they need to switch to a green car? Maybe. Sakti3 has amassed $30M in research funding from backers such as Japanese industrialists, Itochu, Khosla Ventures, General Motors, and the state of Michigan.

Sakti3 claims to have developed a solid-state lithium-ion battery that employs production methodologies similar to solar cells and flat-panel TV displays. This vacuum-deposition technology has the potential to give Sakti3 an inexpensive and fast manufacturing process. At this point, the company is producing cells at a modest pilot production line in Michigan with hopes of commercializing in the next couple of years.

There are hurdles. To operate on a large-scale, the cost of manufacturing is exponentially bigger and more expensive. Making working-sized batteries and lots of them presents significant challenges as well. There are doubts as to whether solid-state batteries could provide the fast acceleration today’s vehicles need, a problem past proponents of solid-state could not resolve. There are questions as to whether such batteries could withstand temperature extremes. Would they be tough enough to withstand the rigors of the road? There are others in the game, including Toyota and upstarts like Solid Power Battery in Colorado and Seeo in California. Others such as Planar energy have already thrown in the towel.

Sakti3 is aiming first to create solid-state batteries for smart phones that can double their life. After that, they will move on to automobile battery packs. Long-distance, Sakti3 envisions solid-state batteries for utility-scale storage of wind and solar power. Frost and Sullivan see the lithium battery market attaining $76.4B by 2020, with up to 25% in growth. Ann Marie Sastry knows she needs a partner with large-scale battery experience. Help could come from large-scale Asian manufacturers with commoditized cell formats covering many sectors, time-proven test results, plus marketing and technical sales teams with experience dealing with challenging sectors.

LG Chemical

Korean company LG Chem recently announced that it could supply an EV battery with a 200 mile range by 2016. Who it would supply this battery to remains a mystery, but the best candidate appears to be General Motors. GM employs LG Chem cells for the Cadillac EDR, the Chevy Volt, and for the exported Volt/Ampera. However, LG Chem also supplies batteries to competing automakers such as Hyundai, Kia, Volvo, Renault, and Ford. GM has been watching Tesla closely to see how their proposed 200-mile car develops (it is expected in 2016-2017).

The proposed 200 mile battery in development will reportedly have enhanced energy density with pouch-type packaging material to withstand high temperatures. Power density should improve to about 400 kWh. At the same time, manufacturing costs are expected to drop as much as 30%. $14B LG Chem is, of course, a leading world supplier of lithium-ion batteries. It is a primary growth area for the company. In the past seven years, investment in lithium-ion batteries has grown five times larger. They have four R&D facilities in the US, china, Japan, and South Korea, and three manufacturing plants in South Korea and China, all focused on production and engineering of lithium-ion batteries.

LG Chem battery cells have a laminated, rectangular-shaped core. Efforts are made to maximize the core space of cells and to minimize lamination. By 2020, they hope to significantly improve their present 1:3 ratio to increase the core of the cell and further minimize lamination. LG’s chemical form factor is pouch-shaped. There are advantages and disadvantages to different form factors of cells and some OEM’s are more loyal to one form versus the other. For hybrid electrics, Ford uses chemistry from Panasonic and it is cylindrical. But, concerning battery electric, they use a completely different chemistry and form factor than LG Chem. As far as electrolytes, some think the company will adopt a solid type, though it is possible that gel-type electrolytes might be utilized.

The company is confident in their reading of the market and that there is growth potential in 12-48 volt batteries. LG Chem is developing technology to be competitive in that area. They also have good synergy with companies such as Samsung and Panasonic, enabling them to work with governments to drive battery technology with regards to chemistry and packaging which can push costs down. Some think the cheapest 12-volt battery in 2022 will cost 170-180 Euros.

A new electric car battery plant is coming to Nanjing, China to meet an increasing demand in the world’s largest automotive marketplace. Slated for completion by the end of 2015, the Nanjing plant will service Chinese car makers SAIC, Qoros, and others. Recently, LG Chem has joined up with Chinese state-run companies, Nanjing Zijin Technology Incubation Special Park Construction Development Co, Ltd. and Nanjing New Industrial Investment Group Ltd. Together they will make EV batteries. LG has invested heavily in the venture and projects $1T in earned revenue by 2020.

LG Chemical, like 3M and Panasonic, is interested in introducing batteries with silicon-based anodes into the market, and they could prove to be a fierce competitor. NCA (Nickel Cobalt Aluminum) will likely be one of the materials adopted for cathode. Many companies want to license the technologies emerging from university and government subsidized laboratories. Firms such as Amprius have developed similar technologies and are anxious to explore many avenues of incorporating silicon into batteries. Patent conflicts will certainly arise as companies large and small position themselves for dominance in this high-stakes battery battleground.

江森自控

The largest manufacturer of batteries in the world, with 15,000 employees in 50 facilities across the globe, Johnson Controls supplies one- third (140M+) of the industry’s batteries to automakers and retailers annually. This includes hybrid and electric vehicle batteries. Johnson Controls has been developing its NMC battery chemistry with the intent of winning some of the world’s biggest automotive contracts, though they have shown reluctance to build factories specifically to serve the EV battery market. AESC, a collaborative effort with Nissan Motor Company and NEC, is the only manufacturer of Li-ion cells that is directly owned by an automotive manufacturer. The company has made a tremendous amount of batteries, especially for the Nissan Leaf.

In 2012, Johnson Controls acquired A123 Systems, for $125M. These assets included products and existing contracts, lithium-ion battery technology, factories in Michigan, cathode ray plants in China, and equity in a Chinese battery company. The company was ultimately forced to seek bankruptcy protection.

Since then, Johnson Controls has continued to thrive. Projections for 2015 sees the company anticipating high profit margins with great opportunities for continued growth in China, where they made in excess of $8B in 2014. Johnson Controls recently opened a new $154M, 133,000 square-foot battery plant in Chongqing City where they anticipate manufacturing up to 6 million batteries annually.

Car Companies

Recently, 大眾汽車 has teamed with Sanyo to develop a battery which could potentially deliver four times the power that was previously available. Developed using Volkswagen technology, it could potentially provide 80 kWh. Insiders believe it to be a lithium-air unit in the early stages of development.

It’s estimated that Tesla will consume two billion li-ion cells by 2017. Both the Model S and The Model X employ the 18650 cell. With the biggest battery in an electric car (85 kWh) the Model S provides the longest driving range. The powertrain utilizes Johnson Control’s NMC li-ion system which is also found in e-bikes, military and medical devices, and power tools. By 2020, Tesla may shift to using silicon carbide power electronics to initiate cost savings. A wide bandgap material, silicon carbide is more efficient and could result in power savings of up to 20% for the Model S. This translates into a potential $6,000 savings in battery cost reductions.

通用汽車 is working with the Electric Power Research Institute and 15 other utilities to create a “smart” plug-in vehicle charging system. BMW, Honda, Mitsubishi, Ford, Toyota, Mercedes-Benz, and Chrysler are also part of this consortium. The overall concept is to instigate a “demand charging” system that allows utilities and plug-ins to communicate so that during peak hours vehicle charging is scaled back, thereby cutting down on energy expense. There is a need for the system as the amount of plug-in vehicles on the road is escalating steadily. The automakers hope to create an open platform that is compatible with any of their plug-in vehicles.

寶馬 is offering a plethora of charging options for its existing models, including SAE Combo Fast Chargers and solar chargeports. At a recent plug-in conference in San Jose, California, BMW touted a new iDC fast charging unit and what they call the ChargeNow DC Fast Program. BMW’s iDC Fast Charger is smaller and less expensive than others in their class. A combo connector makes it compatible with VW, Chevy, Ford and other EV’s. The iDC Fast Charger bring a vehicle to 80% full in about 30 minutes. The chargers are accessed by ChargePoint or ChargeNow cards. BMW will offer drivers cost-free charging until the end of 2015 at participating NRG eVgo Freedom Stations, provided they use the card initially by the end of 2014. 50 of the chargers will be available in California by 2016.

豐田 is presently researching solid-state battery possibilities as well as lithium-air technologies with long-range plans to switch from lithium-ion by 2020. Additionally, the automaker will soon introduce the Mirai in Japan, an electric vehicle powered by a hydrogen fuel cell.

日產 has been working with major Japanese universities developing an analysis method that allows for direct observation of electron activity in the cathode material of lithium-ion batteries while they are charging and discharging. Potentially, this could lead to the creation of high-capacity, durable batteries that can help extend the range of zero emission EV’s. The new analysis method combines x-ray absorption spectrospcopy that utilizes L-absorption edges and the first principal calculation from Japan’s Earth Simulator Supercomputer. Lithium-rich materials are being analyzed that hold the promise of increasing energy density by as much as 50%. It was noted that during a high potential state, electrons from Oxygen were active during charging. Concurrently, manganese electrons were active during the discharge reaction. Nissan considers this to be a big step towards eventual development of electrode materials rich in lithium that can yield high-capacity batteries that have a longer life.

Lithium Ion Batteries: Safety, Political And Patent Issues

Safety Issues

Despite the success of lithium-ion batteries in the world marketplace, safety concerns and issues have arisen concerning the batteries themselves. For example, in 2006 Sony was forced to recall 6M batteries which had a failure rate of 1:200,000. Sony stated that microscopic metal particles could potentially make contact with battery cells causing possible short circuits and venting with fire. That rate has since been reduced to 1:10,000,000. Warehouse fires were reportedly not considered uncommon. There were also concerns about quick disassembly and possible internal shorting.

The Chevy Volt has had fire issues associated with lithium-ion batteries. A pack which had been crash-tested by the NHTSA subsequently caught fire in a storage area weeks after initial testing. Additional tests recreated the scenario and more fires occurred. GM and NHTSA officials were questioned by members of the US Congress as to why the NHSTA didn’t report the incidents until 5-months after they occurred.

Political Issues

Government intervention and regulation often affect the forward progress of the hybrid/electric battery industry. Green technology itself is often a wedge issue between those beholding to the existing petroleum-based energy economy and those looking to promote more progressive environmental agendas.

China has a national policy designed to promote electric vehicles, though it has not been as successful as hoped. Some think that if governments choose to add pressure to have more electric vehicles on the road they could make it happen through taxes and attractive incentives. The right economic balance and incentive packages are needed to promote the higher sales they desire.

The US Department of Energy (DOE) wants to cut petroleum imports in half by 2020. They also want auto emissions to be 17% lower than they were in 2005. To this end, they are looking to hydrogen fuel cells, battery upgrades, vehicle electrification innovation, and biofuels to aid their cause. It’s all laid-out in their Strategic Plan 2014-2018 document, recently released by the DOE. Because of this, many companies can expect some government funding to help with these goals being reached. As part of the DOE’s five-year plan, it is hoped that renewables such as wind, solar, and geothermal can double their output in the established timeframe, leading to some inevitable public-private partnerships.

The taxman cometh … Mark Gottleib, Secretary of Transportation for the state of Wisconsin, has urged that there be a $50 registration fee for owners of hybrid and electric vehicles. This is part of his November 14th, 2014 budget request. Secretary Gottleib feels these owners should “pay their fair share of the operating costs of our infrastructure.” If green-lighted, Wisconsin would join five other US states (North Carolina, Nebraska, Colorado, Virginia, Washington) that have levied fees on green car owners to retrieve revenues for gas taxes these drivers would otherwise not be paying. Some, however, feel the proposed tax merely penalizes drivers for not using as much petroleum.

There was a spirited competition to lure Elon Musk’s $5B Giga Battery Factory to Arizona, Texas, Nevada, or New Mexico. At stake were estimated billions of dollars in direct investment and as many as 6,500 new jobs. As bait, courting politicians used promises and taxpayer’s money. To complicate matters, many US states have instigated legislative efforts to stop Tesla from selling directly to their customers. Minnesota and Massachusetts have been Tesla-friendly, but New York, Ohio, and New Jersey have shown visible resistance.

Texas Governor Rick Perry, the recipient of over $300K in political contributions from car dealerships, went so far as to drive a Tesla Model S through Sacramento last June as a political stunt aimed at impressing Tesla. It didn’t work. Ultimately, the state of Nevada won the prize in September, 2014 and will be home to Tesla’s new Giga Factory. The state was reportedly chosen due to its proximity with both Tesla’s nearby California factory and Nevada lithium mines. A $1.25B incentive package certainly didn’t hurt Nevada’s persuasive efforts.

In California, state agencies there are formulating initiatives to get 1.5M zero-emission vehicles on the state’s highways by 2025. Recently, the California Energy Commission voted to use almost $50M for 28 hydrogen refueling stations and a mobile refueler by 2015’s end.

Charging Stations – Establishing Infrastructure

“Range anxiety” causes would-be green vehicle purchasers to balk because of the short distances they can travel before needing a charge. Beyond that, there is the question of where to charge one’s hybrid/electric. As the industry evolves and grows, a supportive infrastructure of charging stations will be needed in order to meet the demands of more and more electric powered vehicles on the road.

As of now, most charging stations are located near large cities. There are estimated to be a few thousand such stations worldwide. Most agree that some private sector money influx will be needed to develop infrastructure and encourage more purchasing of EV’s. This need is compounded because at present EV’s have a rather limited range. Green vehicle drivers will surely clamor for faster charging times, as well.

It’s expected that the charging market will double each year through 2020. Newly-developed wireless charging will make things simpler, allowing drivers to park over ground sensors and charge their vehicles easily and quickly, no wires attached. Ten auto manufacturers are known to be testing wireless systems and many will build-in wireless charging systems in their vehicles. Volkswagen may have an inductive system in place by 2017. By the end of the decade, sales of wireless charging units may exceed 350K.

Evatran, a company that has worked with Duke Energy, Hertz, and Google, is the first firm to gain ETL certification for their Plugless L2 cordless system. Compatible with the Chevy Volt extended range plug-in and the Nissan Leaf battery/electric, Evatran’s system utilizes magnetic fields and inductive power to charge to an onboard adaptor from a floor pad. No safety incidents have thus far been reported.

Patent Issues

Since the advent of nickel hydride battery chemistry in the early ‘90’s; chemistry that is integral to the development of today’s hybrid vehicles, there has been conjecture raised that the US Auto Battery Consortium was used by the auto industry to thwart electric car technology and development. One way this could be achieved is by not allowing knowledge of applicable patents to be made available to the public. The patents in question would be those of Ovonics founder, Stan Ovshinsky. He claimed that the auto industry wrongly suggested NiMH technology was not yet ready. By ’94, GM took controlling interest of Ovonics and patents concerning the making of large nickel metal hydride batteries. Still later, in 2001, Texaco purchased GM’s share of Ovonics and then Chevron acquired Texaco. The plot thickened.

By 2003, Texaco Ovonics became Cobasys together with Energy Conversion Devices Ovonics. Chevron held a 19.99% interest in ECD Ovonics and had the power of veto over any licensing or sale of NiMH technology. Chevron also felt they had the right to Cobasys’ intellectual property rights if ECD Ovonics defaulted on contractual obligations. Was Chevron denying access to large NiMH batteries by controlling patent licenses in order to limit competition? Ovshinsky felt that ECD Ovonics was in err by going into business with an oil company who intended to put them out of business.

Elsewhere, Envia systems was sued by past-executives who felt the company had wrongly used its technology and misrepresented the technology of another company as its own. This was all for the purpose of supplying a high-energy density battery to GM.

Tesla recently made news, opening its patents up to all takers. Some investors and EV enthusiasts greeted the news warmly, while others shrugged. Some posited that a patent, in and of itself, provides only so much information. Plus, they can quickly become old news as new products and technologies emerge. Despite the mixed response to Tesla’s offer, there are rumors about Nissan and BMW having clandestine meetings with Tesla in June of 2014 to discuss charging technology. BMW confirms this meeting. Honda and GM expressed little interest in Elon Musk’s offer. Toyota, Chrysler, and Ford were silent on the issue. Mahindra is said to be looking Tesla’s patents over to see if applications might be beneficial in its development of an electric Vento Sedan in Bhutan.

Advancements in battery technology and performance will continue to emerge in the years ahead, to meet the economic needs of the private and business sectors. Environmental regulations will create challenges for manufacturers as they struggle to meet regulatory requirements while delivering increased EV/PHV range and reliability. Inevitably, the hybrid and the electric are here to stay, and the battle for the battery’s future will continue. Only the strong and the truly innovative will survive, and many will fall by the wayside, but the possibilities of what is to come by 2020 … 2030 … and beyond, fires the imagination of the industry’s best minds and visionaries. They will make the breakthroughs that make our battery-powered future the best it can be.

Some information used in the creation this paper was drawn from the following sources. (Specific instances and references available upon request):

about.com – Stanford.edu – The Strategic Sorcerer – Frost and Sullivan – Handleman Post – batterypoweronline.com – greenautoblog.com – futuretech.com – hybridcars.com – idtechex.com – Diesel Technology Forum – makeuseof.com – insideevs.com – oilprice.com – cleantechnical.com – greentechmedia.com – Bloomberg.com – futureextremetech.com – Wikipedia – autoblogquebec14.com – hydrogenfuelnews.com – autobloggreen.com – Koreanherald.com – greencarcongress.com – triplepundit.com – 4evriders.org – cleantechnica.com – autocar.co.uk – designnews.com – motleyfool.com – batteryuniversity.com – automotive-fleet.com – autoblog.com – prnewswire.com – digitaltrends.com – greencarreports.com – hyundaicarsindia.in – digitaltrends.com – nissan-global.com – nbc.com – dallasnews.com – caranddriver.com – plugincars.com – media.ford.com – fortune.com – cartalk.com – lgcpi.com/chem.shtml – hybridcars.com – environmentalleader.com – abcnews.com – foxnews.com – wallstreetcheatsheet.com – scientificamerican.com – businesscafe.com – National Legal Policy Center – Rollcall.com – US Dept. of Energy – theenergycollective.com – phoenixbusinessjournal.com – Reno Gazette-Journal – Frost and Sullivan – infosources.org – the energyroadmap.com – nbcnews.com – besttopics.net – autobytel.com – cnbc.com – inhabitat.com – telematicswire.net – Chargedevs.com – luxresearchinc.com – bing.com – 2016hybridcars.com – Isustainableearth.com – Museum Autovision – hislimited.co.uk – scienceblogs.com – psipunk.com